State and Local Supply-Side Affordable Housing Solutions

- More than 20 states and the District of Columbia now supplement the federal Low-Income Tax Credit (LIHTC) program with their own tax credit initiatives.

- Local zoning reforms, including efforts to reduce lot size requirements, legalize accessory dwelling units, and expand mixed-use properties, are being utilized to create new housing units.

- Federal budget disputes have delayed planned funding increases for existing affordable housing programs.

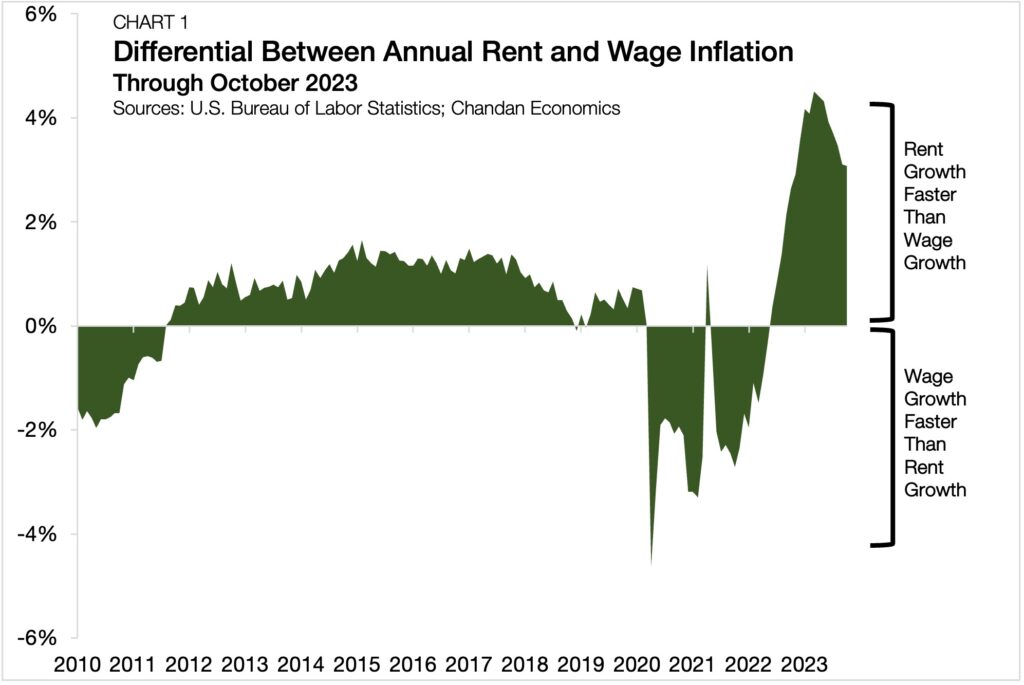

For low-income renters, affordability is a deeply rooted issue. Since 2010, rental affordability has consistently and severely eroded in the U.S., with average rents growing faster annually than average incomes more than 72% of the time. As renters face increased inflationary pressures, state and local governments are exploring a mix of creative and tried-and-true solutions to expand the affordable housing supply.

States Push Tax Credit Solutions

With new legislation on affordable housing stalled at the federal level, state and local governments have stepped in to help fill the supply-side housing policy void. Approaches have varied, but a consistent strategy is to supplement federal tax credits with state-level incentives for housing development.

