The Proposed Federal Budget and What It Means for Affordable Housing

- House Appropriations Committee approved $56.5 billion in new funding for HUD in fiscal year 2022 (FY22), reflecting the Administration’s focus on housing affordability.

- The largest portion of the bill would expand the Section 8 program, covering an additional 125,000 low-income households.

- The HOME Investment Partnerships Program proposed budget represents a 37% step up and would be the program’s largest funding pool in 17 years.

Key Findings

The proposed federal budget for fiscal year 2022 (FY22) signals housing affordability is a significant policy priority. The nation’s affordable housing shortage has regained attention amid the pandemic’s outsized impact on income-constrained households.

In their recently approved bill, the House Appropriations Committee, which takes Congress’ first pass at amending the President’s proposed budget, included a substantial funding increase for the Department of Housing and Urban Development (HUD). The budget was mostly in line with the President’s proposal.

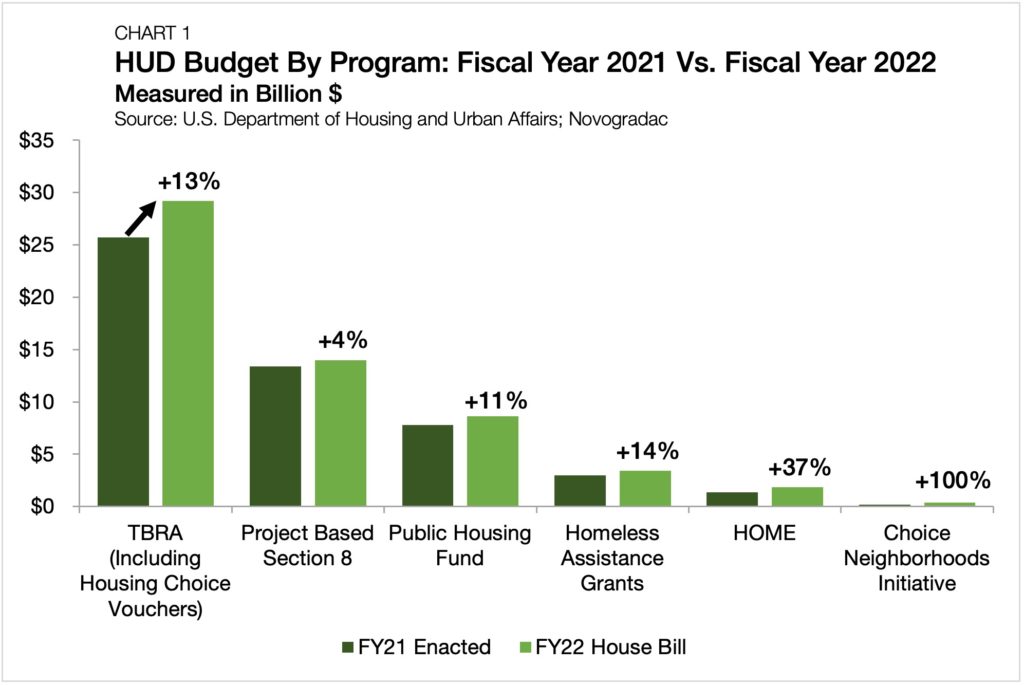

HUD administers most federal housing assistance programs. The bill would appropriate $56.5 billion to the agency, $6.8 billion more than in fiscal year 2021 (FY21). Combined with close to $12 billion in projected receipts from the Federal Housing Administration and Ginnie Mae, these funds would bring HUD’s total budget to $68.4 billion in FY22. This is a 14% increase from FY21 (Chart 1).

While Congress may further reduce or change the budget, its emphasis on addressing housing affordability would have major implications for the residential sector. Here we highlight the specifics of the Committee’s budget and the impacts on investors and tenants.

Budget Breakdown: Tenant-Based Rental Assistance and Section 8 Housing

The largest portion of the bill’s proposed funding is a provision expanding Tenant-Based Rental Assistance (TBRA). The bill ups the program’s total from $25.7 billion in FY21 to $29.2 billion in FY22, a 13.3% increase.

According to the bill, the funds would cover an additional 125,000 low-income households, improving on its current funding for 2.3 million households. This increase represents the largest one-year increase in coverage since 1998.

The main use of TBRA funds is through the Housing Choice Voucher program, known commonly as Section 8. These vouchers provide direct rental assistance to eligible income-constrained households who may use the subsidies to lease in the private market.

