Renters See Apartments as ‘Forever Homes’

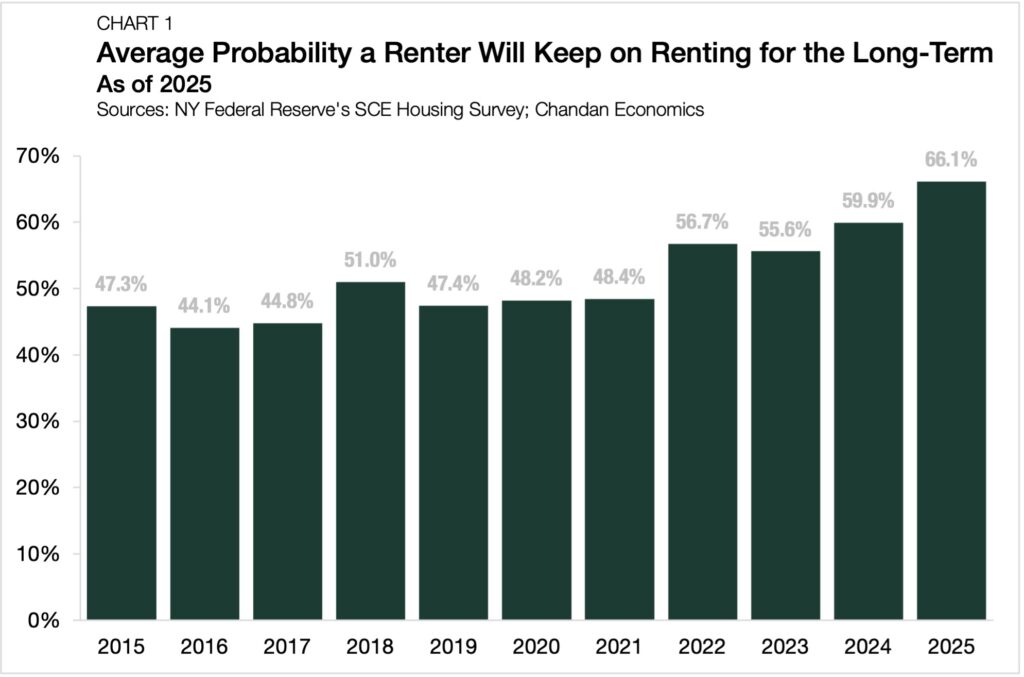

- The average renter estimates a 66.1% probability that they will keep renting for the foreseeable future, a 6.2 percentage point rise over last year.

- Renters expect home price growth and interest rates to increase in the years ahead, driving the lifestyle renting trend.

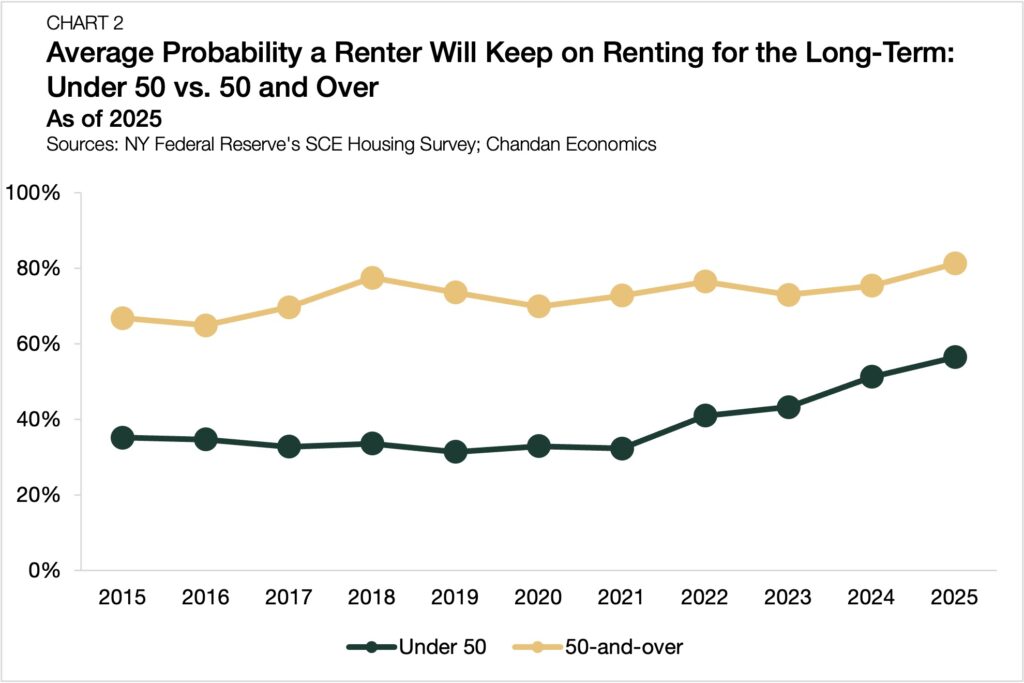

- Renters over age 50 are less sensitive to the changing housing market conditions, underscoring the prevalence of lifestyle renters.

Today’s renters are in it for the long haul. The Federal Reserve Bank of New York’s recently released 2025 SCE Housing Survey shows that the average renter thinks there is a two-in-three chance they will rent for the foreseeable future. With home prices and interest rates unfavorable to would-be homebuyers, we explore renters’ perceptions and how they could impact future rental housing demand.

