Solar Panel Usage Accelerates in Rental Properties

- Solar panel adoption has increased exponentially in the U.S. over the past decade, surpassing 5 million installations in 2024.

- Solar usage climbed faster in owner-occupied homes than in rentals, though falling costs and better incentives will likely lead to a narrowing of the gap.

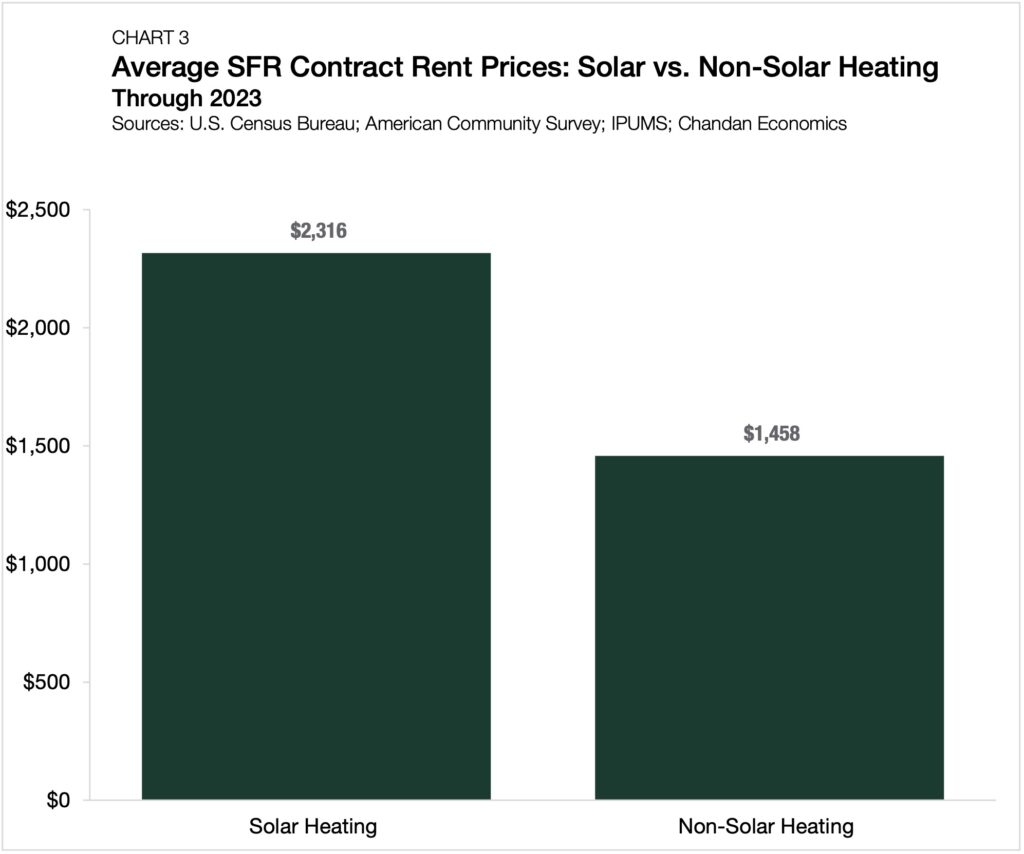

- SFRs with solar panels benefited from a “green premium,” with average monthly rents nearly 60% higher.

Solar panel installations, which skyrocketed in the U.S. over the last half-century, are projected to double to 10 million in just six years. While installations soared in all types of residences, owner-occupied properties significantly outpaced rentals. However, the evolving economics of solar power may be approaching a tipping point for single-family rental (SFR) operators looking for a differentiator.

Solar Adoption Rates Vary

In recent years, solar has been increasingly relied on as a power source for homeowners and property owners alike. According to the Solar Energy Industries Association, the U.S. reached the five million solar installations benchmark in 2024, just eight years after surpassing one million.

