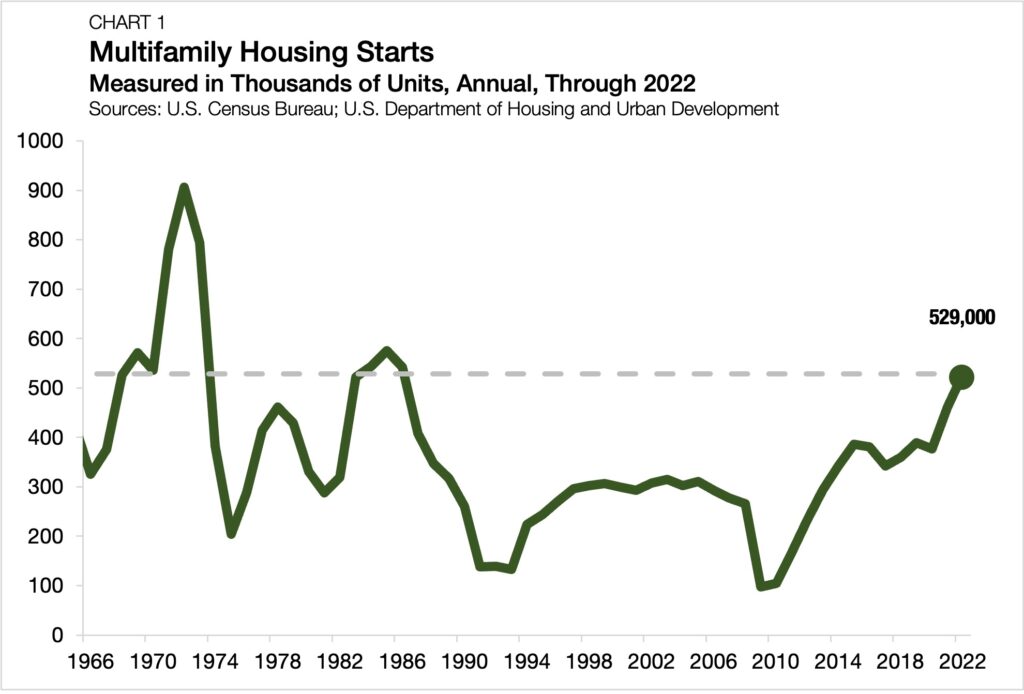

Multifamily Construction Starts Hit 36-Year High in 2022

- Construction started on 529,000 new multifamily housing units in 2022, rising more than 14% from a year earlier.

- The 2022 total was the highest annual total in 36 years.

