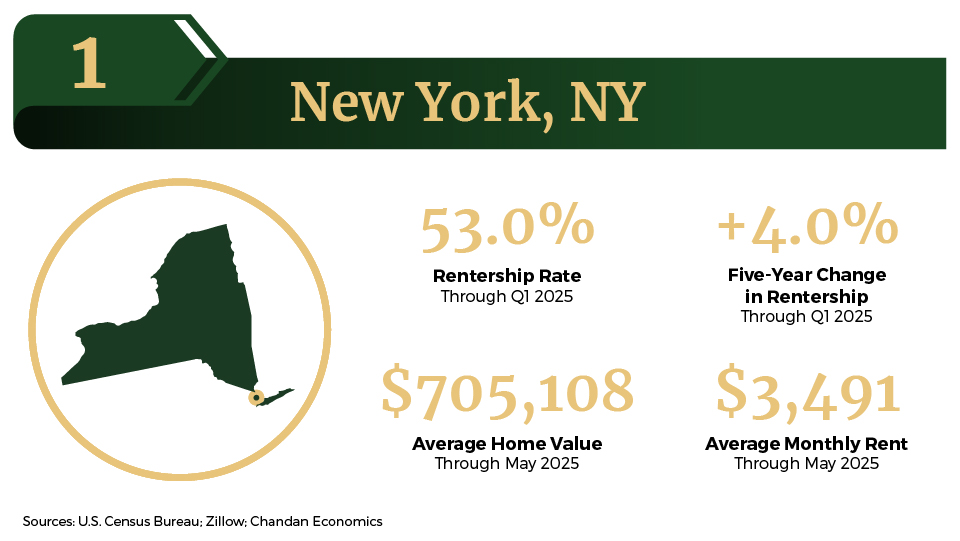

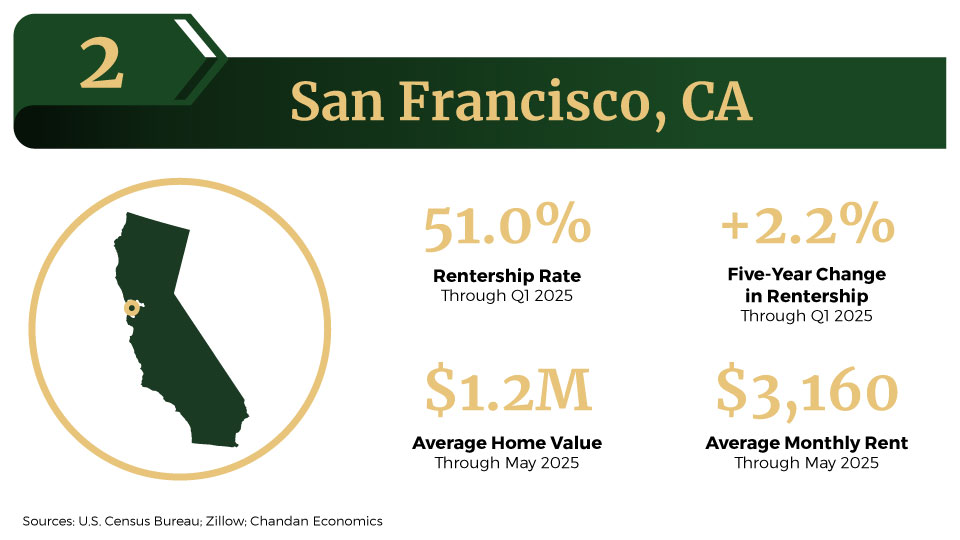

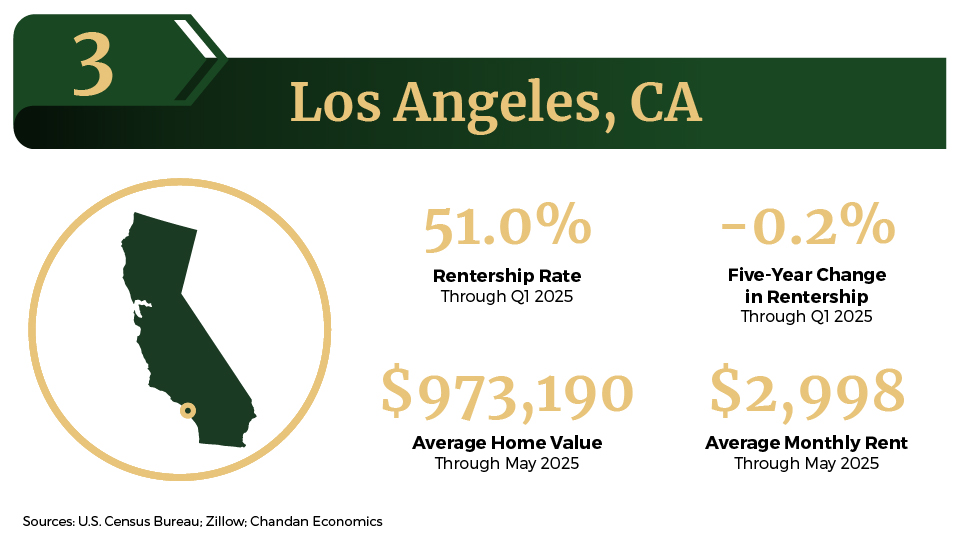

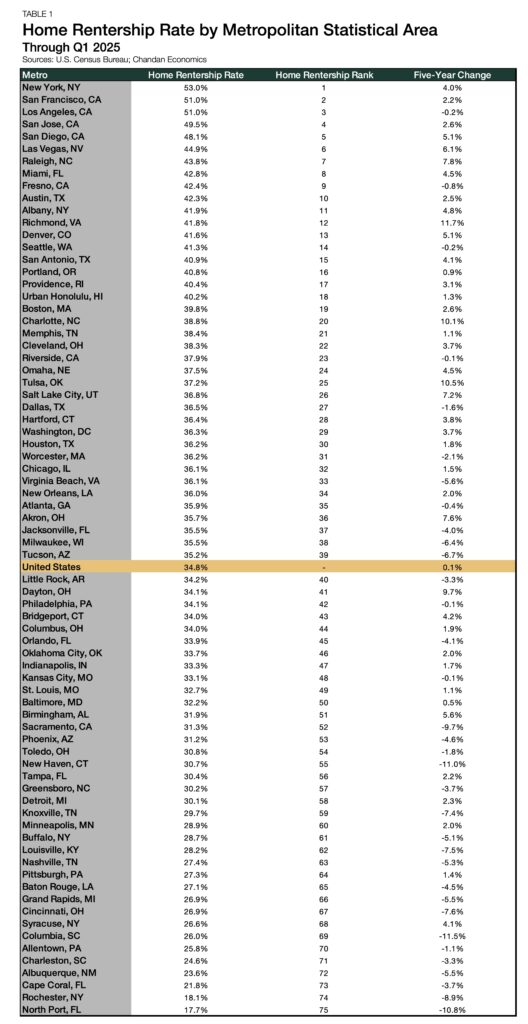

Markets Where the Share of Renters is Highest

- The New York metropolitan area had the highest share of renters in the country, with San Francisco and Los Angeles following closely behind.

- There is a strong connection between home values and the rental share of households in a metro, underscoring the cost barriers to homeownership.

