Multifamily is Well-Positioned for Short- and Long-Term Growth

- Freddie Mac’s Apartment Investment Market Index rose 8.7% in the first quarter from the fourth quarter of 2023, and the share of multifamily professionals reporting improving sales conditions jumped by 15.3 percentage points.

- Cap rates have begun stabilizing, with slight declines already observed in the small asset subsector.

- As household formations outnumber housing additions and the rental housing stock ages, the need for more rental units in the U.S. will continue amplifying.

With the macroeconomy maintaining its underlying strength and a handful of rate cuts expected by the Fed within the next 18 months, green shoots of optimism within the multifamily sector are multiplying. Even as high interest rates impede normal operations, stabilization is underway while the sector’s long-term prospects remain unwavering. In this deep dive, our research teams will explore the tailwinds underpinning the multifamily sector’s short- and long-term outlook.

Short-Term Improvement

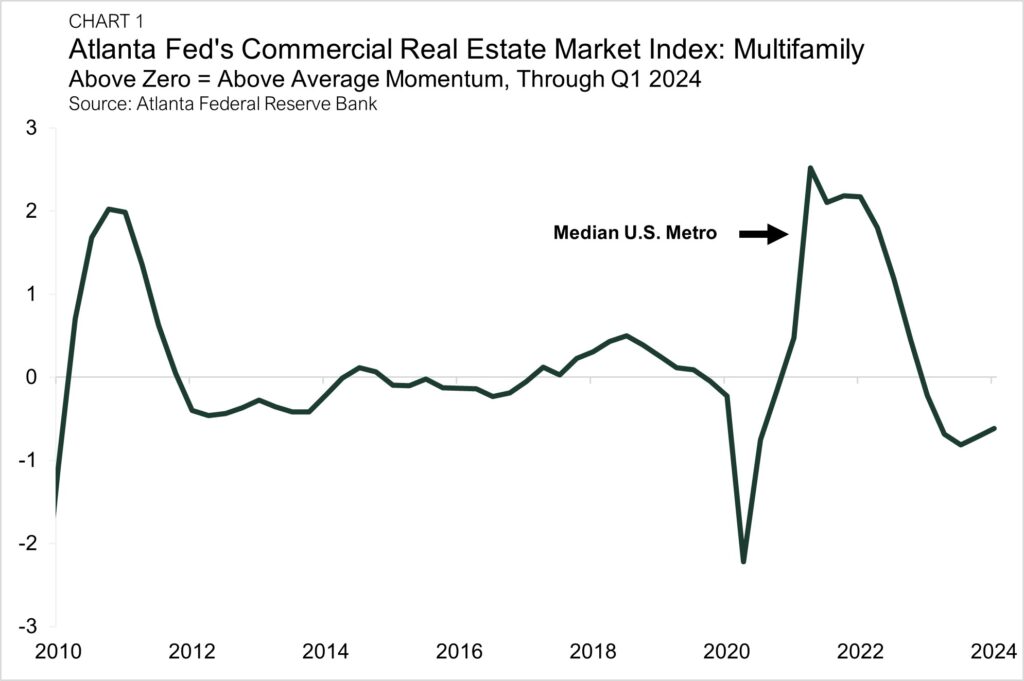

The Atlanta Fed’s Commercial Real Estate Market Index (CREMI) — a monitor of market momentum — has recently started showing signs of improvement for the multifamily sector. The index tracks the median U.S. market, with scores above zero denoting above-average momentum and below zero indicating below-average momentum.

After reaching a low point in the third quarter of 2023, the multifamily CREMI improved in each of the past two quarters (Chart 1). Further, through the first quarter of 2024, the number of tracked multifamily markets seeing above-average conditions has risen to 107 of 390 — up from a low of 91 just six months earlier.

Another positive sign for the short-term prospects within the multifamily sector is the recent uptick of the Freddie Mac Apartment Investment Market Index (AIMI), which rose 8.7% in the first quarter from the end of last year. AIMI considers three primary factors in its index: mortgage rates, asset prices, and net operating incomes (NOI). The combination of higher NOIs relative to property values and mortgage rates declining from 2023 highs has improved the sector’s investment profile. Through the first quarter of 2024, AIMI has risen to its highest point in seven quarters.