Compared to last year, the SCE Housing Survey’s “forever-renting” probability average rose by 6.2 percentage points to 66.1% (Chart 1). Just nine years ago, the average renter estimated less than even odds (44.1%) that they would still be renting in the distant future. Since 2016, the forward-looking renting probability has grown by 22.0 percentage points.

Renters under age 50 have seen their housing expectations shift dramatically since 2021. Four years ago, the average renter in that cohort gave only a one-in-three (32.3%) chance that they would rent their whole lives, a reflection of an optimistic homebuying environment before the Federal Reserve began tightening monetary policy (Chart 2). As of 2025, the probability that renters under age 50 will rent for the foreseeable future is 56.5%, an increase of more than 20 percentage points since 2021.

Meanwhile, renters over age 50 appear far less sensitive to shifting interest rate dynamics, likely signaling an intent to be long-term renters. Between 2021 and 2025, the probability that the average 50-and-over renter will keep renting has risen from 72.8% to 81.3%. The rental-centric outlook of this group underscores how many seniors prefer rental options, like single-family rentals, that have lifestyle-enhancing amenities.

Driving Factors

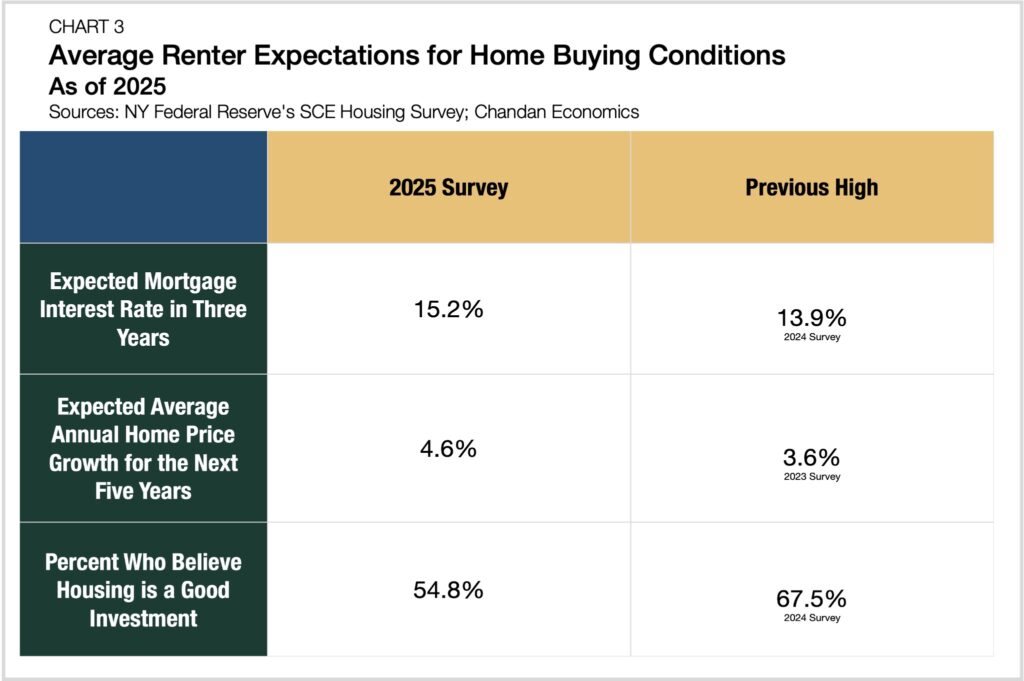

Home price and interest rate challenges are two significant factors contributing to recent changes in the expectations of renters. Renters surveyed by the New York Fed expected annual home price growth to average 4.6% over the next five years, significantly exceeding a previous high of 3.6% found in 2023 (Chart 3).

Mortgage interest rate expectations among renters are also soaring. Responding to the prompt: “Where do you think national mortgage rates will be three years from today?” the average renter had a forecast of 15.2%, which is more than double the current prevailing interest rate.

Borrower eligibility still appears to be a limiting factor for potential homeowners in 2025, despite slightly declining from 2024. Responding to the question: “If you wanted to buy a home today, do you think it would be easy or difficult for you to obtain a home mortgage?” two-thirds of renters (66.8%) reported that it would be either very or somewhat difficult.

The New York Fed survey results also suggest that existing renters have a less favorable view of leveraging homeownership as part of an investment strategy. Slightly more than half (54.8%) of renters believe homebuying is a good long-term financial decision, down from 67.5% the year before.

At the same time, the rental housing market has evolved. Purpose-built communities, garden-style multifamily, and other high-quality options have made rental housing more attractive for households of any age.

The Bottom Line

Prospective homebuyers of all generations continue to face a challenging marketplace. Elevated mortgage interest rates and high home prices have made homeownership less attainable for many. With the number of U.S. renters climbing, the latest New York Fed survey shows, renters are not waiting for the market to swing in their favor but are building their future in rental housing.

Interested in the multifamily real estate investment market? Contact Arbor today to learn about our array of multifamily, single-family rental, and affordable housing financing options or view our multifamily articles and research reports.