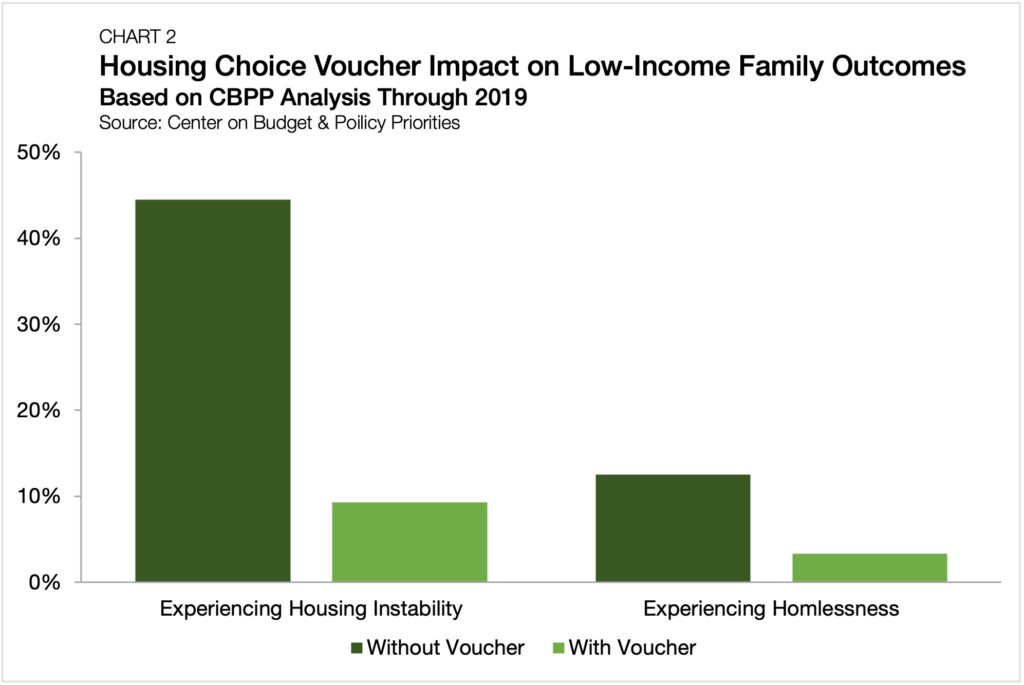

A 2015 report published by the Center on Budget and Policy Priorities (CBPP)showed that low-income families who receive housing choice vouchers are three-quarters less likely to experience homelessness compared to those who do not receive them.[1] Further, while close to 45% of low-income households experience housing instability, housing vouchers reduce that likelihood to 9.3% (Chart 2).

The Administration’s expansion of TBRA would have the most direct impact on low-income families. CBPP notes the number of families using housing choice vouchers fell dramatically following the sequestration cuts outlined in the Budget Control Act of 2011, which cut most discretionary federal spending.

CBPP estimates that by June 2014, a year after sequestration went into effect, the Section 8 program covered roughly 100,000 fewer households. About half of those cut out were then reincorporated during congressional budget increases granted in 2014 and 2015, but a significant portion of households who lost coverage remain in need.

The additional 125,000 households under the proposed expansion would include those who had been covered prior to the budget cuts and new, previously ineligible households. The bill also puts forth $14 billion in funding for Project-Based Section 8, a 4% step up from FY21. The funding directs subsidies to eligible properties, untied to the individuals or families residing there.

The budget also includes a $3.4 billion request for Homeless Assistance Grants, a 14% increase from FY21. The American Rescue Plan provided a substantial $5 billion in aid to the grant program earlier this year, which assists those who are currently homeless or at-risk of homelessness. If enacted, the increase would cover an estimated additional 100,000 households.

Budget Breakdown: The HOME Program & Public Housing Fund

The Committee’s bill also aims to increase funding for homebuyer assistance and rental construction through the HOME Investment Partnerships Program (HOME). Administered by HUD, HOME is a federal block grant program providing funding to states and municipalities to finance the development, acquisition or rehabilitation of affordable homes for rent or homeownership, and providing direct rental assistance.[2]

