Regional Construction Trends: Annual Multifamily Completions Surged in the South and West

- In 2023, the South had the highest total number of multifamily units completed (209,000) and the highest growth rate (40.3%) of any U.S. region.

- The Northeast (55.6%) and West (53.0%) had the highest shares of completed units with one or fewer bedrooms.

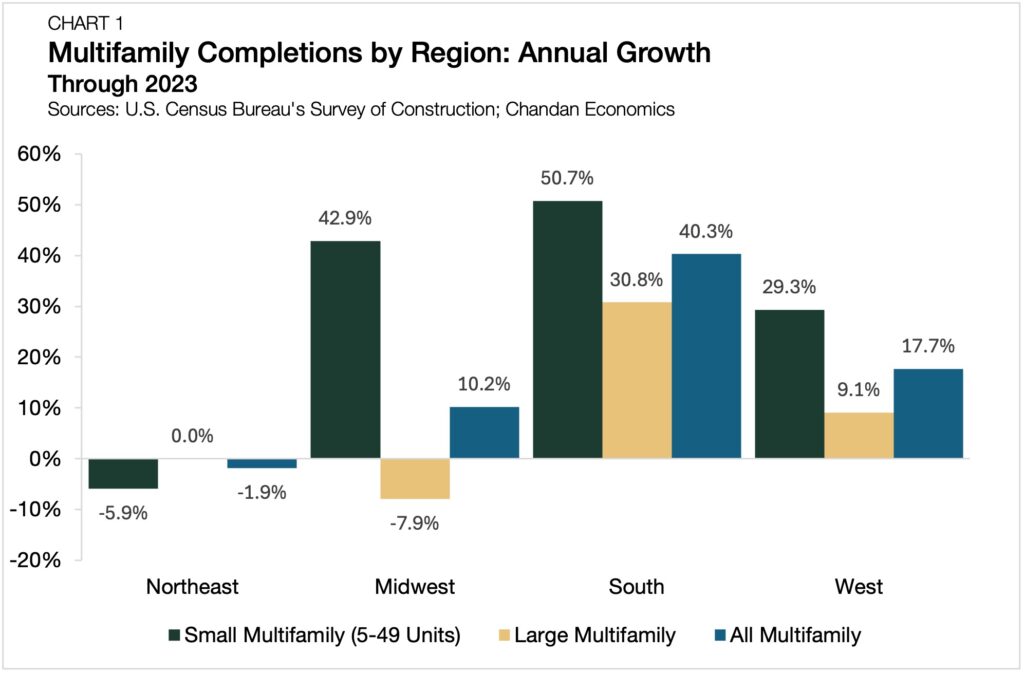

- Small multifamily construction jumped in both the South (50.7%) and Midwest (42.9%).

After the volume of newly issued multifamily permits hit a 37-year high in 2022, multifamily completions surged another 22.3% last year. As the sector continues to gain strength, its growth has remained concentrated in the southern and western regions of the country, according to an analysis of new data from the U.S. Census Bureau’s Survey of Construction.

Completions Jump in the South, Drop in the Northeast

Driven by robust net domestic migration flows from other parts of the country, multifamily development activity has intensified most dramatically in the South. Measured from a year earlier, the number of multifamily completions in the South surged by 40.3% in 2023 — leading all U.S. regions (Chart 1). The South also had the highest number of multifamily completions at 209,000 units, accounting for 47.6% of the national total.

The South’s dominance in the completions category is unsurprising. In 2023, seven of the top 10 markets for multifamily permitting per capita were in the South, led by Austin, TX.

The West had the second-most annual growth and aggregate activity. Multifamily completions in the West grew by 17.7% in 2023, rising to 113,000 units. By comparison, the Midwest saw 10.2% growth, and the Northeast recorded a loss of 52,000 units over the year before.

