Renters Account for Majority of Household Growth

- Rental households grew 1.9% in 2024, more than double the rate found in owner-occupied homes.

- It was the fastest pace of rental household growth since 2015, excluding the pandemic-era bounce back in 2021.

- Increased supply, shifting household preferences, and homeownership affordability challenges all contributed to the rise in rental households.

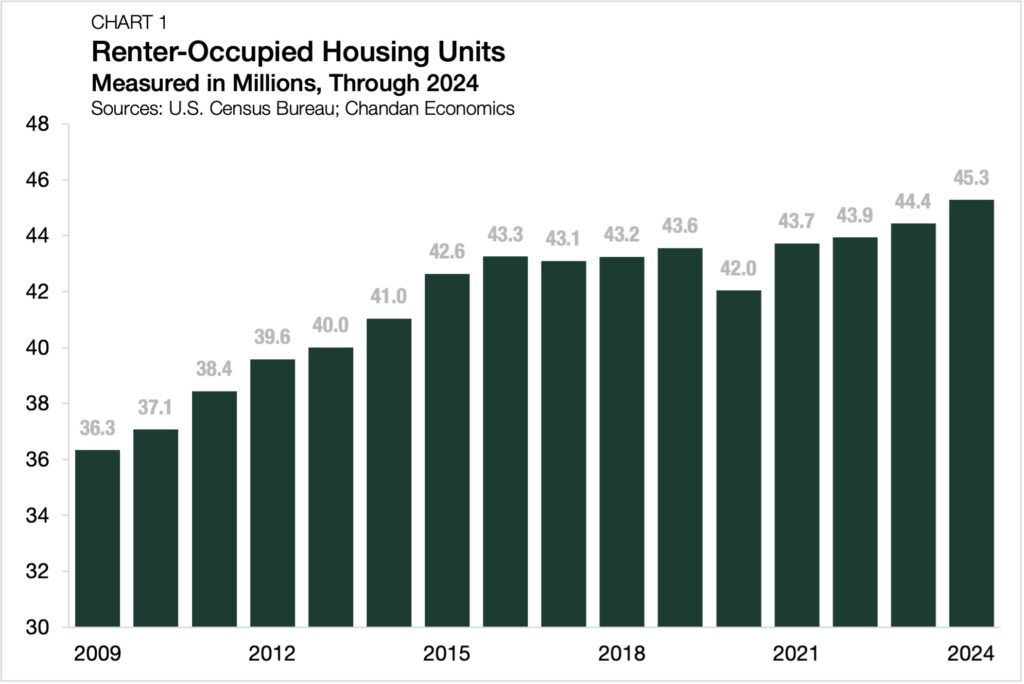

The number of rental households climbed nearly 2% last year, as 848,000 more households became renters, an analysis of the U.S. Census Bureau’s Housing Vacancies and Homeownership Survey shows (Chart 1). Rental households also hit a new high of 45.3 million, accounting for more than half of all U.S. household growth in 2024. Weakening affordability, evolving lifestyle preferences, and a limited supply of quality housing all contributed to surging multifamily and single-family rental (SFR) demand.

Rental Households Surge

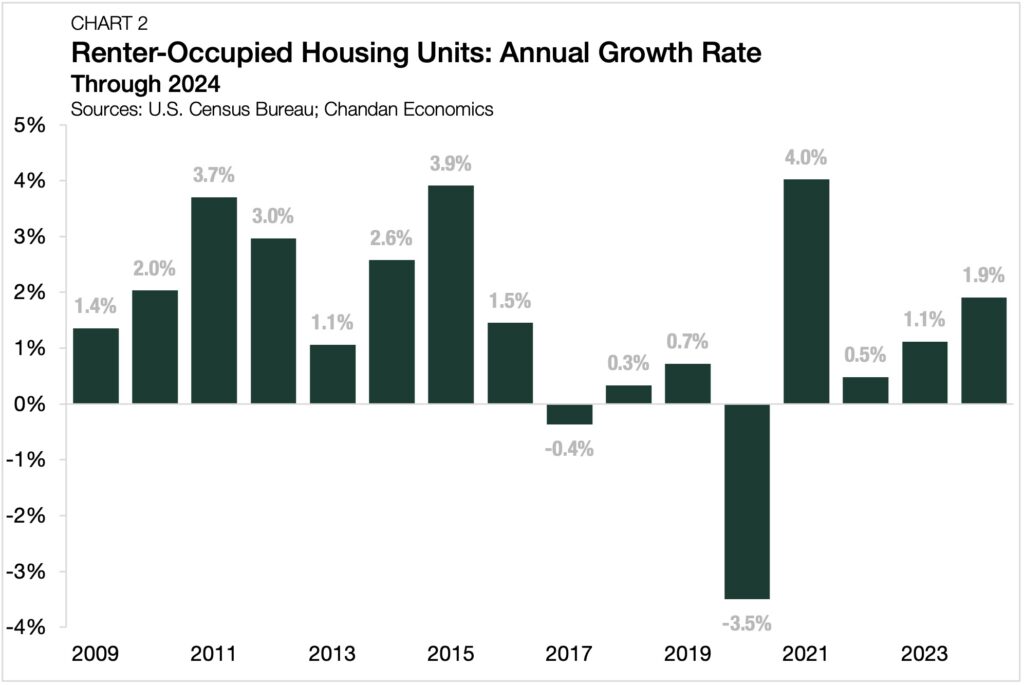

At 1.9%, the annual household growth rate in the rental housing sector more than doubled the pace of increase (+0.7%) of owner-occupied households over the same period (Chart 2). Last year also had the fastest pace of rental household growth since 2015, excluding the pandemic-era bounce back in 2021.

