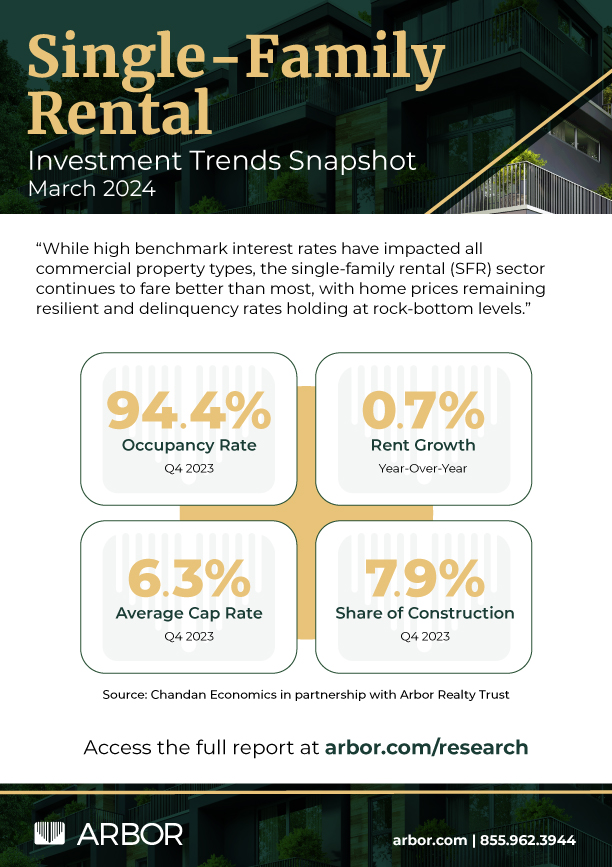

Single-Family Rental Investment Snapshot — March 2024

While high benchmark interest rates have impacted all commercial property types, the single-family rental (SFR) sector continues to fare better than most, with home prices remaining resilient and delinquency rates holding at rock-bottom levels.

SFR construction has been the sector’s greatest strength as affordable access to homeownership has decreased substantially over the last few years. According to data from the Atlanta Federal Reserve Bank, buying a home is about 37% less affordable today than it was at the onset of the pandemic. As a result, developers are leaning into build-to-rent (BTR) projects, driving the number of SFR/BTR construction starts to an all-time high.

A combination of high barriers to homeownership and the addition of more purpose-built SFR communities has led to an increase in lifestyle renters. Compared to existing SFR households, new renters entering the sector are younger, less likely to have started a family, and earn an average of $11,000 more per year. With homeownership remaining prohibitively expensive for many would-be buyers, SFR is positioned to absorb a sizeable portion of housing demand.

On balance, the SFR sector continues to demonstrate strength amid economic turmoil, attracting increased attention from the broader multifamily investment community.

Access key highlights in our latest Single-Family Rental Investment Trends Report.

Interested in the multifamily real estate investment market? Contact Arbor today to learn about our array of multifamily, single-family rental, and affordable housing financing options or view our multifamily articles and research reports.