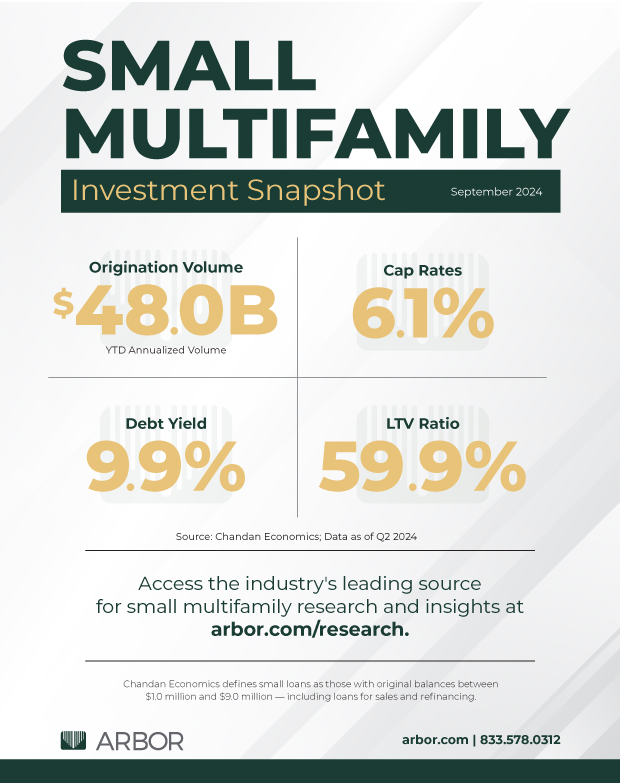

Small Multifamily Investment Snapshot — September 2024

Small multifamily continued to moderate through the midpoint of 2024, as strong demand and lending support from government-sponsored enterprises (GSEs) counterbalanced an elevated interest rate environment and rising property-level yields.

Although loan activity retreated slightly, distress has remained limited within the small multifamily subsector. According to Freddie Mac, 97.2% of its small balance multifamily loans were current through May 2024 — a decrease of about two percentage points from the end of 2022. The share of the outstanding loan balance that has either reached foreclosure or REO (real estate owned) was just 0.2%, signaling that lenders and borrowers are increasingly working together to cure non-performance.

With a consensus of opinion building that the Federal Reserve will cut interest rates multiple times by year’s end, a macroeconomic inflection that would accelerate a normalization could be on the horizon.

Access key highlights in our latest Small Multifamily Investment Trends Report.

Interested in the multifamily real estate investment market? Contact Arbor today to learn about our array of multifamily, single-family rental, and affordable housing financing options or view our multifamily articles and research reports.