The Top Factors Set to Impact Multifamily in 2022

- The intersection between the economy’s trajectory, inflation concerns and new virus variants are taking center stage as the Federal Reserve eyes changes to monetary policy.

- Evolving domestic migration patterns will be under the microscope in 2022, as work-from-home (WFH) and return-to-city trends will have competing impacts.

- Housing affordability is front-and-center as inflationary pressures contribute to increasing renter costs.

- After a year of volatile construction supply costs, raw material prices should ease in 2022 while labor dynamics remain uncertain.

Key Findings

The U.S. economy has gone on a rollercoaster ride through the pandemic. While the multifamily sector has faced its share of challenges and uncertainties, it’s proven to be a source of stability. The sector offers a safe destination for investor capital amid volatility and reliable growth. As the country attempts to turn the page on the economic and public health recovery, the factors set to impact multifamily in 2022 are taking center stage

In this lookahead, the research teams at Arbor Realty Trust and Chandan Economics put an eye toward the year ahead. We anticipate which macroeconomic trends will be driving the narrative.

When Will the Fed Tighten Monetary Policy?

The Federal Reserve has expressed intentions to tighten monetary policy in the coming months. The timing and pace will be top-of-mind for investors preparing for its impact on borrowing costs and cap rate yields.

The future of monetary policy is in a tug of war between prospects of slower GDP growth and persistent inflation. The statement from the FOMC’s December’s meeting indicates that the Fed intends to double the pace its reducing its asset purchases starting from $15 billion to $30 billion in January. The committee’s decision weighs their concern about inflation’s strength against their judgement that the labor market is not at full employment.

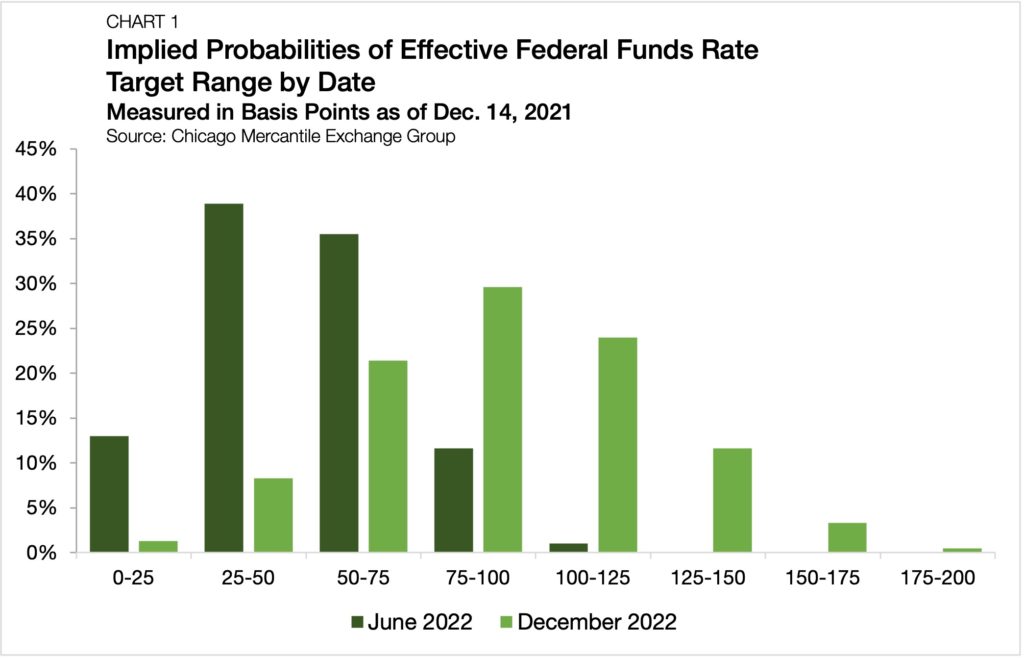

Data from the Chicago Mercantile Exchange’s FedWatch tool, which calculates rate hike probabilities based on Federal Funds Rate futures contract prices, imply that a majority of the market expects at least one rate hike by mid-2022 and at least three by year’s end (Chart 1). Moreover, the December 15 release of the Federal Reserve’s Summary of Economic Projections signaled the committee’s expectation of three rate hikes in the year ahead.

On top of inflationary concerns, the arrival of Omicron initially jolted financial markets. However, the markets have calmed recently as new public health data show lower rates of severe illness than some had feared. Still, rising cases globally have government officials reaching back into their mitigation toolbox, so its presence will remain a factor for policymakers in the near term.

How Will Domestic Migration Patterns Impact Multifamily in 2022?

The dominant demand-side trends that impacted multifamily in 2021, namely Sun Belt migration, the growth of small and midsize metros, and shifting Millennial housing preferences, were already developing prior to COVID-19. The pandemic accelerated these trends, and their evolution will continue to drive multifamily demand in 2022. However, a secular change in remote-work adoption and a pandemic-driven reshuffling of tenant preferences represents a set of new, potentially lasting factors.

