The Probability Renters Will Keep Renting Hits Record High

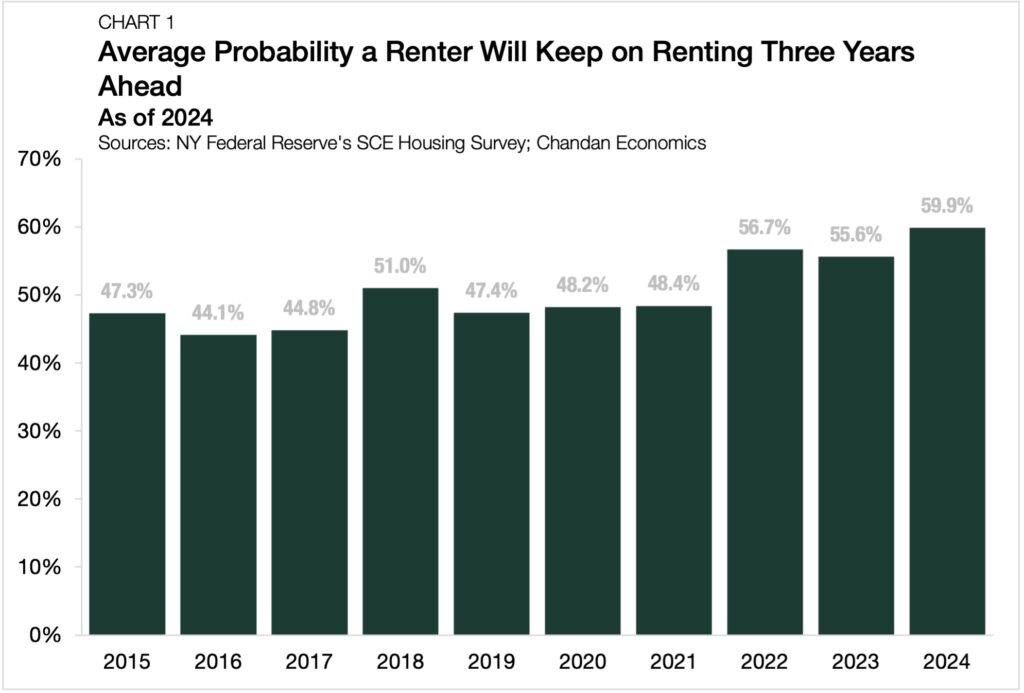

- The average renter polled in a recent New York Federal Reserve survey reported an approximately 60% chance that they would still rent for at least the next three years.

- Declining mortgage availability and expected home price growth are the primary factors influencing renter preferences.

- Renters 50 years old and over are less sensitive to changing housing market conditions and are more likely to prefer renting.

The average renter thinks there is a three-in-five chance they will still be in the rental market in 2027, according to the Federal Reserve Bank of New York’s recently released 2024 SCE Housing Survey. Compared to last year, the probability of the average renter not becoming a homeowner in the next three years was up 4.3 percentage points, reaching its highest mark since the study began in 2015.

Shifting Expectations

Between 2015 and 2021, the average renter’s self-reported probability of staying in the rental market eclipsed 50% just once. But starting in 2022, rising mortgage interest rates and record-high home prices changed renters’ outlook as many renters found homeownership less attainable. While many renters are delaying homeownership right now, nearly 70% of current renters in the survey would like to own a home one day.

