Single-Family Rental Investment Supports a Balanced Housing Market

- Single-family rentals (SFR) accounted for 44.9% of all rental households in 2021.

- Last year, SFR’s share jumped by its largest margin since 2014.

- SFRs still make up a smaller share of all single-family unit households than at any point between 2013 and 2019.

In the years leading up to and through the onset of the pandemic, growing demand for single-family housing and the emergence of the single-family rental sector (SFR) has reshaped the residential landscape in the U.S. But as SFR’s share of rental households expands, its share of all single-family homes remains balanced.

SFR Share of Rental Households on the Rise

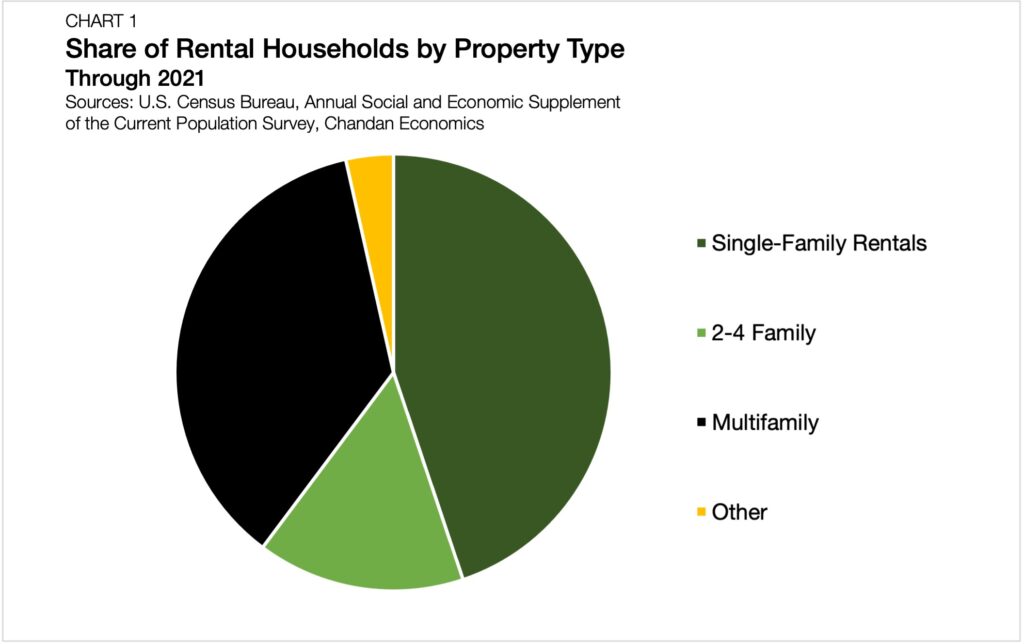

According to a Chandan Economics analysis of the U.S. Census Bureau’s Current Population Survey, SFR is the largest standalone rental sector in the U.S. by share of households. In 2021, SFR accounted for 44.9% of rental households (Chart 1). Multifamily and 2-4 units follow next, accounting for 36.3% and 15.4% of total rental households, respectively.

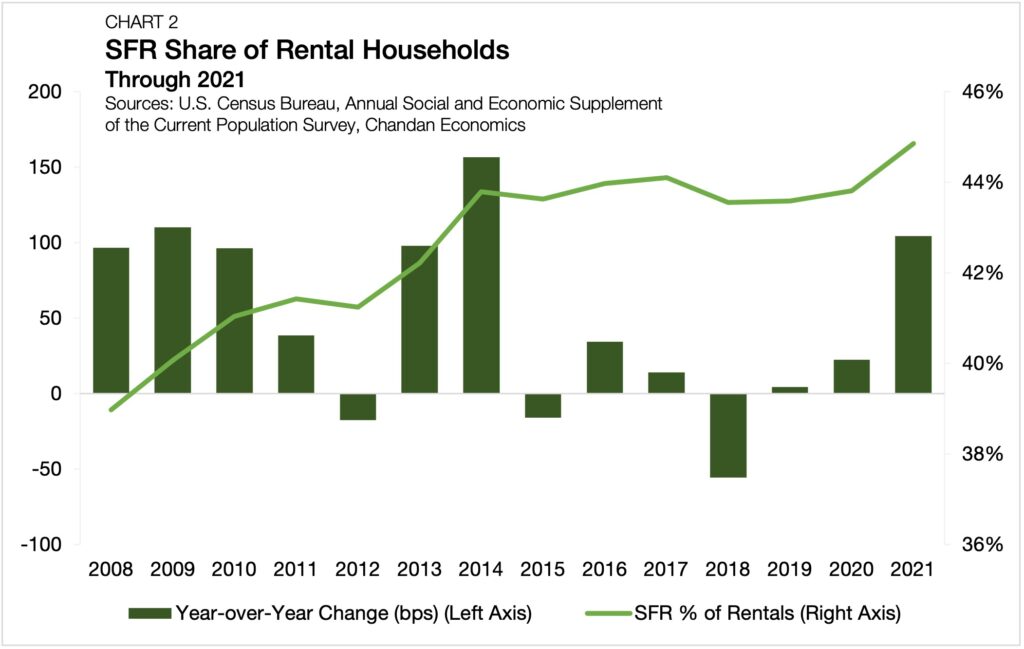

Since 2015, SFR’s share of rentals has risen in five-of-six years. Between 2020 and 2021, SFR’s share of rental households grew by 104 basis points (bps), which was its largest single-year jump since 2014 (Chart 2). Moreover, SFR’s share of rental households is at a peak, eclipsing its recent high watermark of 44.1%, which was last seen in 2017.

