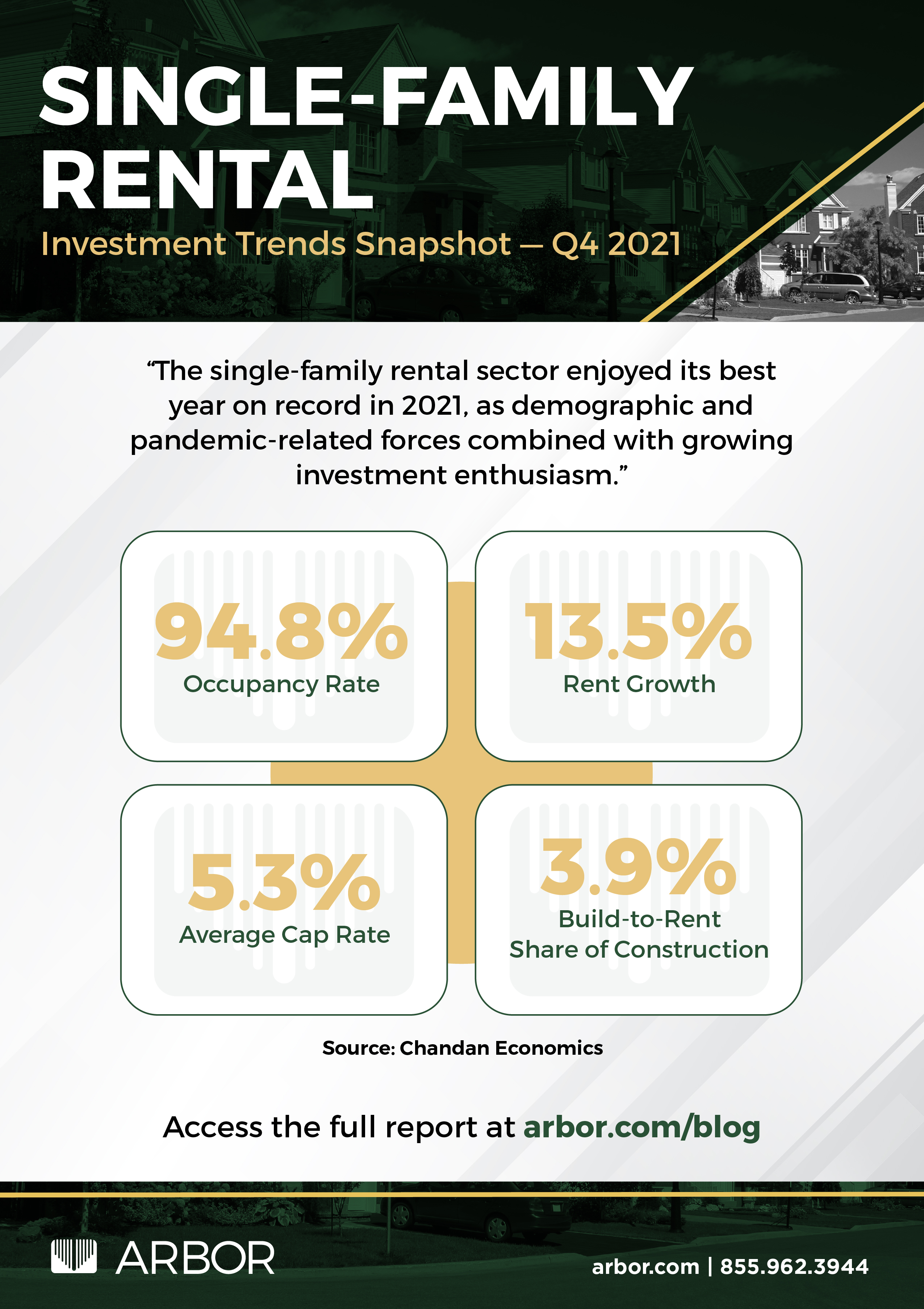

Single-Family Rental Investment Snapshot — Q4 2021

The single-family rental sector (SFR) enjoyed its best year on record in 2021, as demographic and pandemic-related forces combined with growing investment enthusiasm. The sector’s decade-long trend of institutionalization has accelerated over the past year.

Occupancy rates across all SFRs averaged 94.8% in the fourth quarter of 2021, dipping by 20 basis points (bps) from the third quarter. Through October 2021, the last month of available data, vacant-to-occupied annual rent growth sat at 13.5%— 359 bps off the July peak but still 670 bps higher than any pre-pandemic reading.

SFR cap rates averaged 5.3%, down 21 bps from the previous quarter and down 50 bps from the same time last year. The reading marks the lowest observed cap rates since Chandan Economics began tracking the sector in 2011.

Build-to-rent construction starts totaled 47,000 units through the 12 months ending in third-quarter 2021, a 17.5% growth rate from a year earlier and a new all-time high.

On balance, the demand for single-family housing in the U.S. has only increased throughout the pandemic while access to ownership has not. Single-family rentals have helped to fill the gap, providing accessible housing options in suburban neighborhoods with family-centric amenities. Nationally, the SFR sector remains in growth mode with many supportive tailwinds.

For more market insights, read our latest Single-Family Rental Investment Trends Report and visit arbor.com/sfr to learn more about our SFR portfolio financing.