SFR Construction Starts Hit a Record High in 2022

- Construction started on 69,000 new single-family rental (SFR) housing units in 2022 — a new record high.

- SFR’s share of all single-family construction hit a new peak, reaching 6.9%.

- The South remains the focus of new SFR development, accounting for more than half of the sector’s nationwide construction.

Even as some developers have pumped the brakes on single-family construction, construction starts of single-family rental (SFR) units soared to a new record high in 2022 — a signal that demographic and structural tailwinds continue to outweigh cyclical recessionary headwinds. With a robust 32.7% construction start growth rate, SFR’s strength starkly contrasts with declines seen in the rest of the single-family market.

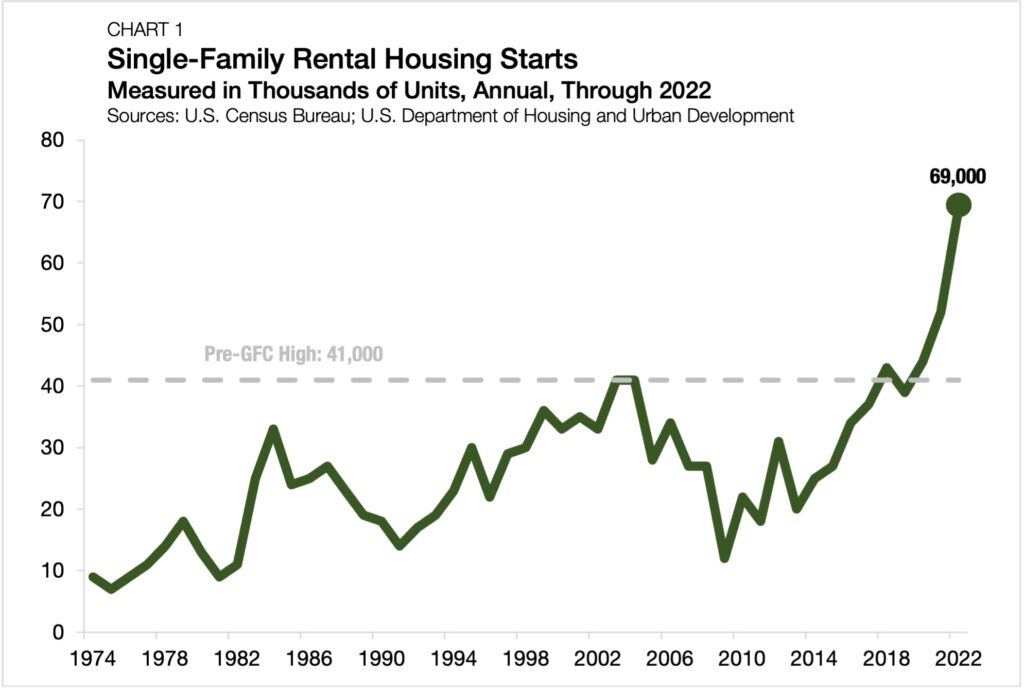

SFR Starts Hit New High for Third Straight Year

Construction began on 69,000 new single-family rental units in 2022 — a new record high, according to the U.S. Census Bureau and the U.S. Department of Housing and Urban Development (HUD) (Chart 1). Before the 2019 housing crisis, SFR construction starts never rose above 41,000 in any given year. Now, new annual records have been set in each of the past three years.

SFR construction starts grew a robust 32.7% from 2021 to 2022 — the highest annual growth rate in 12 years. The growth of SFR starts last year stood in stark contrast to the rest of the single-family market. Single-family construction, excluding SFR, totaled 936,000 starts in 2022 — a 12.8% decrease from the previous year.

