Q3 2016: Multifamily Construction on the Rise

All signs are pointing to a strong 2017 in terms of multifamily construction.

The National Association of Home Builders’ quarterly Multifamily Market Survey, for instance, shows that its members are feeling more optimistic about multifamily construction this quarter across the board.

This quarter’s MPI reading is consistent with our projection that the multifamily housing sector will have a strong year in 2017,” said NAHB Chief Economist Robert Dietz in recent World Property Journal article. “The multifamily sector has led the housing recovery and should continue to be supported by favorable demographics.

Note that the spread between Low Rent Starts and Market Rent Starts has narrowed in recent quarters. While there is some concern that certain urban metros could experience an oversupply of newly-built Class A luxury product, demographic and economic factors are poised to keep upward demand pressure on well-located Class B and C assets.

The U.S. Census Bureau and the Department of Housing and Urban Development recently released new data on residential construction, including data for multifamily buildings (classified as structures with five or more units). All data is seasonally adjusted at an annual rate. Let’s dive into the numbers.

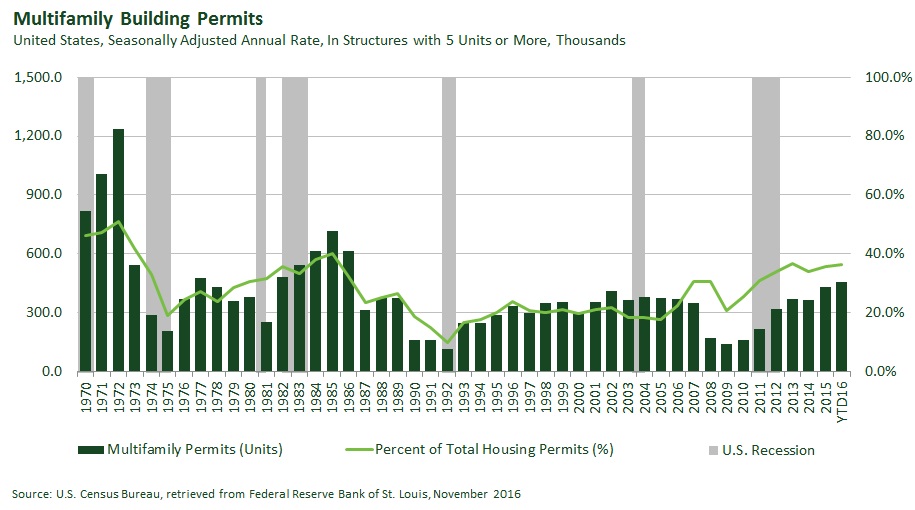

Building Permits

Total privately-owned residential housing units were authorized by building permits in the United States at a rate of 1,229,000 in October, an increase of 28,000 (2.3%) from the year-end 2015 rate of 1,201,000.

Permits for units in multifamily structures were at a 439,000 rate in October, up 11,000 (2.6%) from the end of 2015, and represented 36% of the total residential permits issued. The multifamily rate for 2015 was the highest year-end level since reaching 614,000 in 1986.

For 2015, the states with the highest multifamily permits as a percent of total residential permits were the District of Columbia (92.6%), New York (83.3%), New Jersey (62.3%), Connecticut (57.5%), and Massachusetts (55.8%).

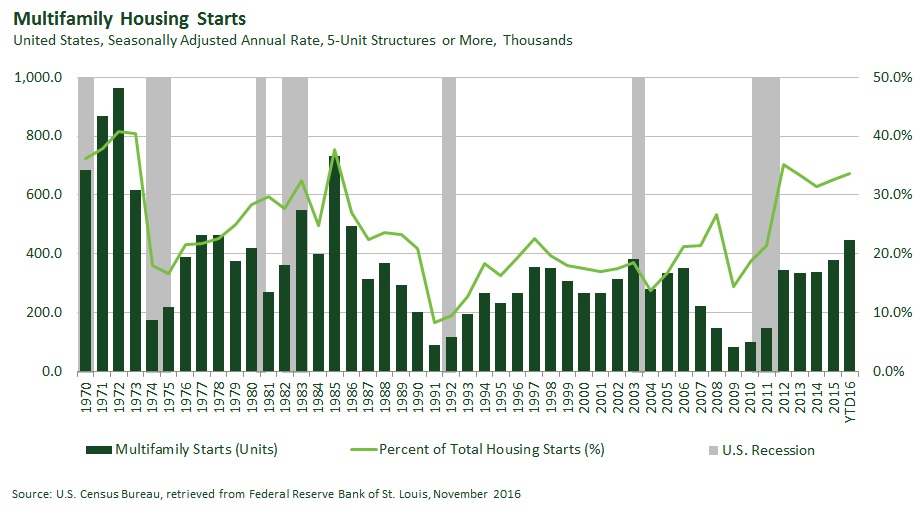

Housing Starts

Total housing starts were at a 1,323,000 rate in October, an increase of 163,000 (14.1%) from the 2015 year-end total.

Housing starts in multifamily buildings were 445,000, up 67,000 (17.7%) from the end of 2015, and represented 34% of total residential starts. The 2015 total was the highest year-end rate since 381,000 at the end of 2003.

Total residential housing units authorized, but not started, were at rate of 129,000 at the end of October, down from 149,000 (-13.4%) at the end of 2015, including 62,000 in multifamily structures, down from 80,000 (-22.5%).

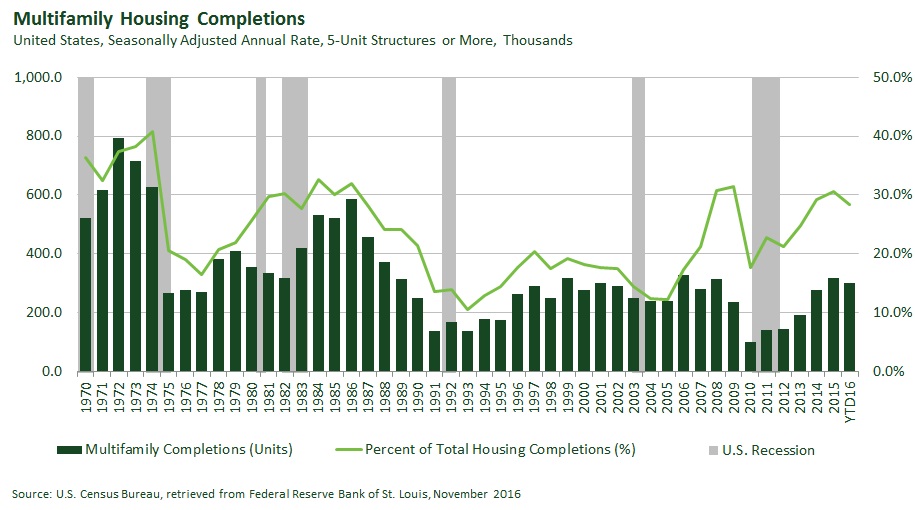

Housing Completions

Total housing completions were at a rate of 1,055,000 in October, up 22,000 (2.1%) from the end of 2015.

Completions in multifamily buildings were at a 300,000 rate, down 16,000 (-5.1%) from the end of 2015, and represented 28% of total completed residential units. The 2015 total was the highest year-end total since 326,000 units were completed in 2006.

At the end of October, there were 1,049,000 housing units under construction in the U.S., including 597,000 in multifamily structures, representing 57% of the total.