Labor Markets Most and Least Impacted by COVID-19

- Omaha registered labor force gains from a year ago, reinforcing renter demand.

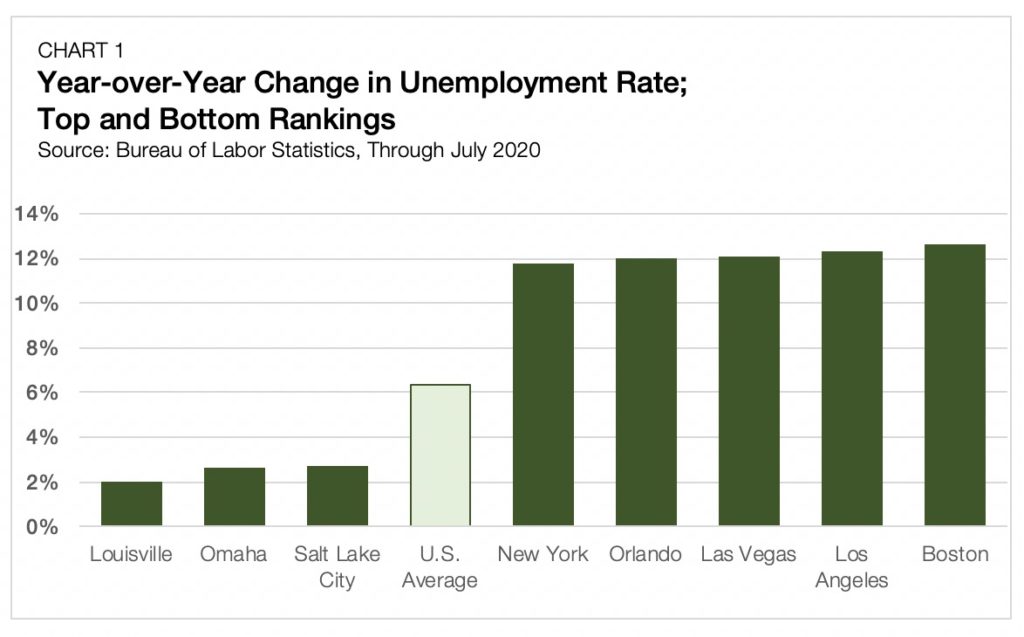

- Unemployment in the country's least impacted labor market, Louisville, rose by 2.0% year-over-year.

- Boston experienced the nation’s highest unemployment percentage gain, up 12.6% from a year ago.

Unemployment Differs by Geography

Year-over-year employment growth turned negative in each of the top 50 largest U.S. metros, according to the Bureau of Labor Statistics’ latest Metropolitan Jobs Report. While no city went unscathed, the scale of damage to labor markets differed depending on location.

Smaller cities like Louisville, Omaha and Salt Lake City made it through July with only a moderate uptick in unemployment. However, larger metros, including Boston, Los Angeles and Las Vegas, were less fortunate. Chandan Economics analyzed the latest metro-level job numbers, examining where there’s more to the story than meets the eye.

Boston edged out Los Angeles in experiencing the country’s largest year-over-year percentage increase in unemployment. Through July, Boston’s civilian unemployment rose 12.6% from a year ago, with Los Angeles closely following, increasing 12.3%. Las Vegas, Orlando and New York ranked shortly behind, with unemployment hikes of 12.1%,12.0% and 11.8%, respectively.

The U.S. declared coronavirus a national emergency in mid-March. Massachusetts, New York and California were some of the areas earliest hit by the health crisis. By extension, they were among the first states to issue widespread stay-at-home orders. Las Vegas, which initially avoided the brunt of the health crisis, nonetheless became one of the country’s most adversely affected economies. The city saw its tourist and hospitality-dominated businesses reach a standstill as travel activity came to a virtual halt.

Impacts on the rental market are already visible; in Manhattan alone, the number of empty apartments tripled compared to a year ago.

