Investors Upbeat on Multifamily as Rate Cuts Stimulate Deal Activity

- Apartment demand is expected to stay high as the multifamily sector continues to benefit from a healthy set of fundamentals.

- A projected slowdown in deliveries in 2025 indicates high-growth markets are primed for a rebound in rent prices.

- Falling borrowing costs and narrowing bid-ask spreads should stimulate deal activity.

The skies surrounding commercial real estate markets are clearing, suggest the Emerging Trends in Real Estate 2025 (ETRE 2025) findings. As pandemic-related structural changes settle into place, cyclical economic trends, such as interest rates, demand, and construction levels, are now the key drivers to watch.

Demand Remains Strong, Supply in Flux

Housing supply continues to dominate many discussions about multifamily in 2025. As developers in the Sunbelt and other high-growth metropolitan markets built to keep up with post-pandemic demand patterns, multifamily housing starts have climbed over the last several years.

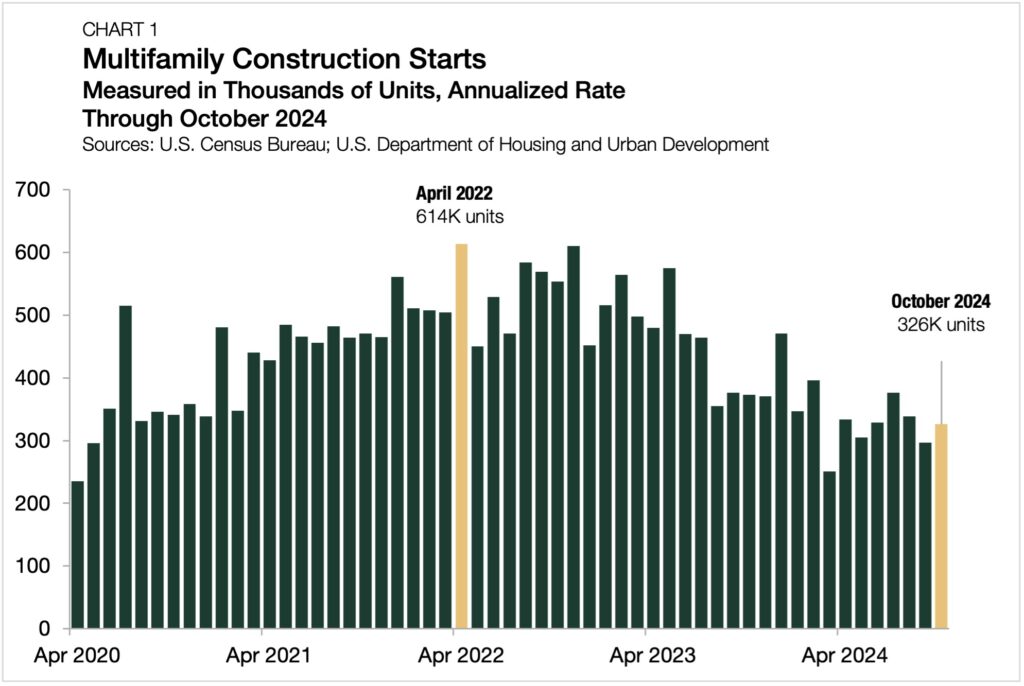

The downstream effects have been evident, with apartment deliveries projected to peak at 500,000 in 2025. More recently, multifamily starts have declined noticeably as demand has stabilized in several regions. Multifamily starts fell from a cyclical high of 614,000 units in April 2022 to 326,000 units in October 2024 (Chart 1).

While multifamily demand has decreased from highs in 2021 and 2022, regional trends and healthy fundamentals at the national level support the sector’s ongoing strength. As covered in Arbor’s Top Markets for Multifamily Investment Report 2024, Sunbelt metros like Nashville, Phoenix, and Austin have remained attractive destinations due to favorable mixes of affordability, population growth, and climate. Recent supply surges in these markets have softened rent growth; however, absorption has remained strong, and as newer supply leases up, rent prices are likely to accelerate.

