Small Multifamily Expanding Rapidly in Smaller U.S. Metros

- The majority of U.S. rentals are located in a handful of large metros.

- Multifamily properties make up the overwhelming bulk of rental options in the top 20 U.S. markets.

- Recent trends suggest small multifamily is growing the quickest in smaller metros.

Multifamily is Still ‘Big City Living’

Expanding on our analysis of the recent Census update for U.S. multifamily, we now examine trends in rental inventory concentration and identify the emerging hotspots for rentals.

While large cities have historically held a tight grip on the U.S. rental housing supply (especially multifamily), new data indicates a development push toward smaller metros.

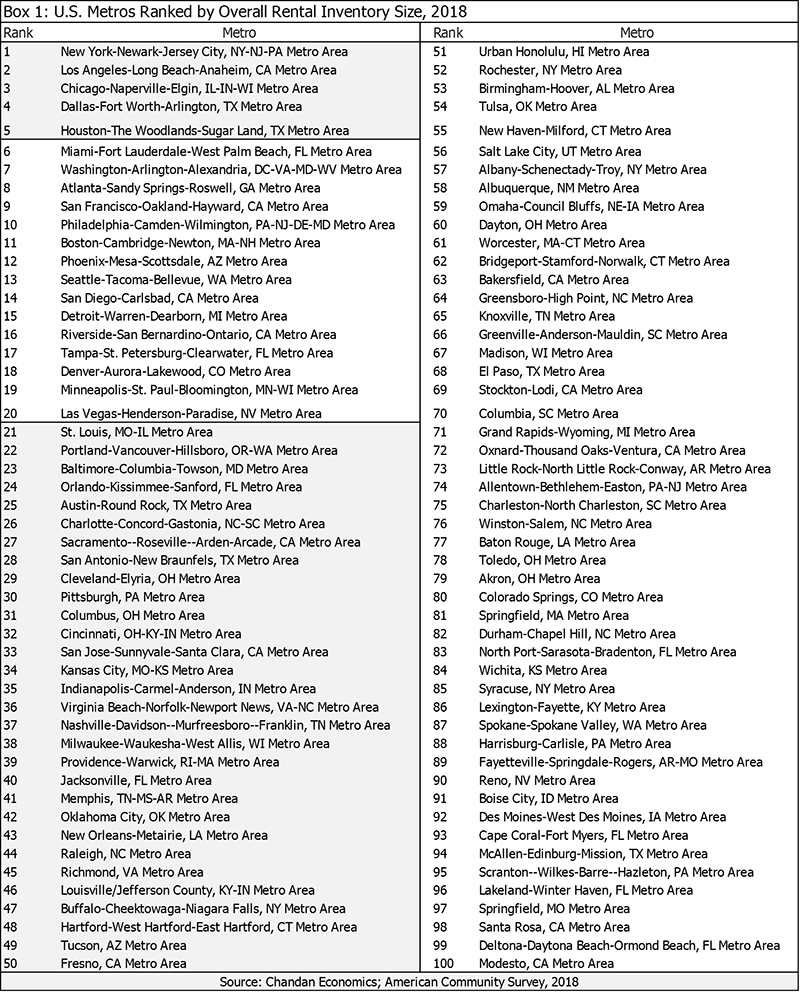

The five metros with the most rental units — New York, Los Angeles, Chicago, Dallas and Houston — accounted for 23% of the national total. The other 15 metros filling out the Top 20 accounted for another 23%. (See Box 1 below for a complete ranking of the Top 100 U.S. metros.)

Source: Chandan Economics; American Community Survey, 2018

Unsurprisingly, the presence of multifamily follows urban density and density follows city size. Within the five metros with the most rental inventory, 60% of units are in multifamily properties. Going down the list, multifamily’s share of rentals drops off as the number of total rentals falls.

Ranging from 15% to 19% for townhomes, and 31% to 38% for small multifamily, these two asset types have the least variation in rental concentration across metros of different sizes. Meanwhile, shares of single-family rentals (SFRs) and large multifamily correlate more closely with changes in total metro inventory, with wide differences of 21% to 39% and 10% to 22%, respectively.

Small Multifamily Gaining in Smaller U.S. Metros

The common theme of the latest Census data is that across all metros surveyed, urban inventories are shifting more toward multifamily. Moreover, large multifamily growth is mixed across different-sized cities. On the other hand, small multifamily’s presence is growing the most in smaller metropolitan markets.

From 2016 to 2018, small multifamily inventory share growth increased by 70 basis points (bps) in the Top 21 to 50 metros, and by 80 bps in the Top 51 to 100. Generally, the cities in the bottom half of the Top 100 are midsize urban centers with resident populations between 500,000 and 1 million people.

Small multifamily’s growth in smaller metros supports the emerging narrative that young adults are increasingly seeking these smaller cities. This is because these markets have walkable downtowns offering mixed-use amenities combined with more affordable costs of living. The latest Emerging Trends in Real Estate Report, published by the Urban Land Institute and PwC, classifies the profile commonalities of these pockets within metros as “Hipsturbia.”

In a follow-up to this blog, we will delve deeper into the specifics of metro-level trends for small and large multifamily and further focus in on the hot markets for growth.

For more metro-level multifamily insights, download our 2019 Metro-Level Small Multifamily Investment Trends Report or visit our Chatter Blog.

Note: All data is sourced from the American Community Survey (ACS), unless otherwise stated. ACS statistics are sample-based estimates of the compositional profile of the total population in the given year of data collection, and include a margin of error.