Measuring Unemployment and Labor Markets

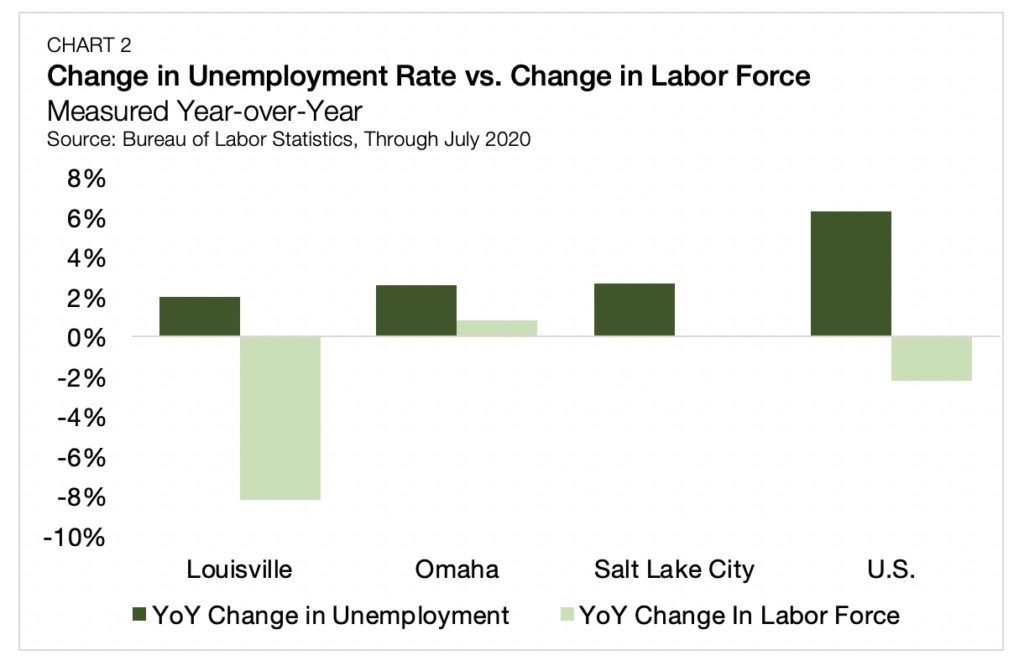

The Louisville area saw the lowest decline in employment, with the unemployment rate ticking up by just 2.0% from July of last year. At 6.4%, Louisville’s unemployment rate is the fourth-lowest in the U.S. However, the area’s labor force had significantly decreased.

Almost 60,000 workers dropped out of Louisville’s local workforce. This represented an 8.0% year-over-year decline, comparing unfavorably to the national drop of 2.0% over the same period. Comparable in size to Louisville, Omaha and Salt Lake City saw unemployment rise by 2.6% and 2.7%, respectively.

However, unlike Louisville, both Omaha and Salt Lake City saw a rise in labor force participation. Omaha’s fortunes appear to be translating into local renter sentiment as well, with 81.1% of the city’s potential movers looking to stay in the city, compared to just 68.0% on average across all major U.S. metros.

The resilience of each of these areas’ labor markets also signals caution. Data gathered by the Harvard Global Health Institute’s COVID-19 Risk Level map rank Louisville and Omaha as the fifth and sixth highest risk metros, respectively, as of September 1, 2020. The most recent COVID-19 risk level data suggests an unfortunate consequence for cities that remained more economically active than others, as the July unemployment statistics appear to have foreshadowed.

COVID-19 and the Future Labor Force

The permanence of sustained job losses and the metro-level factors affecting performance remain unsettled for the foreseeable future. The national drop in labor force participation may reflect a structural shift taking place that could add further context to this debate moving forward.

There are moderate concerns around the possibility of disincentives created by supplemental unemployment benefits, potentially keeping some workers from returning to their jobs. While the supplemental payments undoubtedly did more help than harm, Louisville’s falling labor force participation adds weight to this idea.

That said, broad fears surrounding the dangers of COVID-19 have also kept many of those who would have otherwise looked for work out of the job market. As regional hotspots of coronavirus cases gradually cool, a return to economic normalcy is expected to follow.

Learn more about the multifamily sector in today’s investment environment by reading our Chatter blog. Contact Arbor to speak with a specialist to learn about our different loan programs.