Small Apartment Properties Form Core of Workforce Rental Demand in the Top Metros

Small apartment buildings comprise the largest share of workforce housing demand within the top 20 metros, while single-family rentals dominate the next 30.

Asset Type Distribution of Metro-Level Workforce Housing

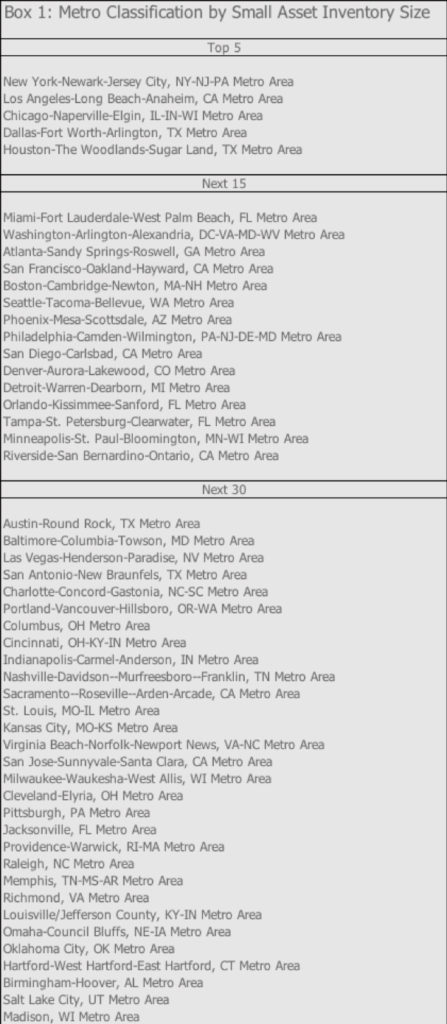

Continuing with our thematic exploration, we examine which property types captured the largest shares of the total workforce rental demand within metro areas of varying sizes.¹

As shown below, in 2016, the share of small asset apartment properties in the overall workforce demand peaked at 40% in the Top 5 metros (see Box 1 for definition), decreasing steadily down the metro tiers to 36% in the Next 15 and over 31% in the Next 30 metros.2

In comparison, the share trend for single-family rentals is the mirror opposite, with shares increasing dramatically from 22% in the Top 5 metros to 35% in the Next 15 and 40% in the Next 30.

Large apartment assets play a smaller overall role, with a 17% share in the Top 5 metros, 15% in the Next 15 and 8% in the Next 30 metros.

Asset Shift of Total Workforce Demand within Top Metros

Changes in the share of workforce renters across asset type reflect the broader changes in the market, including adjustments to the recent supply-side glut in large apartment properties in the larger metros, combined with a slight pickup in single-family ownership.

As shown below, from 2014 to 2016, the share of workforce demand in small apartment buildings saw an increase of 52 basis points (bps) in the largest 5 metros, while declining in the middle-tier cities.

Large apartment assets also increased their share of the overall demand by 23 bps in the Top 5 grouping, while increasing by 166 bps in the Next 15.

Single-family rentals, however, show declining shares across the board, with the largest drop in the middle-tier metros of nearly 70 bps.

While overall workforce demand is increasing across US metros, as covered in our recent blog, small property multifamily stakeholders need to be attuned to short-cycle changes as the oversupply of large building inventory works its way to equilibrium.

1 Workforce households, assumed to rent at prevailing market rates, are typically defined as those falling within a range of 60% to 120% of area median income (AMI), and this is specific to metropolitan and micropolitan areas due to wage differences across the US.

2 All data is sourced from the American Community Survey (ACS), unless otherwise stated. ACS statistics are sample-based estimates of the compositional profile of the total population in the given year of data collection and include a margin of error.