Everything You Should Know about Multifamily Rent Rolls

Submitting a comprehensive rent roll is one way to ensure the fastest access to multifamily financing. Here’s what a great rent roll looks like.

The rent roll is one of the most important tools for analyzing a potential apartment deal. From it, you can calculate annual rental revenue, and identify how much opportunity exists to boost property performance. The rent roll — along with a trailing 12 month operating statement — is also a key element your lender must use to underwrite your deal.

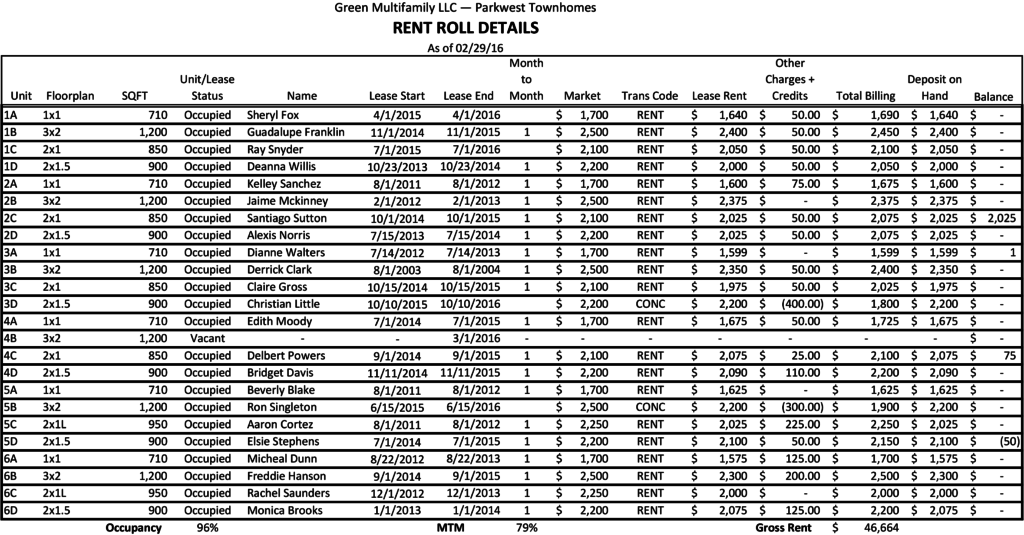

Let’s examine a hypothetical rent roll for a 6-story, 24-unit building that’s 96 percent occupied.

Now this is an ideal rent roll. Handing off something this comprehensive to a loan officer will get you the quickest turn around during the application process.

One of the most important columns — and oftentimes a source for confusion — is the Trans Code. If there are renters at the property who are rent stabilized, or perhaps subsidized through a program like Section 8, this is the spot to make note.

From our rent roll above, we can see that tenant Christian Little in unit 3D and Ron Singleton in 5B are both receiving rent concessions.

It’s also easy to garner the gross monthly rent ($46,664), the percent of renters on a month-to-month lease (79%), and the fact that the renter is unit 2C is a month behind on rent.

Hopefully this example helps you create a more accurate representation of your next potential apartment investment when you are shopping a loan.

Be sure to subscribe to Chatter Updates above for more tips on multifamily investing — and check back in for our examination of how to create a comprehensive Trailing 12 Month Operating Statement (T12) .