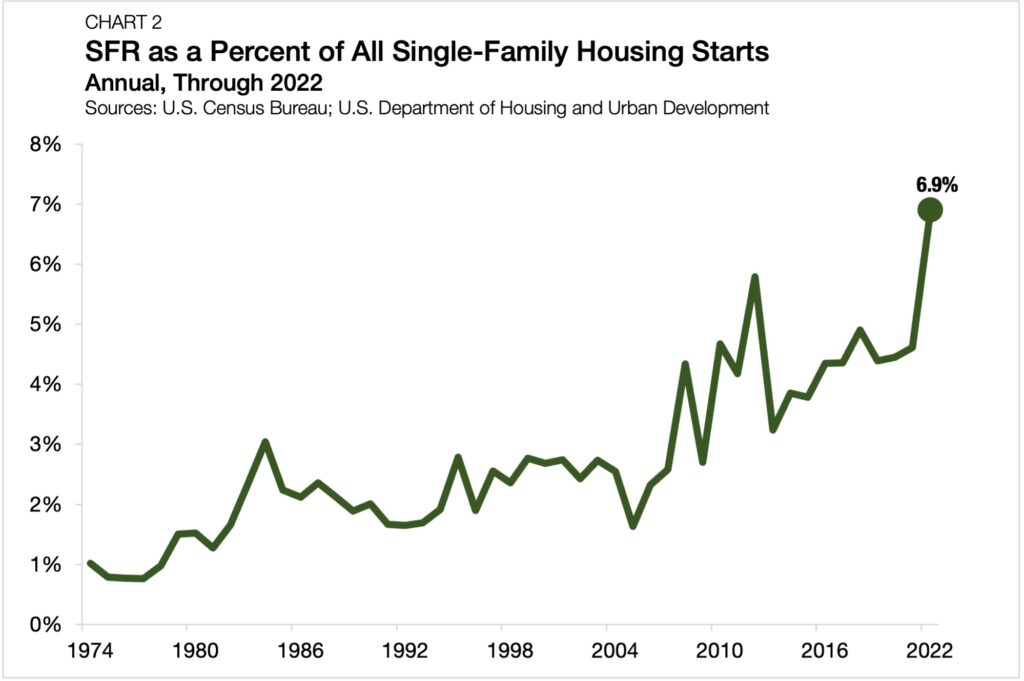

With SFR construction continuing to ramp up and other types of single-family construction pulling back, the SFR share of new development is now higher than ever before. SFR accounted for 6.9% of all single-family construction starts in 2022 — also a new record (Chart 2). Recent yearly totals of SFR starts reflect a massive paradigm shift. Between 1975 and 2006, SFR, on average, accounted for 2.0% of single-family starts — a share that has more than tripled.

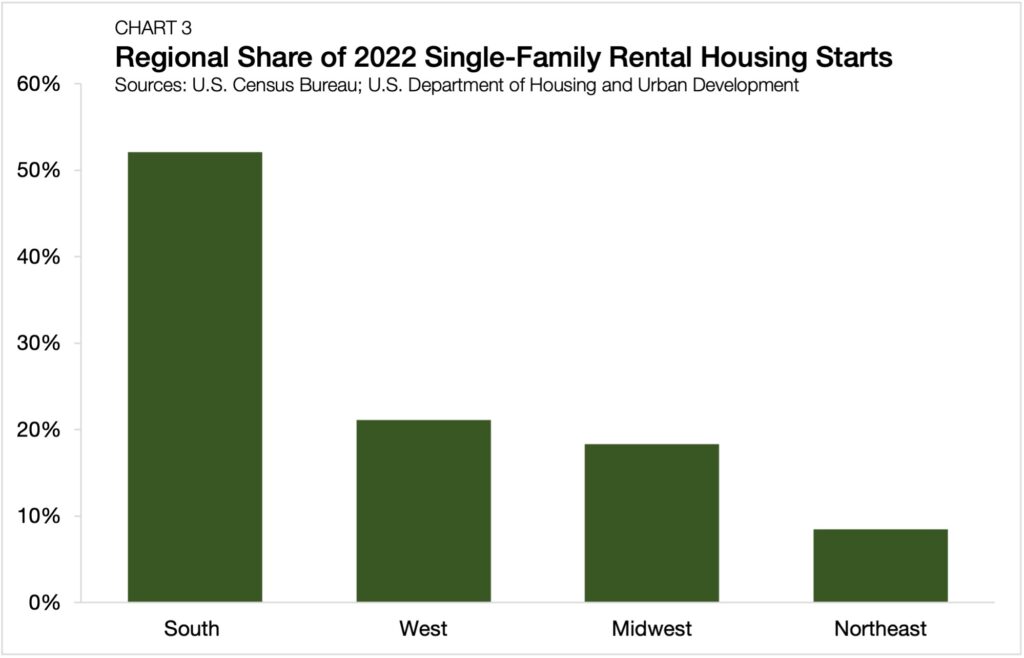

The South Retains Its Focal Point Status

The South remains the most active region of the country for new SFR development (Chart 3). In 2022, construction started on 37,000 new SFR units in the South, accounting for 52.1% of the national total. A mix of thriving urban centers and land affordability has made the South the domestic focal point for new SFR development. The West and Midwest followed next at 15,000 (21.1%) and 13,000 (18.3%), respectively. The Northeast placed last, accounting for 6,000 (8.5%) of SFR starts last year.

SFR Starts High Despite Soft Economy

Entry point access to U.S. homeownership has become increasingly fraught in recent years. Strict mortgage underwriting standards, declining affordability, and a tendency for developers to favor building larger homes have all made it more difficult for young families to access suburban housing. However, as explored by Ivan Kaufman and Sam Chandan, the increased awareness of SFR is allowing the sector to scale up and fill the void. Last year, despite cyclical headwinds brought on by a softening economy and rising interest rates, the SFR sector continued to break new construction records — a fact that should provide momentum in 2023.

Interested in the multifamily real estate investment market? Contact Arbor today to learn about our array of multifamily and single-family rental financing options and view our other market research and multifamily articles in our research section.