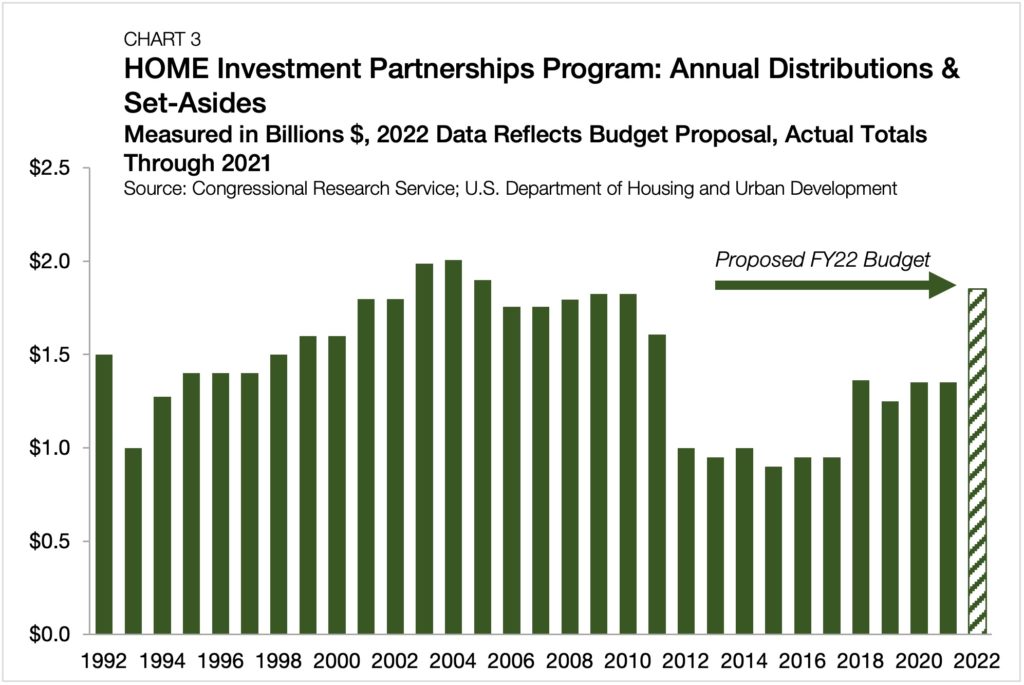

The new request would appropriate $1.85 billion to the program over the next year. This marks its largest funding pool in 17 years and a $450 million (37%) increase from FY21. The proposed HOME funding would signify near-record liquidity provided by the federal government to address the affordable housing gap (Chart 3).

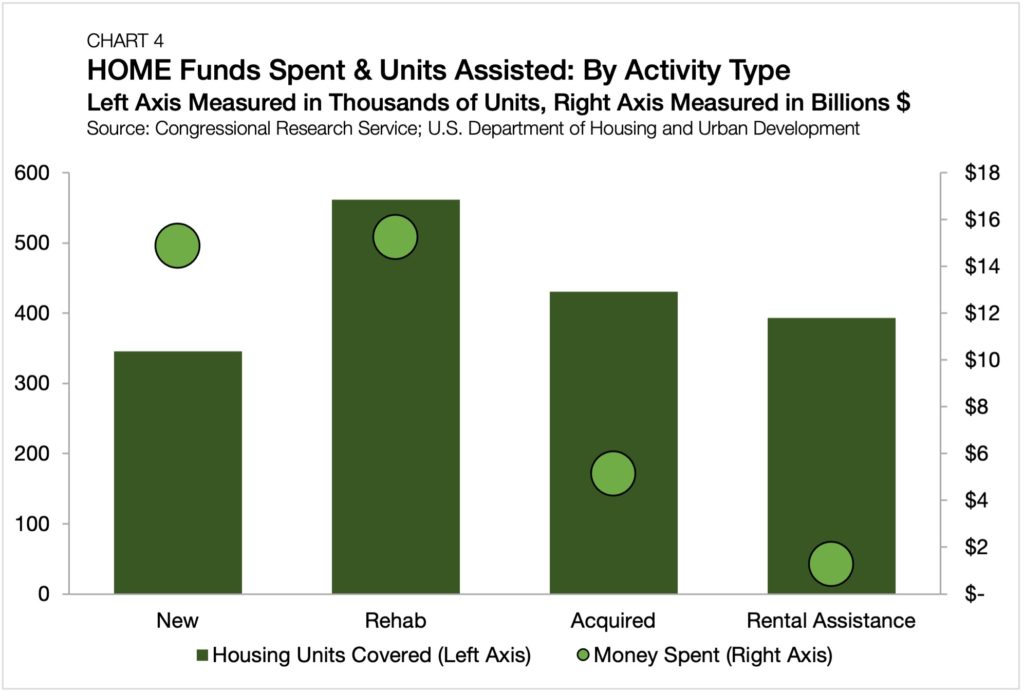

Whereas the Section 8 program focuses solely on subsidizing eligible private housing, the HOME program targets broader supply-side concerns. Figures from HUD show that since HOME’s inception, the program has allocated $14.9 billion to new construction, $15.2 billion to rehab efforts, $5.1 billion for home purchases and $1.3 billion in rental assistance to address the affordable housing shortage.[3]

The program’s breadth allows federal funds to be utilized more effectively. Property investors serving different needs in the market receive funding directly and can deploy capital where needed. The inclusion of direct rental assistance and aid for home purchases has provided the federal government a cost-efficient way to create housing for low-income households.

