Las Vegas Multifamily Market Snapshot — Q3 2021

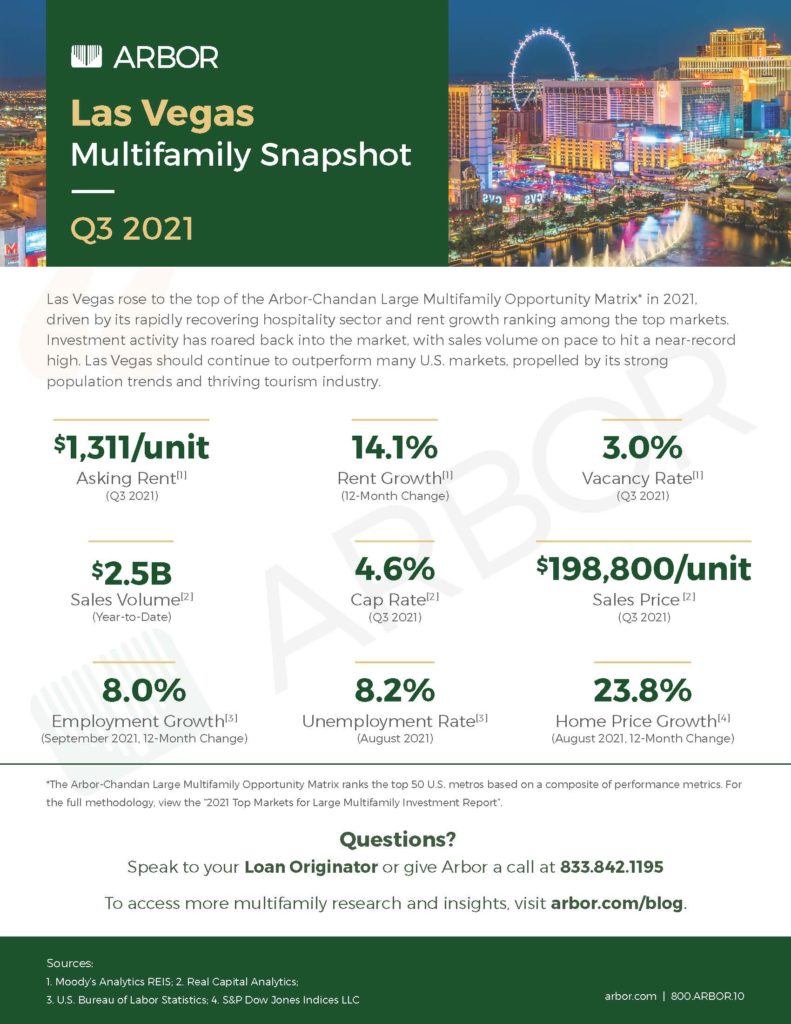

In the third quarter of 2021, the Las Vegas multifamily market once again stood out as one of the nation’s top performers. According to Moody’s Analytics REIS, the average effective rent increased 14.1%, ranking among the top markets. The vacancy rate settled the quarter at 3.0%, well below the national average of 4.6%.

The market also remained an attractive destination for investment capital. Real Capital Analytics reported that sales volume picked up rapidly in the middle of 2021, after a brief pause at the onset of the pandemic, and was on pace to approach 2019’s record high. Cap rates also continued to decline, falling to 4.6%, and remained lower than the U.S. average cap rate of 4.7%.

Las Vegas rose to the top of our Arbor-Chandan Large Multifamily Opportunity Matrix in 2021, driven by its rapidly recovering hospitality sector. The market appears to be work-from-home resilient, given its tourism-centric economy and a high share workers employed in the leisure and hospitality sector.

Here’s a look at the Las Vegas multifamily market benchmarks for Q3 2021.

Learn more about how Las Vegas rose to the top of the Arbor-Chandan Large Multifamily Opportunity Matrix in our 2021 Top Markets for Large Multifamily Investment Report.