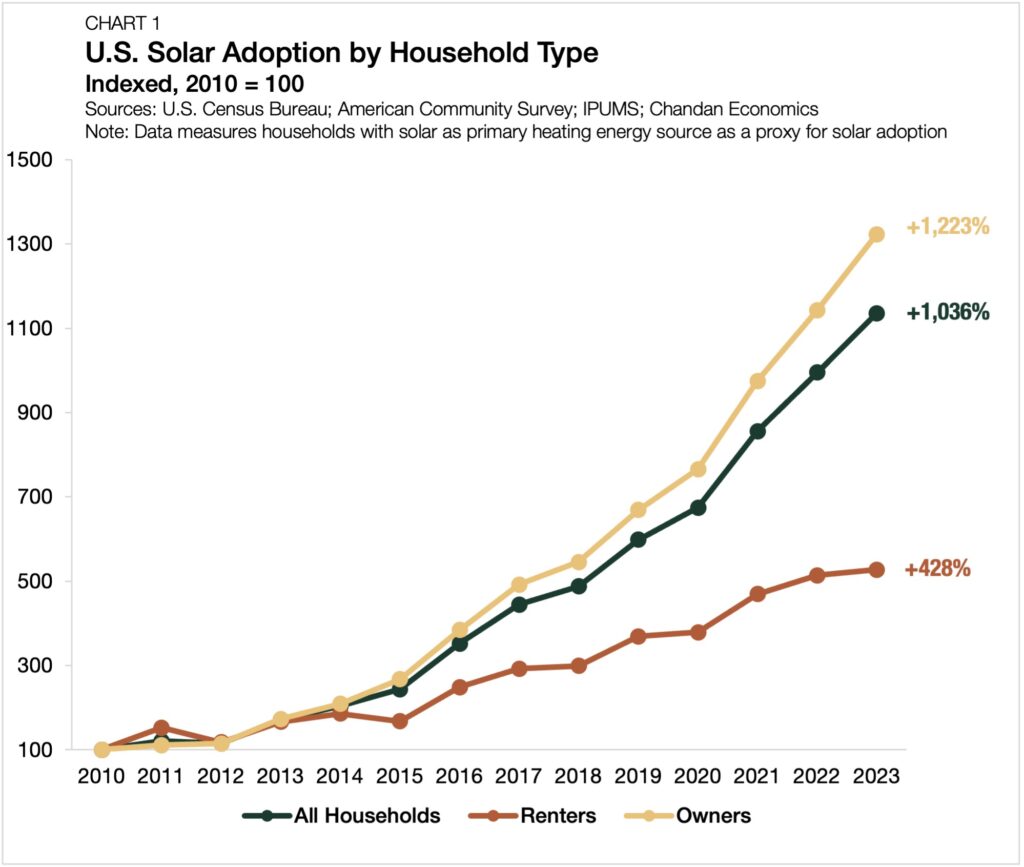

However, solar uptake rates differ greatly across household and property types. Between 2010 and 2023, solar usage in owner-occupied homes rose by more than 13 times (Chart 1). Meanwhile, in renter-occupied homes, an increase of just over five times was far lower, albeit still very substantial, according to analysis of the U.S. Census Bureau’s American Community Survey’s tracking of energy sources used to heat a home.

One of the primary reasons solar panel adoption in rentals lags behind owner-occupied homes is a disconnect between who pays for the installation and who receives the cost-saving benefits. Generally, renters are responsible for paying utilities on top of their contract rent, giving them the bulk of the cost-saving benefits of solar. Meanwhile, the property owner is typically responsible for the up-front installation costs. This cost-benefit misalignment is a powerful disincentive for rental owners to equip their properties with solar. However, the installation price has continued to fall, making solar adoption increasingly feasible and profitable for landlords.