Household growth in the rental housing sector has consistently risen over the past decade and a half. While the homeownership rate has been more variable in recent years, the annual growth rate of renter-occupied housing units has increased in every year since 2009, except for two: 2017 and 2020. As a result, rentals have become an outsized contributor to total household growth. Despite comprising only about three in 10 U.S. households (34.1%), rentals accounted for a majority (54.5%) of all household growth last year.

Supporting Factors

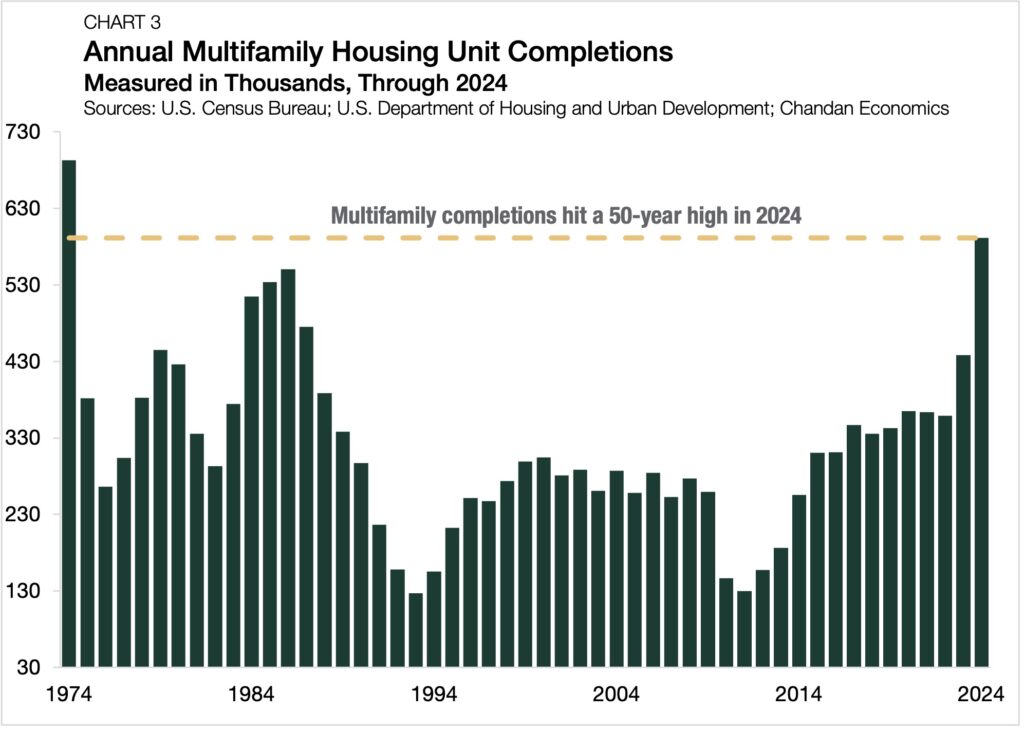

Several fundamental dynamics, including record increases in apartment housing supply, a growing cohort of lifestyle renters, and persistent constraints in the home-buying market, have emerged to steer the expansion of rental housing. Last year, builders completed roughly 591,600 multifamily units nationally, the highest amount in five decades (Chart 3). Additionally, single-family build-to-rent construction projects continue to be developed at a historically high level.

Demand from lifestyle renters continues to drive rental household growth. Lifestyle renters describe those who choose to rent instead of own and those willing to pay more for an optimized living experience, even if it means delaying ownership.

A recent study by Knightvest Capital found that 48% of renters surveyed say they choose to rent versus feeling like they must. Moreover, 34% of those who choose to rent cite relocation flexibility as a top reason for eschewing homeownership. Highly educated young renters with an inclination to pay more to rent and a growing cohort of renters over 50 years old are fueling the rise of lifestyle renting.

Constraints on homeownership are also fundamental factors in the recent growth in rental households. During the past few years, high mortgage interest rates and record home prices have increased the favorability of renting over purchasing. Increased economic uncertainty continues to reinforce the flexibility and financial diversification advantages of renting. While home purchase sentiment increased in 2024 relative to 2023, just one in five consumers believes now is a good time to buy, according to Fannie Mae.

Outlook

The robustness and consistency of rental household growth show it is becoming an even more significant part of the housing market ecosystem. Lifestyle demand combined with persistent challenges in the home-buying market remains a tailwind for rental housing, while the ongoing diversification of rental products will give the sector added strength going forward.

Interested in the multifamily real estate investment market? Contact Arbor today to learn about our array of multifamily, single-family rental, and affordable housing financing options or view our multifamily articles and research reports.