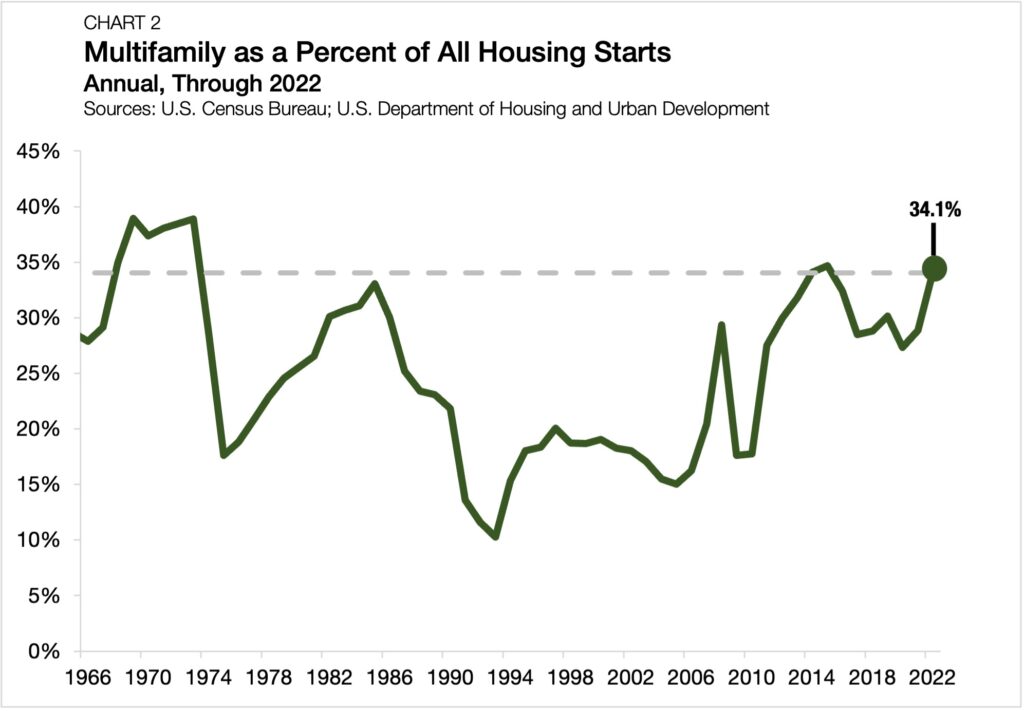

- Multifamily housing units accounted for more than 34% of all new residential construction in 2022 — the highest share since 2015.

Even as the economy’s momentum slowed in 2022, multifamily construction continued to ramp up, reaching highs not seen since the 1980s. As the number of new units increased rapidly last year, the multifamily sector’s share of all new residential construction also expanded to make up more than one-third of all starts.

Starts Reach a Generational High

The multifamily construction sector has had more than its fair share of headwinds to navigate through in recent years. Supply chain disruptions, rising interest rates, and a structural shortage of skilled construction labor have made it more challenging to add supply quickly enough to meet demand. Nevertheless, despite the obstacles, 2022 was a banner year for multifamily construction starts. Last year, construction began on 529,000 new multifamily units — the highest on record since 542,000 units were started in 1986, according to the U.S. Census Bureau and the U.S. Department of Housing and Urban Development (Chart 1). [1]

After reaching a low point of 97,600 annual multifamily construction starts at the close of the Great Recession in 2009, building activity has consistently risen, increasing in 10 out of 13 years.

After the number of multifamily starts contracted by 3.1% in 2020, the sector followed up with consecutive years of double-digit growth in 2021 and 2022. In 2021’s slingshot recovery, multifamily starts jumped by 22.6% from a year earlier — the most robust growth rate since 2013. Although at a more moderate pace, growth remained strong last year, as the multifamily starts climbed 14.5%.

Multifamily Hits Highest Share of All Starts Since 2015

Within the broader residential construction industry, the multifamily sector’s market share has expanded over the last two years. Multifamily’s share of all construction starts increased 5.2 percentage points from a year earlier in 2022, reaching 34.1% of all new building activity (Chart 2).

Following a high point in 2015, a moderation in multifamily construction activity caused its share of new construction to fall from 34.7% in 2015, to a recent low of 27.3% in 2020. However, the multifamily sector made up lost ground in 2021 and 2022 as construction surged. In 2022, its market share of all construction starts was just 0.6 percentage points off its 2015-high. Moreover, last year’s share was only 4.8 percentage points below its all-time high of 38.9%, recorded in 1969.

The Look Ahead

Even as 2022 stands as another high-water mark for new multifamily construction, activity slowed down toward the end of the year. The number of starts of multifamily units declined in each of the last four months of the year. Moreover, the total monthly starts in December 2022 amounted to 33,600 units — a 29.1% decline from November and the lowest monthly total since February 2021.

The outlook for new multifamily construction in 2023 is mixed. The National Association of Home Builders projects that multifamily starts will slow by about 28% in 2023 before stabilizing in 2024. Still, there are reasons to believe the 2023 pipeline will retain some momentum, with increased attention on affordable housing projects and the normalization of building material prices creating hopeful tailwinds.

[1] These data represent new privately-owned housing units started in buildings with 5 or more units. Data includes units intended for renter- and owner-occupancy.

Interested in the multifamily real estate investment market? Contact Arbor today to learn about our array of multifamily and single-family rental financing options and view our other market research and multifamily articles in our research section.