Rental Affordability Under Pressure in Miami

- An influx of high-earning households moving into Miami has squeezed its rental market, reducing affordability for existing residents.

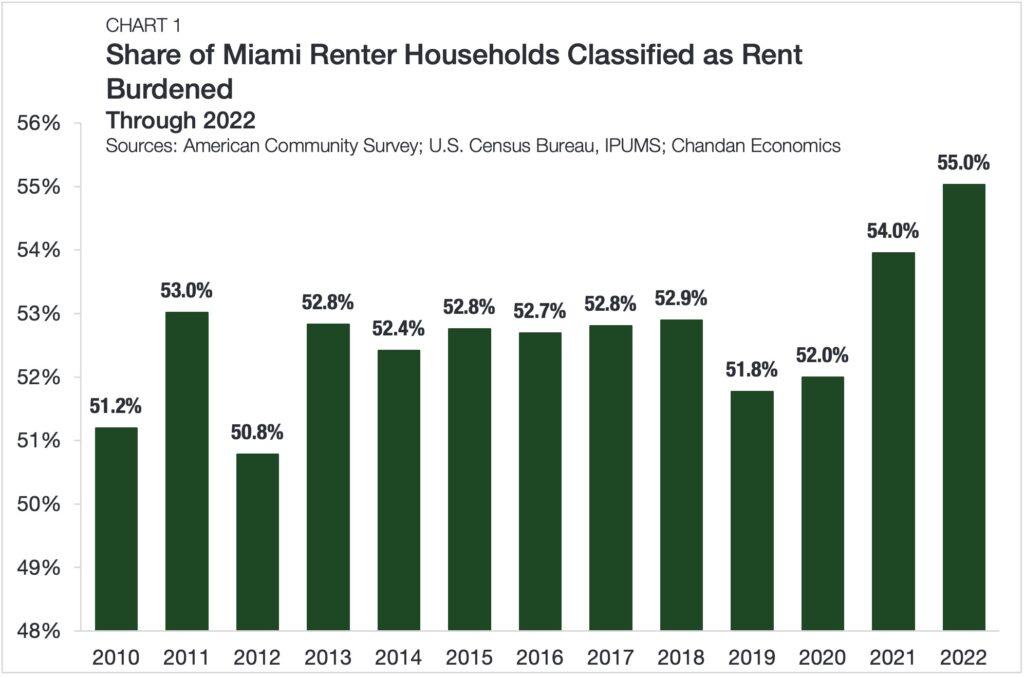

- 55% of Miami renters are now classified as rent-burdened.

- Annual rent growth in Florida’s second-largest city was above 30% last year.

Miami — a market with an attractive climate, urban amenities, and quality transportation options — has seen intense post-pandemic population growth. While its resurgence has been celebrated by many, Miami’s success has come at the cost of weakening rental affordability in the city.

Rising Rent Burdens

Since the onset of the pandemic, rents have climbed in major metropolitan areas across the Sun Belt. From 2013 to 2020, Miami’s share of renter households paying more than 30% of their income toward rent — a widely accepted definition of “rent-burdened” — sat between 51.8% and 52.9% (Chart 1). However, the share of rent-burdened Miami residents shot up dramatically in 2021 and 2022, reaching 55.0% of rental households in the city. For households living below the poverty line, the affordability picture is more dire, with 80.7% classified as rent-burdened.

High Earners Strain the Market

According to the Zillow Observed Rent Index (ZORI), average annual rent growth across all property types in Miami peaked at 31.5% in March 2022 as competition for apartments reached a fever pitch. A major reason why rent prices jumped so dramatically was the influx of high-earning households.

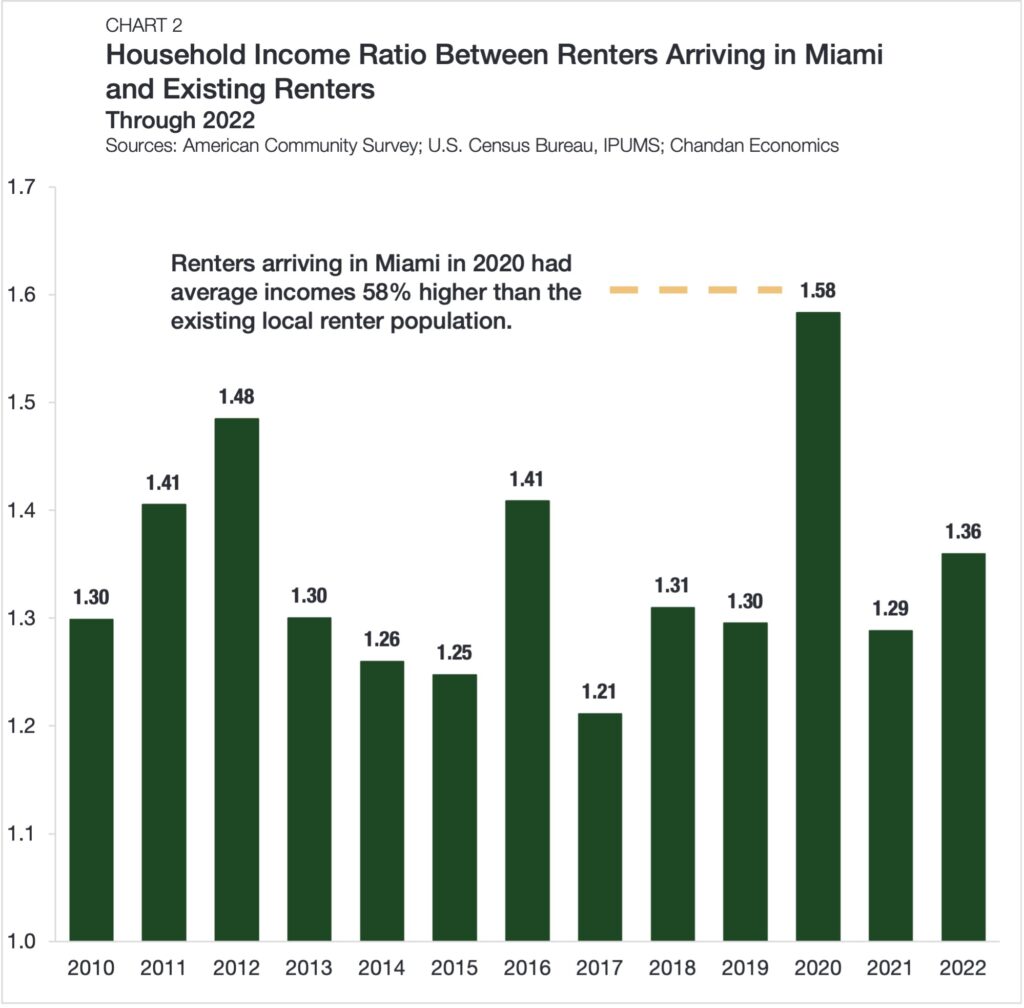

While the average income of renters moving into Miami has consistently been above the earnings of its existing renters, this gap widened during the pandemic. In 2020, incoming renters earned an average of 58% more than the existing rental population (Chart 2). The incoming wave of high-income rental demand bidding for a fixed supply of units created unprecedented rent pressure.

Outlook

Although attracting high earners helps a local economy thrive, it can have unintended side effects, like declining housing affordability. But, with rents starting to cool and new multifamily supply coming online, rental affordability relief may not be far offshore.

Interested in the multifamily real estate investment market? Contact Arbor today to learn about our array of multifamily, single-family rental, and affordable housing financing options and view our other market research and multifamily articles in our research section.