Metro Market Trends: Household Income vs. Asking Apartment Rents

Let’s examine the relationship between small asset apartment asking rents and household income across the nation.

Metros with the highest average household income levels, including Technology Centers and the large Gateway markets, have the highest average unit rents nationally. Additionally, the slower rate of inventory growth in the small property market is having an increasing impact on affordability due to rent growth outpacing household income growth.

Metro Rents are Highly Correlated with Household Income

While examining household income trends by renter groups can help small building operators identify emerging demand segments, income dynamics at the metro level can provide additional insights on overall market strength.

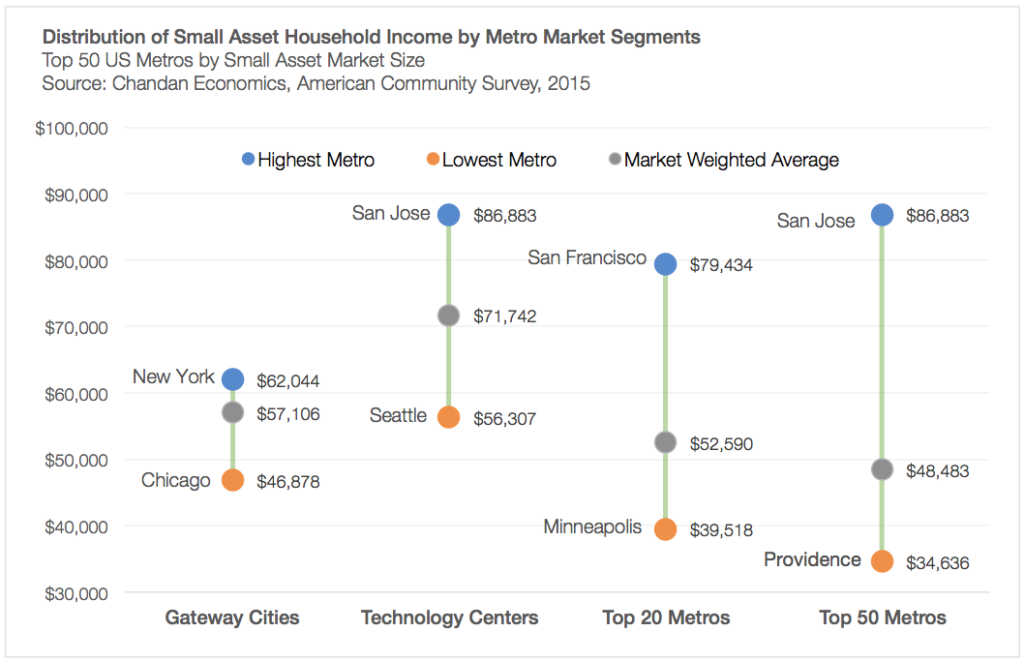

The latest data update from the Census Bureau for year-end 2015 for the Top 50 US metros (see Box 1 at the bottom of the post for definitions) shows that average household incomes generally decline with market segment size.

For example, in 2015, small building renters in Gateway cities had an average household income of about $57,000, while the Top 20 metros taken together had a lower average income of $53,000, and the Top 50 came in at around $48,000.

(Click to enlarge.)

Small property renters in Technology Centers, including the San Francisco, San Jose and Seattle metro areas, had significantly higher average household income levels of around $72,000.

