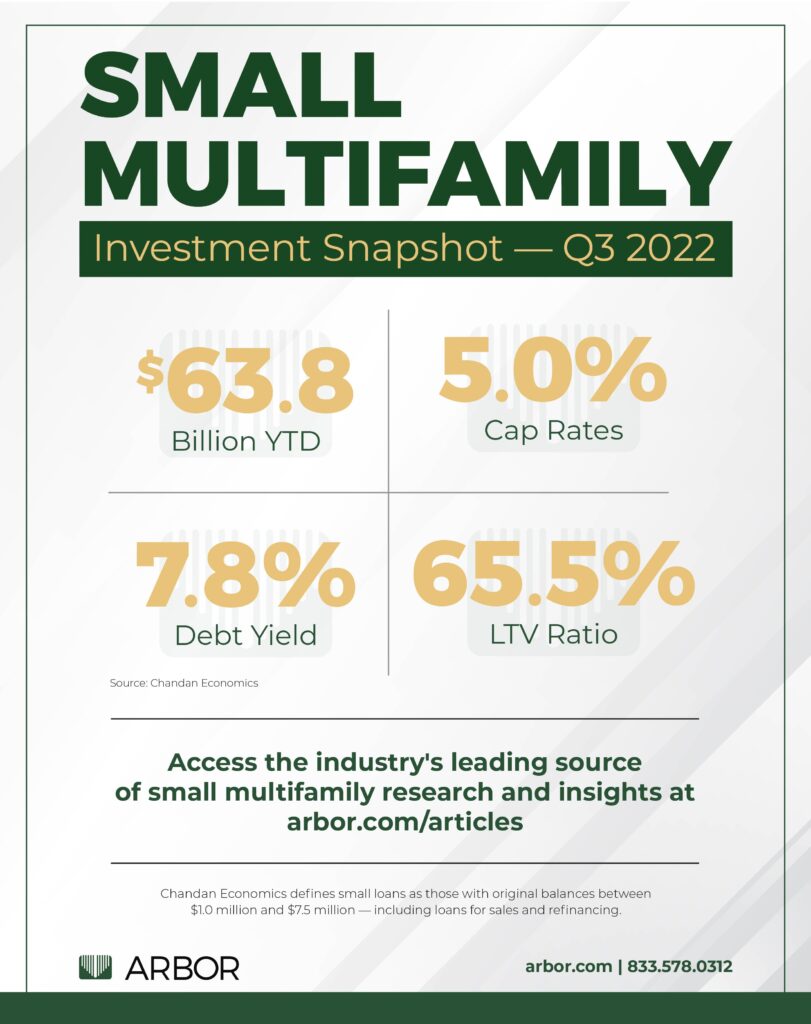

Small Multifamily Investment Snapshot — Q3 2022

The multifamily sector and small asset sub-sector continue to benefit from a unique set of circumstances. While multifamily assets are not “recession-proof,” they are downturn resilient. Positive performance trends this year against the backdrop of economic headwinds and stock market declines demonstrate the sector’s durability.

Even as rent growth decelerates, year-over-year gains still outpace inflation. The sector’s unique ability to absorb inflationary pressures is a powerful differentiator that continues to attract new buyer demand. Liquidity is another factor that has enabled the small multifamily sub-sector to maintain its resiliency. Small multifamily loans for market-rate properties often qualify for Fannie Mae and Freddie Mac’s mission-driven lending mandates, making small multifamily an attractive niche.

There have been some signs of an apparent market shift in recent months, especially with respect to tightening credit underwriting standards. However, the structural undersupply of quality affordable housing options will continue to support rental demand as credit availability remains buttressed by the Agencies. On balance, the small multifamily sub-sector remains in a favorable position to withstand macroeconomic instability.

Access more key highlights in our latest Small Multifamily Investment Trends Report.

Interested in the multifamily real estate investment market? Contact Arbor today to learn about our array of single-family rental financing options and view our other market research and multifamily posts in our research section.