Strong Q2 2019 Multifamily Fundamentals Bode Well for Investors

- Apartment demand remains robust, with second-quarter 2019 seeing record unit absorption.

- Trends such as renters staying in place longer and preference for Class B product have emerged during this cycle.

- Sun Belt markets and suburban locations are attractive investment plays due to their continued growth potential.

A big topic of conversation throughout this economic cycle has been if the multifamily sector is oversupplied. However, perhaps the more important question for investors should be about demand, noted Greg Willett, chief economist at RealPage, speaking on a panel at the 2019 MBA CREF Market Intelligence Symposium.

Robust Demand for Apartments Continues

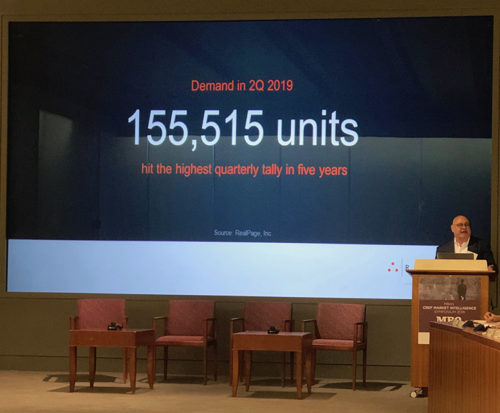

Discussing the findings of RealPage’s recently released report on Q2 2019 apartment trends, Willett noted that apartment demand remained robust in the second quarter for the top 150 metros. Absorption totaled over 150,000 units, which is the highest quarterly total in five years. He added that multifamily investors, therefore, have an opportunity to capitalize on this demand.

On an annual basis, we’ve seen about 300,000 units of demand, or about 2.5 million units absorbed during this cycle, according to RealPage data. Dallas-Fort Worth led the way with over 10,000 units absorbed in the second quarter and 167,00 units since early 2010.

Willett also noted that the top 20 metros that have dominated apartment absorption during this cycle also top the list for job creation and construction activity. This speaks to the strength of these cities’ labor markets and local economies. Many of these metros are in the Sun Belt, including Houston, Atlanta, Charlotte, Austin and Orlando.

Fundamentals also seem to support continued growth in the multifamily sector. The homeownership rate is still at a historical low as more demand goes toward rental housing.

Demographics and Movements of Renters

An interesting trend RealPage observed has been the increase in renters staying in place and renewing their leases over the last few years. While traditional leasing activity has been fueled by apartment turnover, it is now being driven by net-positive demand, which is a good tailwind for the apartment industry, Willett noted.

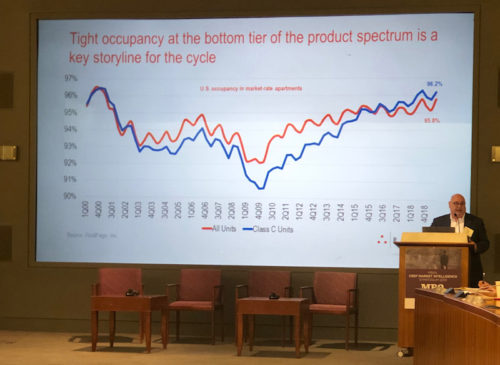

Healthy demand for Class B and C apartment product has also been a key development during this cycle, as affordability remains a major issue for many renters. RealPage found that the Class C sector was actually the tightest in terms of occupancy. Class C occupancy was 96.2% as of fourth-quarter 2018, higher than the 95.8% for all units.

The diversity of renters is driving this demand. By analyzing over eight million lease transactions, RealPage found that while Millennials make up the largest pocket of demand, other renter segments have emerged.

In Class B and C units, the largest cohort is what RealPage calls “Starting-out Singles” (those in their 20s), encompassing 26% of total rental households. RealPage also found that they spend about 29% of their income as a share of their rent, exemplifying their cost burden. Roommates by necessity make up 19% of total rental households, followed by “Mature Singles” (median age of 58) at 13%. The latter cohort is proving to be the fastest-growing category. This is because the population continues to age and the divorce rate among Baby Boomers continues to rise.

For luxury product, the renter categories include affluent singles (those in their mid- to upper-30s) at 17%, young couples/roommates by choice (8%) and established married couples (5%). Willett also pointed out that these segments have household incomes in the $80,000 to $100,000 range. They are also spending only 18% to 20% of their income on rent.

Market Shifts to Watch for Multifamily Investors

Post-recession, Sun Belt markets are performing as well as or beginning to outperform the traditional gateway markets, with more stable returns, according to RealPage data.

With strong inventory growth in downtown and downtown-adjacent markets, more suburban areas have seen stronger rent growth over the last five years. This trend is expected to continue.

Willett also noted that Class B product is becoming increasingly attractive to multifamily investors. While recession concerns would traditionally lead investors to Class A product, with the hope that slightly cutting rents would attract Class B renters up to Class A, now the price spread is too wide.

The monthly rent difference between Class A and B products was about $200 during the last recession, but the difference now is $500 per month, according to RealPage, making it more challenging to implement the same strategy.

Overall, the multifamily market should continue to perform well due to strong tailwinds. Multifamily investors are likely to find attractive opportunities in Class B product and Sun Belt markets where room for growth is still prevalent.

Looking to invest in a multifamily property? Contact Arbor today to discuss our financing options or view our array of multifamily loan products.