Over the next few years, several trends are likely to put continued upward pressure on single-family housing demand. The maturation of the Millennial and Gen Z cohorts, the effects of work from home (WFH) on housing consumption preferences, and a growing tendency for seniors to ‘age in place‘ are all trends that are likely to increase the market need for single-family housing. According to RCLCO, these positive demand influences are forecasted to grow the market need for SFR units by 2.5 million over the next decade.

SFR as a Share of All Single-Family Remains Balanced

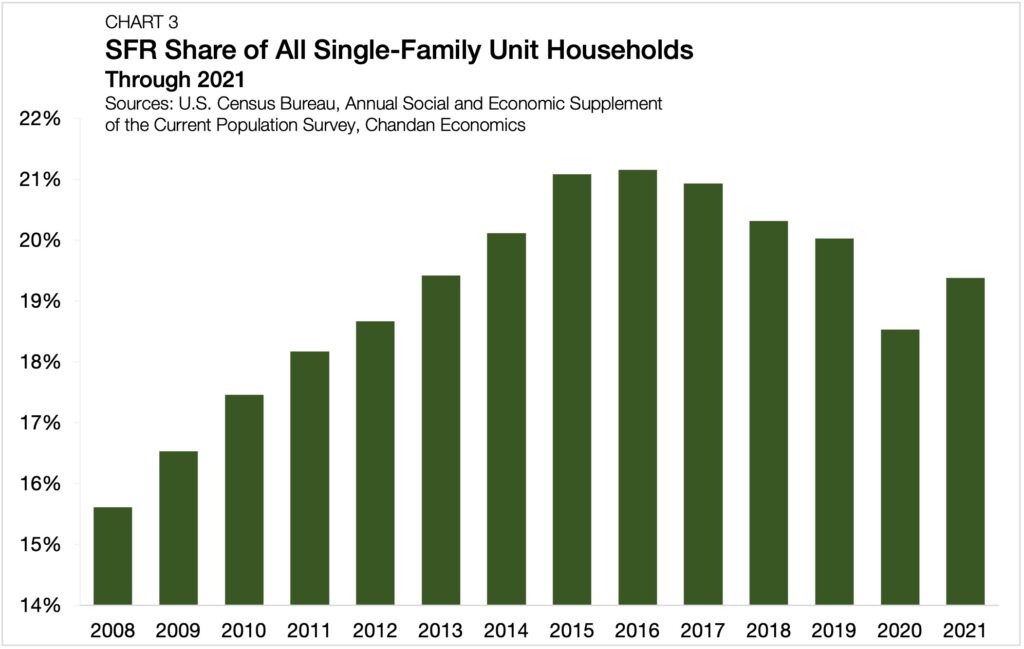

Despite the SFR sector taking up a larger share of rentals, the same trend does not appear to be happening when looking at SFR as a percent share of all single-family households. While the rental share of single-family households did nudge up by 85 bps in 2021, it was the first share increase for rentals since 2016. Rentals accounted for 19.4% of single-family households in 2021, growing from 18.5% in 2020 (Chart 3). Notably, even after the year-over-year increase, the share of single-family households that rented their homes in 2021 was lower than at any point between 2013 and 2019.

SFR’s growing share of all rentals combined with its lack of significant growth as a share of all single-family households is evidence of the underlying wave of demand for suburban housing. Further, it suggests that households tend to have stronger locational preferences (urban vs. suburban) than ownership preferences (own vs. rent).

The Main Street Takeaways

With evolving household preferences increasingly favoring single-family homes, SFR is well-positioned to build on its status as the country’s largest rental housing asset class. However, even as SFR has maturated into a thriving and institutionally viable rental sector, it has not meaningfully shifted the single-family housing balance between rentals and owner-occupied units.

This could change if SFR operators either increase their pace of acquisitions or new construction. However, investment purchasers tend to be more price-sensitive than prospective homebuyers, limiting the amount of supply than can be onboarded through acquisitions. Further, even as developers are building single-family homes to be used as rental properties, the SFR share of the overall single-family construction market remains relatively small (about 5%). If all else remains equal, SFR and the single-family housing market as a whole should benefit directly from a supportive mix of demographic and cyclical trends.

Interested in the multifamily real estate investment market? Contact Arbor today to learn about our array of multifamily and single-family rental financing options and view our other market research and multifamily posts in our research section.