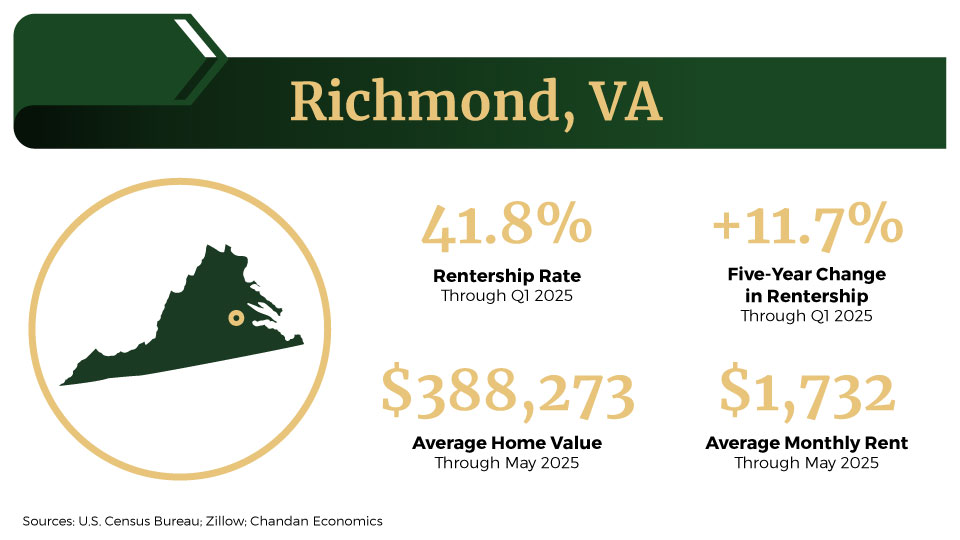

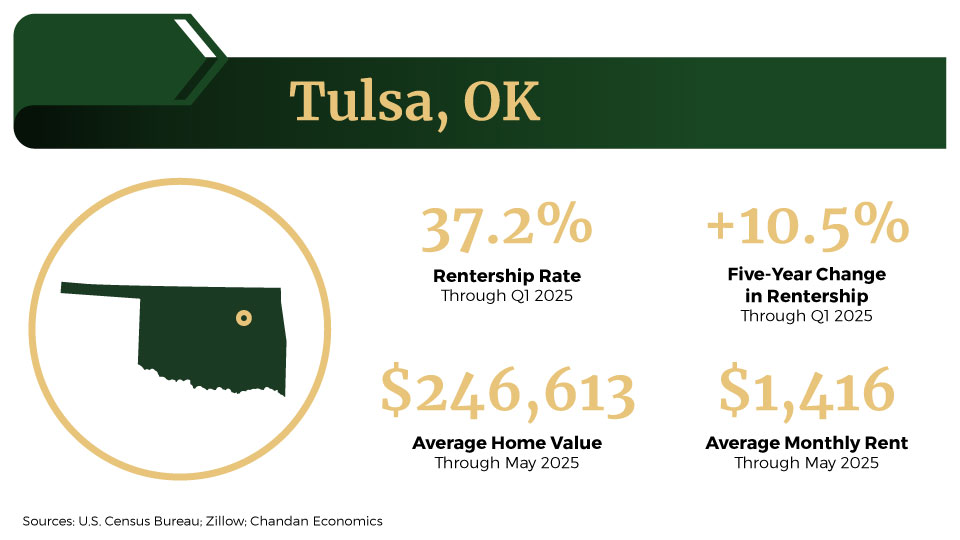

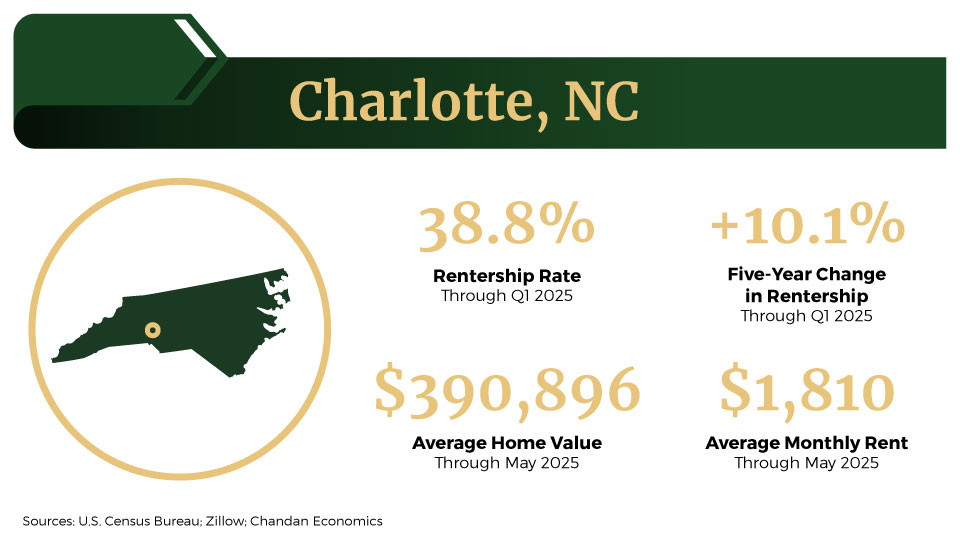

- Richmond, Tulsa, and Charlotte have seen sizable shifts towards rental housing in the past five years, driven by young professionals moving there.

The U.S. housing market reflects a patchwork of local needs, preferences, and geographies, creating distinct storylines. Across the country, many significant shifts have occurred over the last five years, an analysis of U.S. Census Bureau data shows. More expensive housing markets tend to support higher percentages of rental households, and in fast-growing metros, rentals have become a highly effective and flexible way to house new residents.

Metro-Level Leaders

The New York metropolitan area led the nation with the highest rental share of households at 53.0%. The Big Apple has long been a renter-majority market, driven by the economics of extreme housing density within the five boroughs and surrounding areas. Persistent affordability challenges, combined with a highly mobile population, have made renting a preferred housing option in New York, keeping it at the top of national rankings of metro markets’ share of rental households.

Following closely behind is San Francisco, where 51.0% of households in the market are renters. According to Zillow, the average home value in San Francisco was above $1.1 million through May 2025 — making it the second most expensive housing market in the country.[1] The only market with higher average home values was nearby San Jose at $1.6 million.

Rounding out the top three is Los Angeles, where rentals also make up 51.0% of households.[2] In addition to its long-term housing supply constraints, Los Angeles’ strong demand for flexible, lifestyle-driven living — particularly among Millennial and Gen Z households — has strengthened the market’s profile.

Largest Five-Year Change