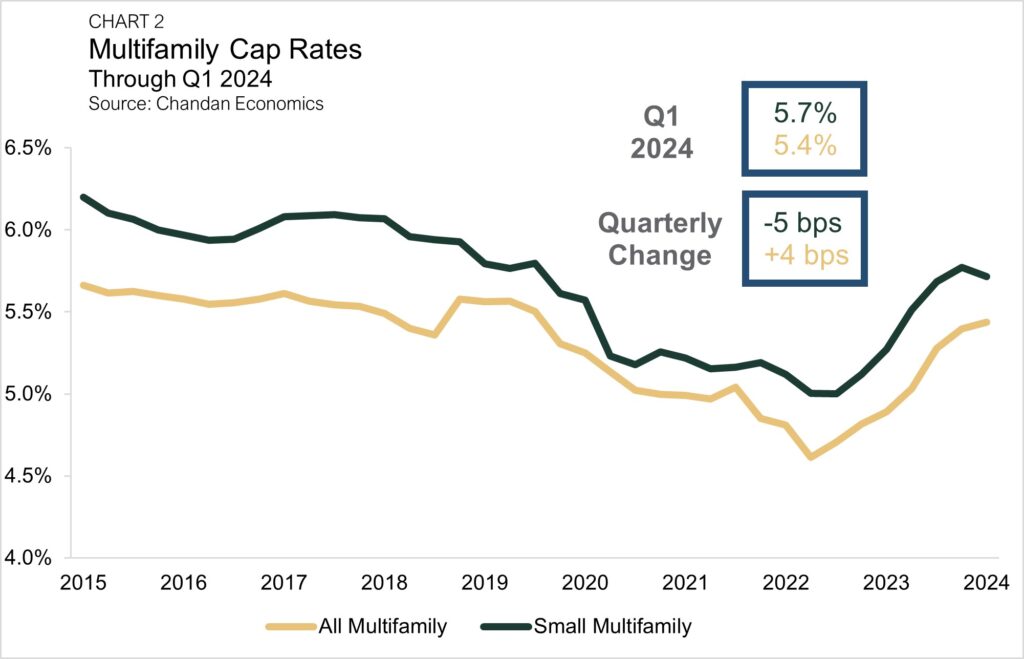

A stabilization of multifamily cap rates could be beginning to take hold. Small multifamily cap rates fell slightly (5 bps) to 5.7% in the first quarter of 2024 (Chart 2). Meanwhile, the pace of increase has slowed for the broader multifamily sector, essentially unchanged at 5.4%.

A recent First American analysis notes that if transaction activity were normalized, multifamily cap rates would likely sit 0.5 percentage points lower. According to the National Multifamily Housing Council’s Quarterly Apartment Conditions Survey, a rebound in transaction activity may already be underway. The share of survey respondents that indicated sales had grown above their previous quarter jumped to 21.2% in the first quarter of 2024, compared to 5.9% at the end of the fourth quarter of 2023.

Long-Term Runway

Beyond the immediate horizon, the multifamily sector remains well-positioned for long-term success, especially for units in the workforce housing segment. The rental housing supply in the U.S. remains critically low. In just the past 10 years, there have been 3.5 million more household formations than housing unit additions and options have grown more limited for affordable and workforce housing. By 2040, the adult population in the U.S. is projected to have grown by more than 26 million, placing increased pressure on the residential rental housing market.

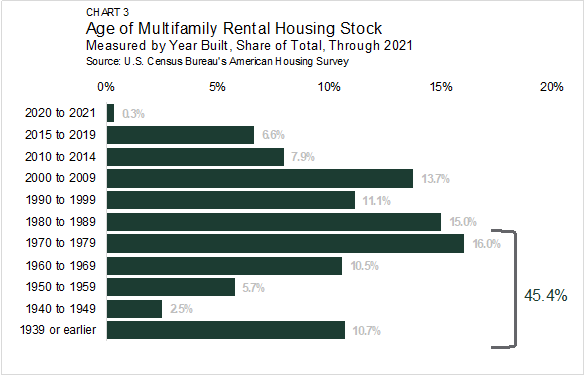

However, higher demand for rental housing is only one part of the equation. The existing rental stock in the U.S. continues to degrade and become less functional. According to the latest U.S. Census Bureau American Housing Survey, the share of units in multifamily properties over 40 years old rose from 35.1% in 2011 to 45.4% in 2021 (Chart 3).

Outlook

Between a low supply of multifamily units, aging rental housing stock, and projections of continued population growth, multifamily is well-positioned for short- and long-term success. Once the Federal Reserve begins loosening its monetary policy, more buyers and sellers will likely come to the table, accelerating the momentum that multifamily has developed amid the current waves of economic dislocation.

Interested in the multifamily real estate investment market? Contact Arbor today to learn about our array of multifamily, single-family rental, and affordable housing financing options or view our multifamily articles and research reports.