Where Solar in Rentals Makes the Most Sense

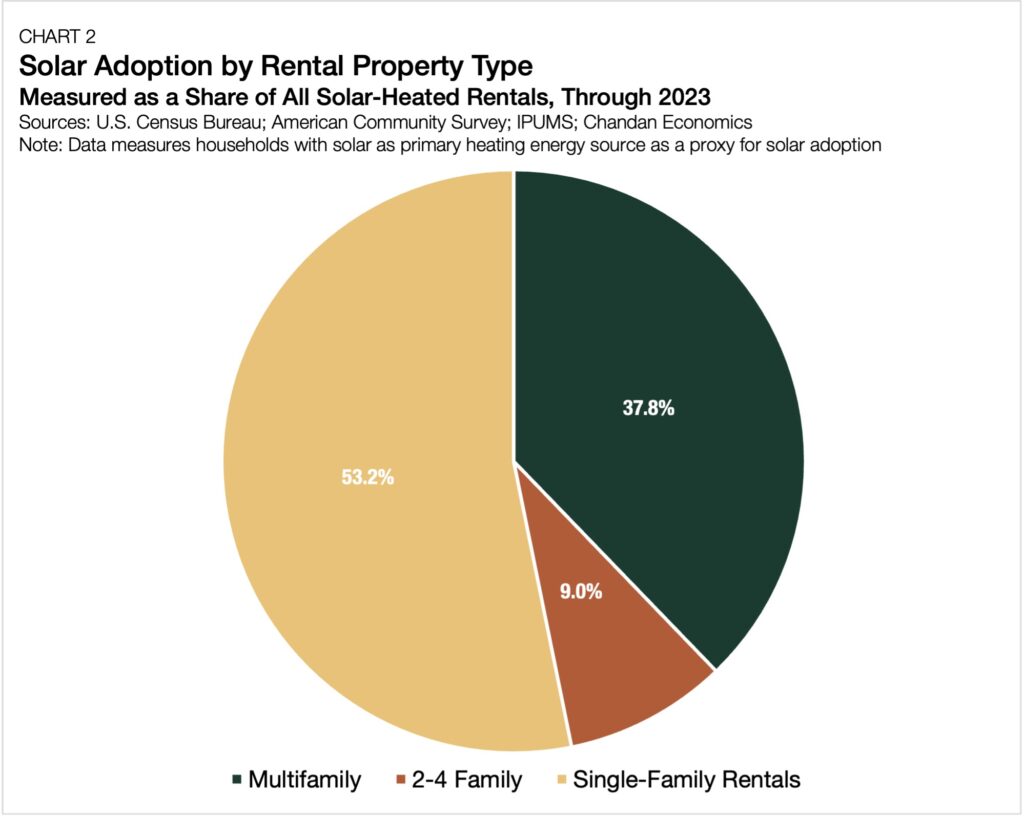

Across all rental property types, solar adoption rates are highest in single-family properties. Despite SFR accounting for only about one-third of all renter households, the sector commanded a share of all solar-heated rentals by property type of slightly over 50% (Chart 2).

According to a recent Chandan Economics analysis, SFR properties have average higher utility costs than other property types due to more exterior exposure per unit and a lack of shared cost-saving inputs, such as HVAC systems. Consequently, existing energy inefficiency issues in single-family properties could lead to higher solar adoption. However, for SFRs to catch up to the owner-occupied market in solar adoption rates, property owners will need to see greater financial benefits and lower installation costs.

Swift progress on the cost side of the equation is already underway. According to the Solar Energy Industries Association, the pre-tax incentive, up-front cost of installing solar panels in an average-sized residential system dropped from an average of $40,000 in 2010 to roughly $25,000 today.

On the benefits side of the ledger, explicit and implicit incentives are starting to come into focus. In addition to the Federal Solar Investment Tax Credit, enacted in 2006, most states now offer tax breaks. Further, solar panels provide rental units with a powerful differentiator in the leasing process, presenting a way for tenants to reduce their carbon footprint and monthly utility bills.

The combination of reduced monthly utility costs and the ability to market the properties as environmentally friendly allows solar-fitted SFR operators to enjoy a so-called green premium with higher-than-average rents. Through 2023, single-family rental units powered by solar energy charged a monthly contract rent of $2,316 — 58.9% higher than non-solar SFR units (Chart 3).

The Bottom Line

Solar panel installations are forecasted to triple in the U.S. by 2035. While rental properties’ adoption rates markedly increased, owner-occupied units still lead by a wide margin. However, as the economic benefits of solar power become more apparent, SFR and other rental property types have much to gain by positioning their growth toward the sun.

Interested in the multifamily real estate investment market? Contact Arbor today to learn about our array of multifamily, single-family rental, and affordable housing financing options or view our multifamily articles and research reports.