The Changing Occupational Profile of Workforce Segment Renters

Workforce segment renters living in small apartment properties are adapting to the changing economy, while also representing a broad occupational base.¹

Occupational Profile Skews Toward Technology Jobs Near the Urban Core

Understanding the impact of new technologies, such as automation, artificial intelligence and the internet of things, on the nature of work and future jobs now occupies center-stage in public debate.

Cities, in the eye of this storm, face several challenges, including supporting a range of housing options for workers with changing occupational and income profiles.

A closer look at the workforce segment – representing approximately 30% of all rental households – provides some initial clues on this transformation.

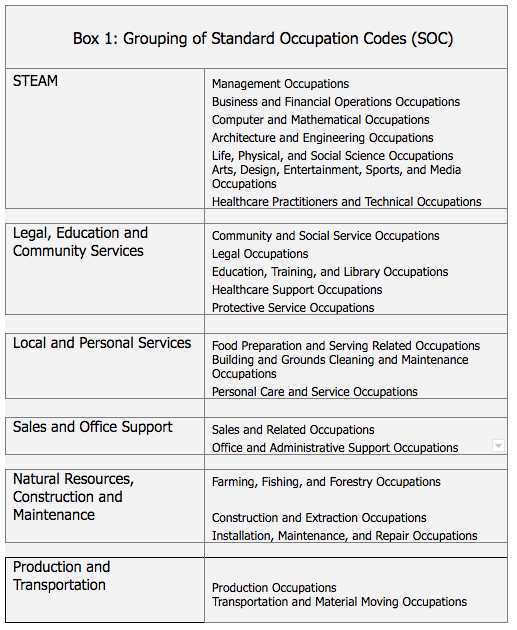

As shown below, the occupational profile of workforce renters (see Box 1 for definition) skews towards technology (STEAM) jobs near the urban core. STEAM workers make up 34% of households in large apartment buildings, as compared to 23% in small apartment buildings and only 16% in suburban single-family rentals2.

Workforce segment renters within small apartment properties, which are more widely dispersed in the metro area, represent a relatively broader range of occupations, including local serving, sales, production and transportation jobs.

Small Properties Gain from Technology Jobs

Technology workers are not only most concentrated near the urban core but are also growing the fastest in these locations.

As shown below, between 2014 and 2016 the share of STEAM-workforce renters in large apartment properties registered an increase of 172 basis points (bps); over the same period, this group registered an equally impressive rise of 99 bps in small apartment properties.

At the same time, renters with jobs related to production and transportation also grew as a share of total demand in small apartment buildings, rising by 20 bps. The growth is likely linked to the rapid growth of ridesharing in urban areas. Single-family rentals have remained comparatively stable over this period.

These emerging trends should be of vital interest to all multifamily and rental asset stakeholders, as urban housing demand is just beginning to reflect deeper transformations affecting the economy.

1 Workforce households, assumed to rent at prevailing market rates, are typically defined as those falling within a range of 60% to 120% of area median income (AMI), and this is specific to metropolitan and micropolitan areas due to wage differences across the US.

2 All data is sourced from the American Community Survey (ACS), unless otherwise stated. ACS statistics are sample-based estimates of the compositional profile of the total population in the given year of data collection and include a margin of error.