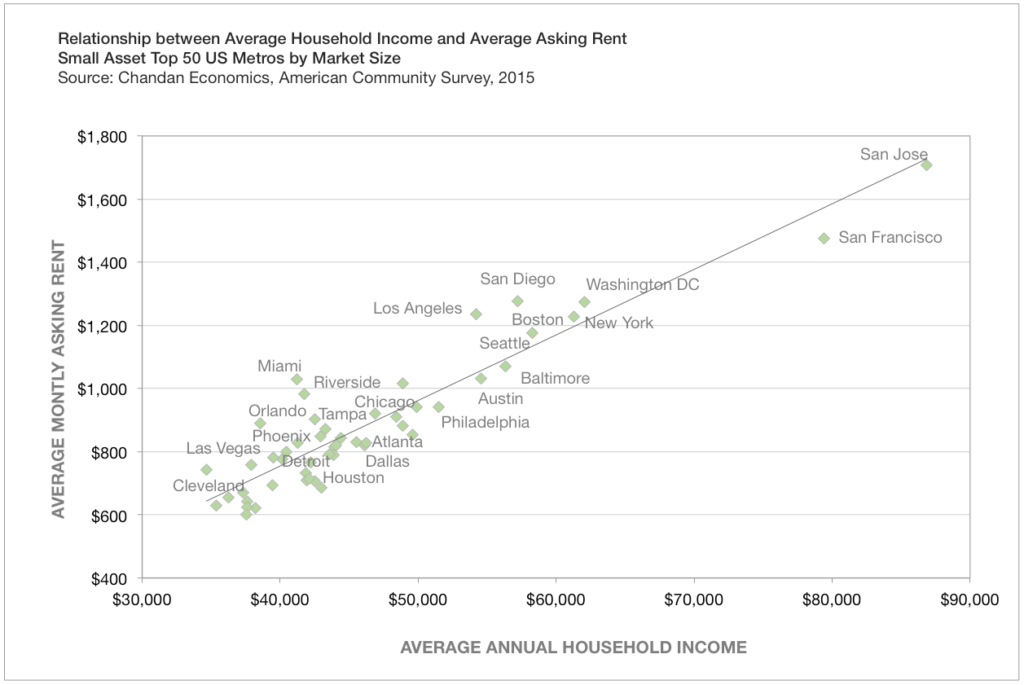

As shown below, when the average household income levels are plotted against average rent levels for each of the Top 50 metros we find a near perfect fit between these two indicators, with data points clustered closely along the trend line.

(Click to enlarge.)

In the chart, metros positioned above the trend line indicate having higher than predicted asking rent levels for their household income levels. For example, this includes the Los Angeles and Miami metro areas, which are in the grips of an affordability crisis.

Income, Inventory and Rent Growth within Metro Market Segments

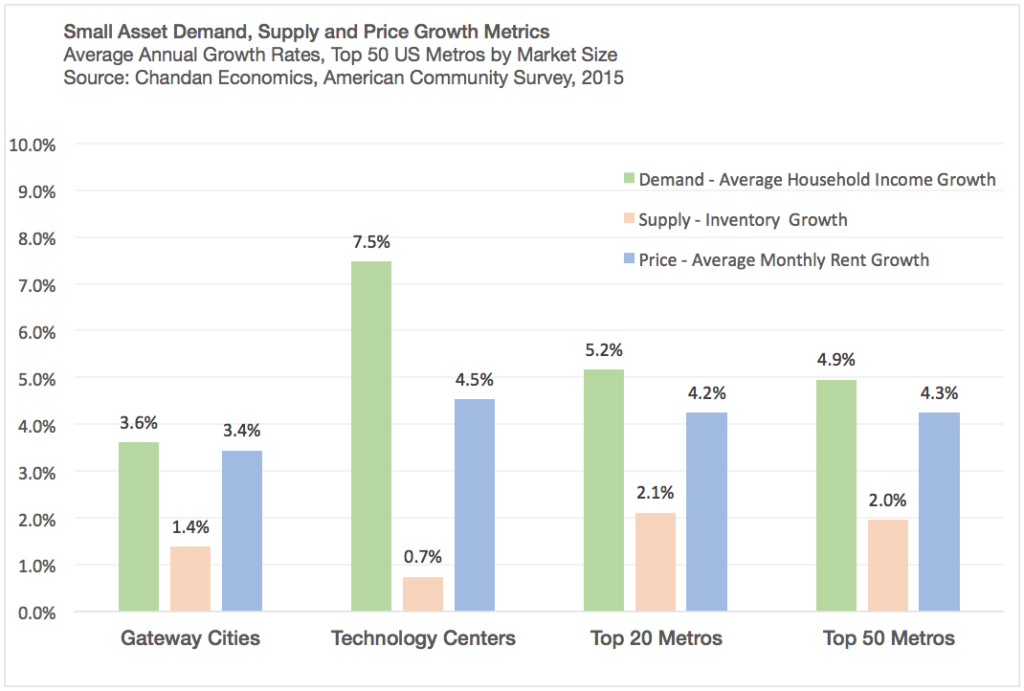

While average household income levels strongly predict monthly asking rent levels, increases in rent are pegged against changes in both demand and supply conditions.

(Click to enlarge.)

As shown above, the annual rate of growth in household income, inventory and rents within the small asset market for 2014-15 indicates that the slower addition of inventory across metro market segments has resulted in market tightening.

Monthly asking rents increased closely in step with household income growth, with rents increasing faster outside the Gateway Cities, especially in Technology Centers.