Within the small multifamily subsector (properties with 5-49 units), the South continued to lead the nation in completions, posting a 50.7% annual growth rate. The Midwest was not far behind, registering an impressive 42.9% jump over the prior year. For large multifamily properties with 50 or more units, the South also led the nation with 30.8% growth. The West was a distant second at 9.1%.

Unit Size Differences

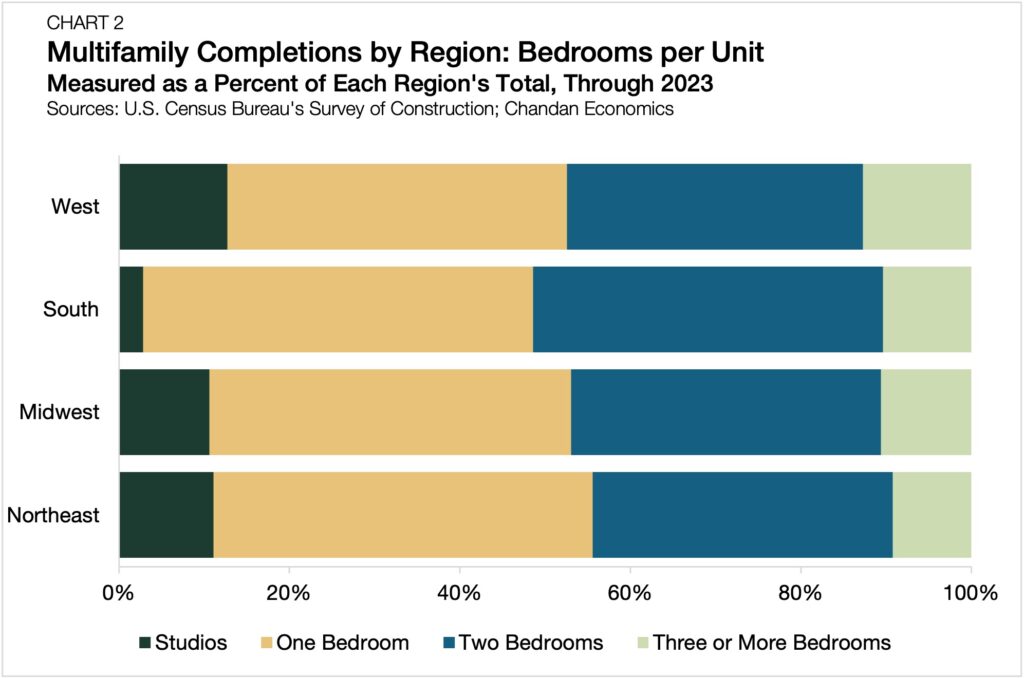

Nationally, multifamily developments have featured smaller-sized units in recent years, with the majority of the new units being either one-bedrooms or studios. Although all regions had at least 49% of their newly completed units have one or no bedrooms in 2023, fundamental differences in unit sizes remain in different parts of the country.

The Northeast had the highest share of newly completed smaller-sized units at 55.6% — of which 44.1% are one-bedroom units and 11.1% are studios. The West followed close behind at a combined 52.5%. However, no region had a higher share of new studio apartments than the West; studio apartments accounted for 12.7% of completions in 2023.

The South, which had the smallest share of small-sized units as a percentage of multifamily completions, also had fewer studio apartments. At 45.8%, this region is the national leader share of one-bedroom completions, but its studio share sits at just 2.8%.

Outlook

More so than any other investment type, real estate is hyper-local and can be distinctively different based on geographic location. The South has been attracting population in-flows while maintaining its lower land prices. As a result, robust levels of multifamily completions and larger-than-average unit sizes both stand above national trends. Meanwhile, legacy markets — especially within the Northeast — have been seeing less new development and tend to feature a higher number of smaller average apartment unit sizes, many attracting premium prices.

Interested in the multifamily real estate investment market? Contact Arbor today to learn about our array of multifamily, single-family rental, and affordable housing financing options or view our multifamily articles and research reports.