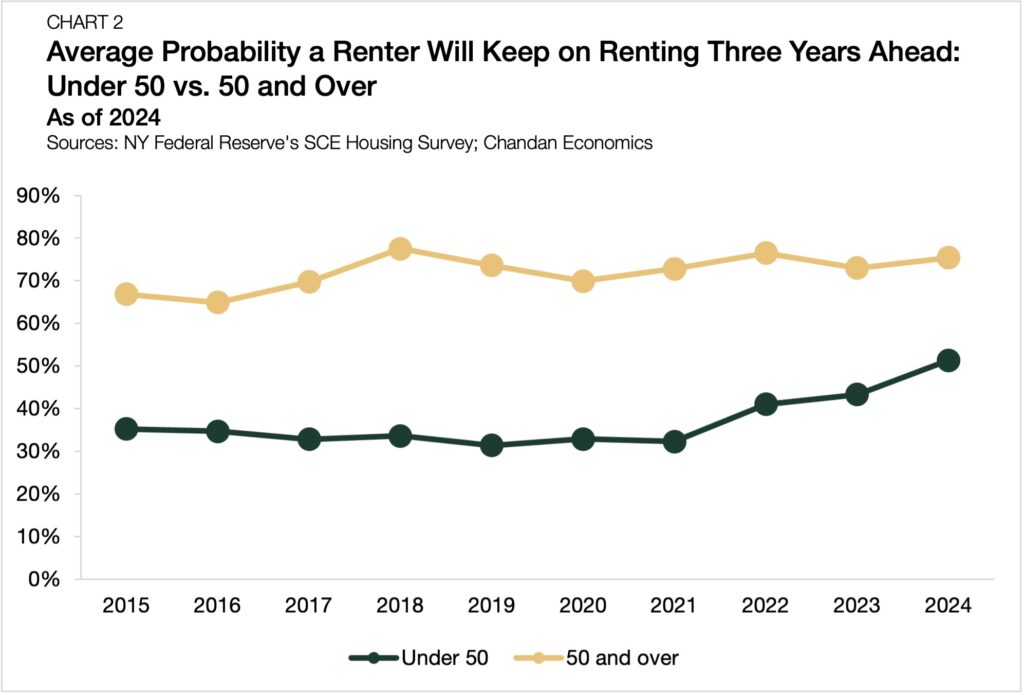

Looking along demographic lines, renters under age 50 have experienced one of the most substantial swings in housing expectations. Between 2015 and 2021, the average renter in this age group self-reported a probability of continuing to rent for more than three years of between 31.4% and 35.2% (Chart 2). Since 2021, this probability has climbed for three consecutive years, reaching a new high of 51.3%. As fewer U.S. adults pursue homeownership, the 2024 survey found that for the first time, the average renter under age 50 does not anticipate buying a home in the foreseeable future, a first in the survey’s history.

Renters who are 50 years old and over appear far less sensitive to fluctuations in housing market conditions, perhaps signaling their greater intent to remain in the rental market. In total, renters in this age group had a self-reported average probability of 75.4% in the 2024 survey that they would continue renting, rising by 2.4 percentage points in a year. The share of respondents who prefer renting is nearly three times higher for those age 50 and over (30.7%) than those under age 50 (10.8%), which supports the lifestyle renting trend in retirees.

Driving Factors

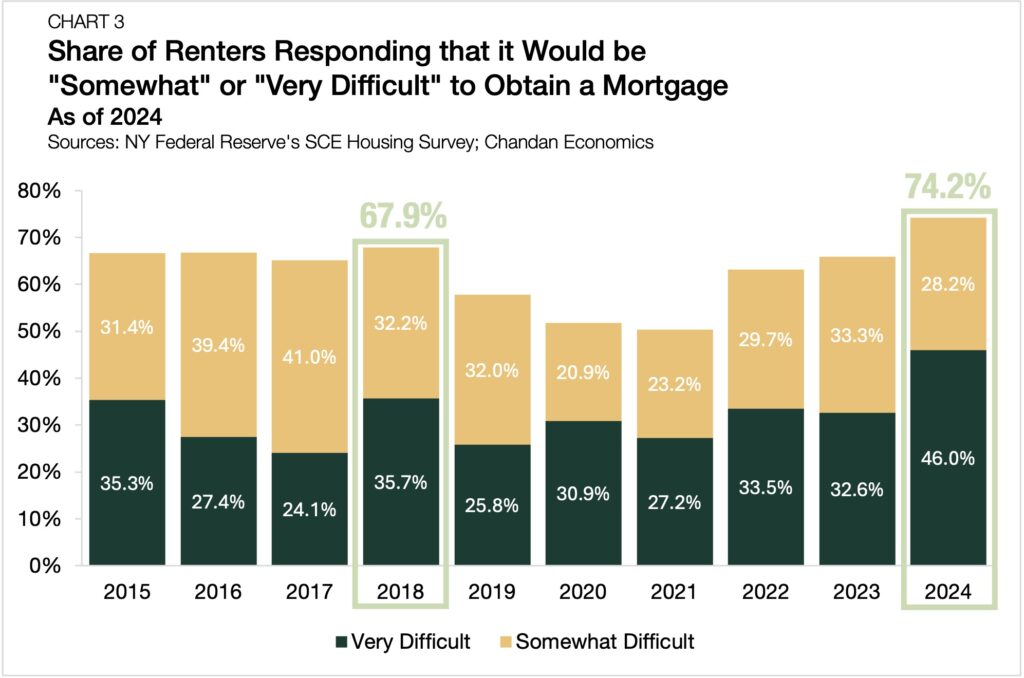

The most significant factor contributing to the change in renter expectations over the past year is a perceived difficulty securing financing. Responding to the question, “If you wanted to buy a home today, do you think it would be easy or difficult for you to obtain a home mortgage,” 74.2% of renters reported that it would be very or somewhat difficult. The nearly three-quarters of renters who anticipated challenges in securing a mortgage were a new survey high, and an increase of 8.3 percentage points over last year (Chart 3).

Projected home price growth also appears to have been factored into renters’ calculations in the survey. They expect home prices to rise by another 5.6% on average in 2024, 1.6 percentage points higher than 2023’s renter forecast.

The Outlook

In 2024, new potential homebuyers must navigate a challenging marketplace. The combination of tight mortgage underwriting, high mortgage interest rates, and record home valuations has kept more households of every age in the rental market. With rental housing demand already strong, the survey indicates demand is likely to gather even more momentum through the rest of the year.

Interested in the multifamily real estate investment market? Contact Arbor today to learn about our array of multifamily, single-family rental, and affordable housing financing options or view our multifamily articles and research reports.