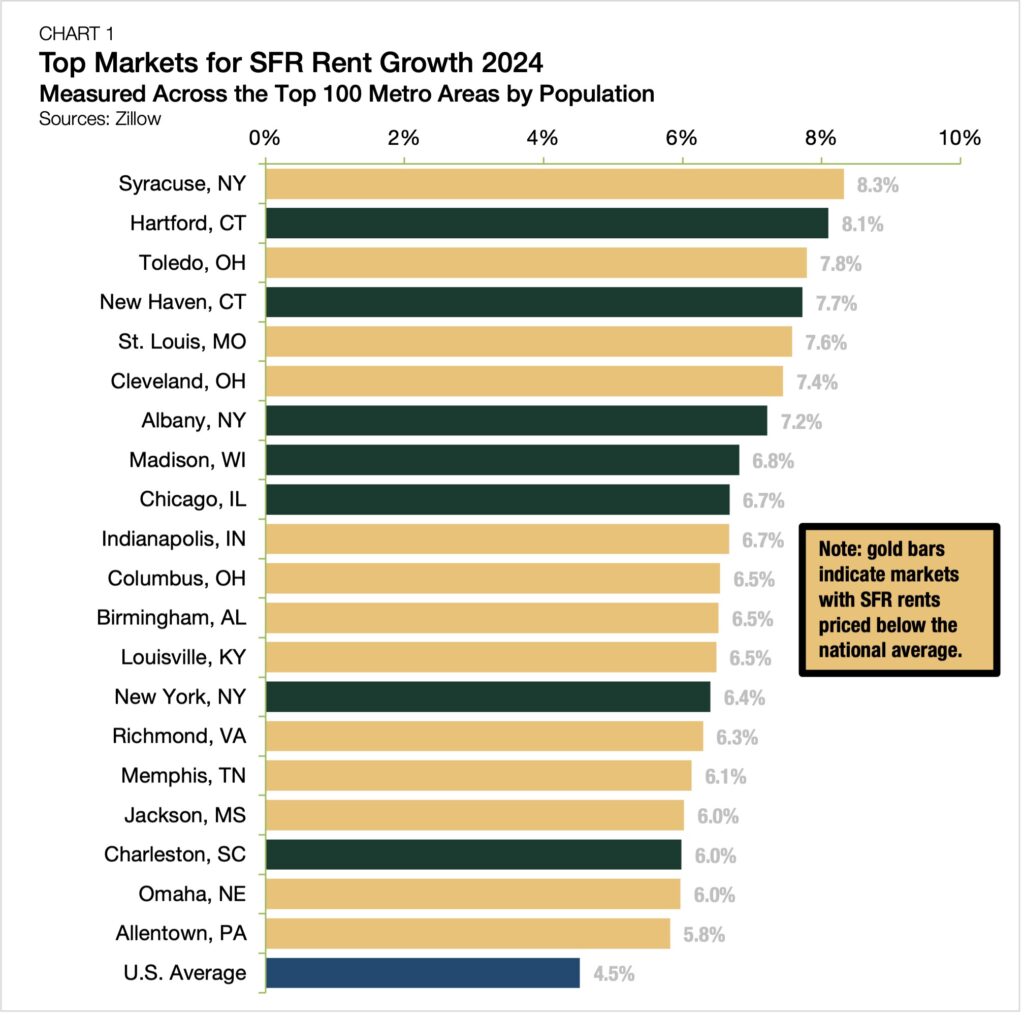

SFR Rent Growth: Top Markets and Leading Regions

- Syracuse, NY, led the nation with an average SFR rent growth rate of 8.3% in 2024.

- The Northeast and Midwest had high rent growth momentum, with prices accelerating fastest in New York, Connecticut, and Ohio.

- SFR rent growth averaged 4.5% nationally, with 99 of the 100 largest markets posting positive price gains.

Elevated mortgage interest rates and high home prices boosted demand for single-family rentals (SFR) last year, supporting the growth of rents in almost all of the 100 largest metropolitan areas. Pricing momentum, which averaged 4.5% nationally, was concentrated in affordable markets in the Northeast and Midwest, an analysis of Zillow’s Observed Rent Index data shows.

Annual Rent Growth

Syracuse, NY, led the nation in average annual SFR rent growth in 2024, posting a year-over-year gain of 8.3%. The monthly rental price for single-family homes in Syracuse averaged $2,030 at the end of the year, which is 6.6% below the national average (Chart 1). Pricing upticks in traditionally affordable markets were a central theme of 2024 as four of the top six markets for SFR rent growth — and 13 of the top 20 — had average monthly SFR rent prices below the national average.

Following closely behind Syracuse was Hartford, CT, which had 8.1% SFR rent growth. The Connecticut capital has an extremely tight housing market that continues to push rents higher. The median for-sale home in Hartford sits on the market for only 37 days — approximately half the national median of 73 days.

In third-place Toledo, OH, a combination of state and local economic factors has strengthened the SFR market. In 2024, wages in Toledo grew by an average of 6.1%. Ohio’s minimum wage indexing, a surge in business applications, and other factors have boosted state-wide wages amid higher levels of inflation following the pandemic’s end.

Regionally, the Northeast and the Midwest claimed the most spots on 2024’s top markets for SFR rent growth list. All top 10 markets were in one of these two connected regions, forming an I-90 corridor of pricing momentum. Although SFR rent growth intensity was uneven nationally, it was uniformly positive, with 99 of the 100 largest U.S. metropolitan areas posting positive average SFR rent growth totals last year.

The Bottom Line

Despite economic uncertainty, the SFR sector has remained a strong source of rent growth in all major markets across the country. With mortgage rates forecasted to stay elevated through the remainder of the year, robust demand for single-family homes should continue to support SFR’s growth for the foreseeable future.

Interested in the multifamily real estate investment market? Contact Arbor today to learn about our array of multifamily, single-family rental, and affordable housing financing options or view our multifamily articles and research reports.