Despite accounting for just 18% of all HOME funding allocation, acquisitions and rental subsidies make up 48% of all the units covered throughout the program’s lifetime (Chart 4).

Beyond the increase in HOME funding, the Committee’s bill includes an additional $834 million to the Public Housing Fund. This is an 11% increase from FY21, bringing its total to $8.64 billion in FY22. The funds can be used for the development and rehab of public housing sites. Upon HUD approval, they may also borrow from the private markets to help finance improvements.

Racial Equity Considerations

Several provisions in the White House’s proposed budget and the committee-approved package specifically aim to address racial inequities across the housing market. The budget includes a request for $85 million in grants to support state and local enforcement of fair housing standards.

The budget’s expansion of Section 8 vouchers also includes assistance to mobility-related supportive services for those looking to relocate. The high cost of relocating is often a barrier for many minorities living in impoverished areas to move to higher-opportunity neighborhoods. The additional funding should alleviate some of this burden. Nonetheless, moving may not be the solution for all households.

To tackle concentrated poverty head-on, the proposal also requests $400 million for the Choice Neighborhoods program, double the FY21 amount. The program leverages public and private funds to support the rehabilitation of low-income housing in distressed communities.

Finally, the bill calls for an additional $950 million to fund the expansion and improvement of affordable housing in tribal communities. Overcrowding and utility problems there are, by some estimates, up to eight times higher than the national average. The funds would also finance infrastructure improvements and local economic development.

Supply Shortages and Federal Government Limits

The most persistent element impeding housing affordability is a significant lack of supply. According to the National Low Income Housing Coalition, a nonprofit focused on housing policy, the U.S. has a 6.8 million housing unit supply gap. Additionally, no state has an adequate number of available homes needed for its lowest-income renters.

Fully addressing the affordable housing supply gap may reside outside of the federal government’s control. Local zoning rules discouraging higher levels of density are one obstacle to federal and state efforts to address the issue.

Federal rental assistance programs are helpful in confronting other root causes of the nation’s housing supply gap, such as the mismatch between rent inflation and income gains. However, more local initiatives meant to increase housing supply could address longer-term equilibrium imbalances.

In a 2020 Brookings Institution paper, housing experts outlined an approach including increased federal funding and zoning reform as key elements for increasing housing affordability. Particularly for larger cities, the challenge in addressing affordable housing is the ability to build dense, low-cost homes on increasingly expensive land – zoning regulations in most U.S. cities prevent this.

According to an analysis from UrbanFootprint, three-quarters of the land in U.S. cities is only zoned for single-family detached homes. In areas permitting multifamily development, building height caps, along with minimum lot sizes and parking requirements, often add additional cost burdens that are implicitly passed on to consumers. Another challenge is the pervasiveness of existing homeowners blocking high-density development. This can place an artificial cap on housing supply in favor of higher land values.

The Look Ahead

Now that the President’s proposed budget has passed the House Appropriations Committee alongside an agreed upon budget framework in the Senate, it is primed to head to the floor for a full vote in the coming weeks. Still, the current version of the bill may not be the end-all, be-all.

Any committee-passed bill may still see at least minor changes as it works its way through both chambers of Congress. However, with Democrats in control of the Senate and overseeing a budget reconciliation process that would allow most provisions to pass with a simple majority, the bill’s current form may be a reliable preview for what’s to come.

Regardless of the final text, affordable housing promises to remain an important topic as U.S. policymakers assess the largest concerns facing the pandemic recovery. Beyond ongoing budget debates, the uncertainties surrounding the CDC eviction moratorium is adding fuel to concerns about affordability.

Persisting evidence of a K-shaped recovery means that despite overall improvements to the housing and labor markets, households requiring housing assistance prior to the pandemic are now in greater need. Higher savings rates and a recent surge in wage growth should help stave off the worst of these effects. However, for households at the lowest end of the income spectrum for whom these benefits don’t reach, directly addressing the affordable housing supply remains necessary.

[1] CBPP analysis is based off the 2008 working paper “Housing Affordability and Family Well-Being: Results from the Housing Voucher Evaluation” by Michelle Wood, Jennifer Turnham and Gregory Mills.

[2] HOME uses a funding formula to distribute aid to eligible jurisdictions that can be used to finance certain housing activities. Participating jurisdictions also have the flexibility to appropriate funds directly or through non-profit organizations.

[3] Figures are based on data from HUD’s July 1, 2021 HOME National Production Report.