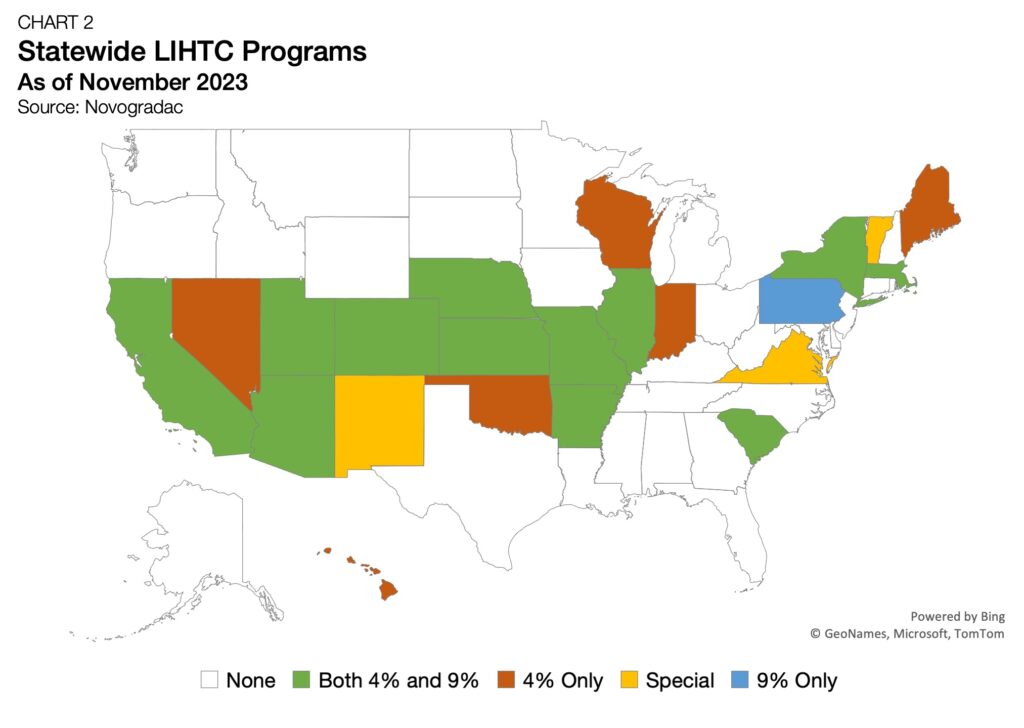

The District of Columbia and 23 states have now created state tax credit programs that supplement the federal Low-Income Housing Tax Credit (LIHTC), with many available that are not contingent on using the federal credit.

LIHTC has gained a favorable reputation among private developers as an effective incentive for encouraging affordable housing development, funding tens of thousands of new apartments for income-constrained renters each year. The federal program utilizes a two-tiered credit system: a 9% tax credit to incentivize new development and a 4% tax credit for rehabilitating and preserving existing properties.

Several states, including Arizona, California, and Illinois, maintain programs that allocate both the 4% and 9% credit types with varying credit-length terms. Other states have enacted only the 4% or 9% credit or have built their own specialized structure that differs from the federal program.

Zoning and Local Supply-Side Developments

Zoning reform has gained attention and support at the local level as a potential solution to housing supply constraints in municipalities. Ongoing local initiatives range from reducing minimum parking and unit requirements to legalizing accessory dwelling units (ADUs) to expanding transit-oriented development, according to a survey by Zoning Reform Tracker.

Phoenix, Arizona

In September, the municipality of Phoenix passed a law that legalized accessory dwelling units (ADUs) throughout all residential parcels in the city. The Valley of the Sun saw some of the most significant population growth of any U.S. metropolitan market when the pandemic-era migration boom placed severe pressure on the local housing market. The new law, which is projected to create thousands of new units, takes steps to protect the affordable housing supply by restricting the use of ADUs as short-term rentals.

Boise, Idaho

In June 2023, Boise, Idaho, passed a comprehensive reform bill that expanded the types of development allowed in residential zones previously limited to single-family construction to include ADUs, duplexes, triplexes, and fourplexes. Boise’s reform notably contains rules aimed at preventing speculative activity, assuring affordability, and limiting the displacement of tenants in mixed-use districts. As efforts to expand the housing supply seemingly collide with renter protection initiatives such as rent control, Boise’s model may present an alternative, multi-pronged approach to housing policy reform that reflects the various stakeholders’ concerns.

Madison, Wisconsin

Reforms geared toward transit-oriented development (TOD) have had less momentum in 2023. Still, earlier this year, the city of Madison adopted a new TOD zoning district that covers 15% of the metropolitan area’s land mass — a significant amount designated for this type of use. The municipality projects that it will add over 100,000 residents between 2020 and 2050 and views TOD as an effective strategy for reducing long-term housing and transportation costs as well as the strain on local infrastructure and the environment.

Madison’s zoning code has substantially changed permitted uses in TOD areas. For example, it allows for additional and higher dwelling units in TOD zones. It also eliminates minimum parking requirements and restricts the layouts of auto-oriented properties to rein in the relative proportion of vehicle land use.

Federal Budget Delays Freeze Key Programs

In recent years, federal policymakers have increasingly signaled a desire to tackle supply-side housing challenges, but progress has been limited.

On November 15, the U.S. House of Representatives passed a new continuing resolution (CR) that extends current federal funding levels until early 2024, effectively freezing department budgets. Consequently, the possibility of significant changes in funding for HUD-related affordable housing programs, such as the Housing Choice Voucher (HCV) program and LIHTC, remains undetermined.

In recent weeks, momentum has appeared to build for the Affordable Housing Credit Improvement Act (AHCIA), a bipartisan bill that seeks to expand LIHTC. A group of 145 Republicans in the U.S. House of Representatives recently indicated support for this tax reform package that would create a legislative path for housing tax credit proposals. The bill would restore a 12.5% cap increase that expired in 2021 while lowering the required threshold that private activity bond financing must make to trigger maximum credit allocations from 50% to 25%.

Beyond new program expansions, the Biden Administration is exploring how existing federal funding can be used toward commercial to residential property conversions amid a significant drop-off in office space demand. In October, the White House released updated guidelines outlining 20 federal programs that can be used for such conversions, emphasizing repurposing office space in the face of high vacancy rates to create new affordable housing units.

The Look Ahead

As 2023 closes, a comprehensive federal affordable housing solution appears less attainable. While state-level reforms have limitations, they have become a vital piece of the affordable housing supply puzzle.

Interested in the multifamily real estate investment market? Contact Arbor today to learn about our array of multifamily, single-family rental, and affordable housing financing options and view our other market research and multifamily articles in our research section.