Despite experiencing volatility throughout and after the pandemic, the share of U.S. renters remains almost directly in line with its level five years ago (+0.1 percentage points). Across the 75 largest metro areas, markets with increases in renters outnumbered those with gains in homeowners by 41:34.

In the past five years, no major metro area has seen a larger increase in its share of renters than Richmond, VA (+11.7 percentage points). The Virginia metro has attracted a growing number of renters due to its expanding population of young professionals and relative affordability. Compared to the adjacent Washington, D.C., market, rents in Richmond are about 30% lower.

In Tulsa, OK, the share of renters has risen 10.5 percentage points since 2020. Tulsa’s surge in renters reflects a national trend of increasing demand for affordable rental housing in smaller metropolitan areas. Even though home prices are comparatively low in Oklahoma’s capital city, the local government’s plan to attract remote workers has boosted demand for rentals.

Charlotte, NC, has seen a significant shift away from homeownership as its share of renters has climbed 10.1 percentage points in five years. While Charlotte was once considered relatively affordable, home prices have risen rapidly there in recent years as it has emerged as a major economic engine. As a result, both multifamily and single-family investments have surged throughout the metro area.

The Bottom Line

In all parts of the country, rentals represent a substantial thread in the tapestry of the housing market. From small multifamily to single-family rentals, rental housing is an increasingly dominant source of housing and a primary way to meet rising demand experienced recently in rapidly expanding markets.

[1] Analysis is limited to top 75 metropolitan areas by population.

[2] Note: Los Angeles MSA includes Orange County.

Interested in the multifamily real estate investment market? Contact Arbor today to learn about our array of multifamily, single-family rental, and affordable housing financing options or view our multifamily articles and research reports.