Deal Activity Set to Increase

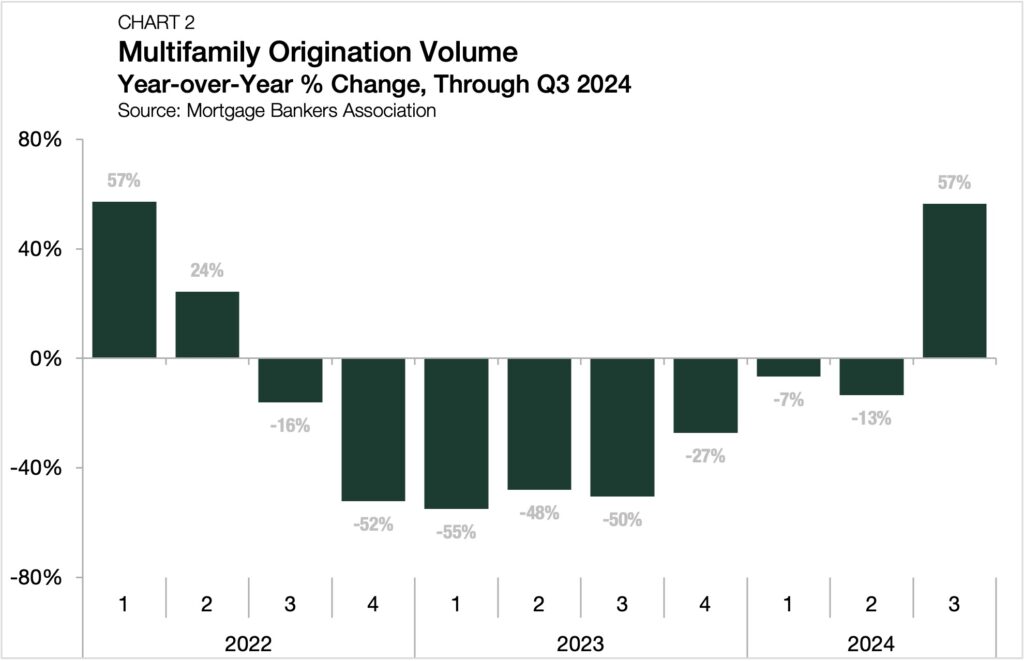

ETRE 2025, which was published by PwC and Urban Land Institute, noted that industry experts anticipate falling interest rates will spark an increase in deal activity in 2025. According to the Mortgage Bankers Association, multifamily mortgage originations rose 57% in the third quarter of 2024 compared to one year ago and were up 53% from the second quarter of this year (Chart 2).

With the results of the 2024 election finalized, re-anchored interest rate expectations will help stabilize transaction activity in the coming quarters. As medium-term uncertainty subsides, bid-ask spreads should narrow. However, Federal Reserve Chair Jerome Powell and many Federal Open Market Committee members have continued to express caution, and recent robust gross domestic product readings have allowed the Fed to take a wait-and-see approach to lowering the federal funds rate. While the expected pace of interest rate cuts is unlikely to eliminate bid-ask spreads entirely, transaction activity should settle into a new, steadier equilibrium.

Affordability Remains in Focus

Affordability challenges in the U.S. result from a structural need for housing. As explored in Arbor’s Fall 2024 Special Report, households have grown faster than housing completions in seven of the past 10 years, widening the nation’s cumulative production shortfall to nearly 3.5 million units.

The Emerging Trends report indicates that affordable housing shortages will persist into 2025, remaining high on industry advocates’ and policymakers’ agendas. Experts polled suggested a range of remedies, such as boosting construction, reforming state and local zoning laws, and realigning market incentives, to close the gap. From a policy perspective, the implementation of any new actions could require overhauls at the national, state, and local levels. However, programs with bipartisan support, such as the Housing Choice Voucher program, are likely to receive support from the incoming Congress. Meanwhile, Republican initiatives, such as easing construction regulations, are likely to be a part of the new administration’s legislative agenda.

Looking Ahead

In 2025, medium-term demand fundamentals will continue to anchor the forward-looking prospects of multifamily investors and operators. On the supply side, the industry will continue to contend with headwinds such as high financing costs, materials inflation, and oversupply concerns — but the projected slowdown in property deliveries could lead to resurgent rent growth in the near term.

Regardless of any upcoming policy shifts, the shortage of for-sale housing inventory will not be resolved in the short term, resulting in many would-be homeowners remaining in the apartment market.

On the horizon, America’s demographic trends and structural housing needs are opening up opportunities in the multifamily space. Over the coming year, supply trends in high-growth markets, regional labor market performance, and the fate of regulatory reform efforts will be the key signals for investors to watch.

Interested in the multifamily real estate investment market? Contact Arbor today to learn about our array of multifamily, single-family rental, and affordable housing financing options or view our multifamily articles and research reports.