Even as the pandemic’s grip on our economy has lessened, WFH has persisted. The ability to WFH has become a job search sticking point. According to Owl Labs’ 2021 State of Remote Work report, 71% of people who worked from home during the pandemic want a hybrid or remote-working structure moving forward. A separate 38% signaled a willingness to take a pay cut to achieve such an outcome. Additionally, 1 in 4 employees said they would quit their jobs if they couldn’t WFH.

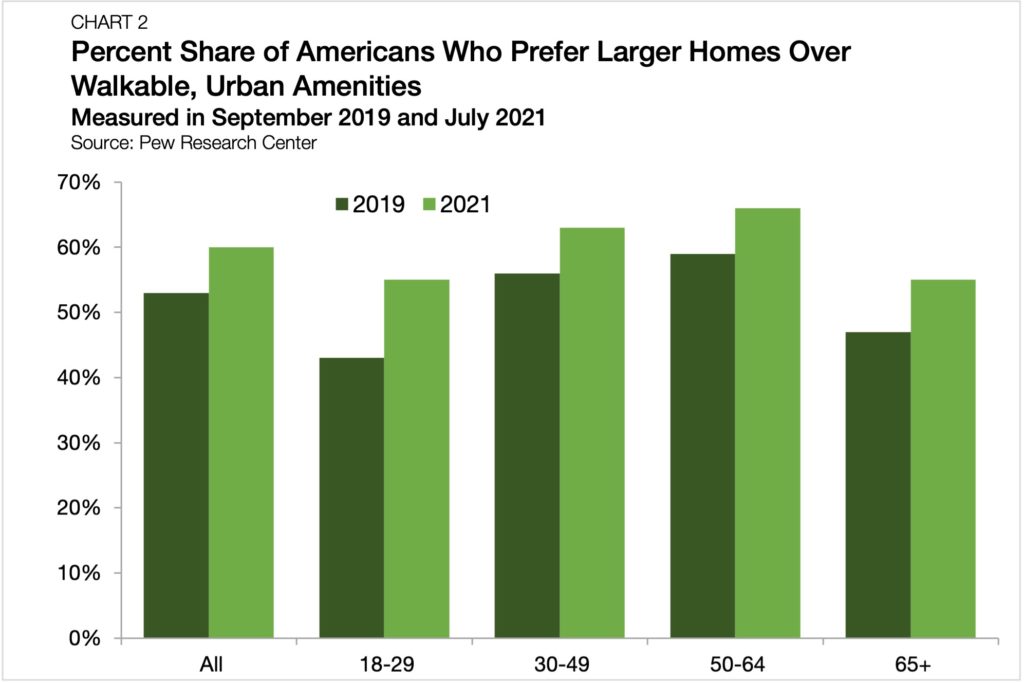

In addition to shifting working preferences, the pandemic has also influenced renters’ living preferences. Renters are increasingly choosing where to live based on lifestyle choices rather than proximity to their office. According to a July 2021 Pew Research survey, 60% of Americans value living in a community where houses are larger, but schools, stores and restaurants are farther away—up from 53% in September 2019. This shift was prevalent across all age cohorts surveyed, with the biggest change seen in the 18-29 age group. (Chart 2).

Suburbs and more residentially dispersed cities are poised to benefit from these shifts in location preferences. However, as we move further away from the pandemic, big cities’ economic and social engines are starting to turn again. According to the NYC Comptroller Office’s analysis of USPS change of address data, from July to September 2021, New York City gained a net 6,332 permanent residents compared to the same period in 2019. As big-city migration reaccelerates, real estate will continue to play a key role in supporting local growth. It will be important for investors to keep an eye on urban centers and central business districts (CBDs) as they recover from pandemic impacts.

What’s Next for Affordable Housing?

As housing prices have skyrocketed over the past two years, affordability concerns have climbed. In September, the Atlanta Fed’s Housing Affordability Index, which measures home prices in conjunction with median household incomes, fell to its lowest level since the middle of the Great Financial Crisis (November 2008). However, during the Great Financial Crisis, supply climbed to record highs while low liquidity and risk contagion held capital markets back, straining affordability. Conversely, during the pandemic, capital markets have been buoyant while supply constraints have emerged as the primary barrier to affordability.

Low-income renters, many of whom are no are longer shielded by eviction protections, on average remain just as insecure about their housing circumstances as they did at the height of the pandemic. According to the Census Bureau’s latest Household Pulse Survey (taken from Sept. 29 to Oct. 11, 2021), 6.7% of both renter and owner-occupied households are behind on a rent or mortgage payment. They are also at least slightly concerned about their ability to make next month’s payment. This is only a slight improvement from the 7.2% share of all renter and owner-occupied households who expressed the same sentiment when surveyed in August 2020.

In 2022, the growing affordability crisis will likely refocus public and private attention toward the nation’s Affordable Housing sector. The success and expansion of Low-Income Housing Tax Credits (LIHTC) in the past decade provide a foundation for private capital looking to enter the space. Additionally, the House-passed version of President Biden’s Build Back Better Act proposes an inflation-adjusted 10% addition to 9% LIHTC allocations from 2022 to 2024. The 10% increase would significantly raise the dollar amount of LIHTCs per person allocated to the states. This, in turn, would incentivize capital deployment towards the nation’s Affordable housing stock.

On the state and local level, zoning reforms may continue to see an increased presence in legislative activity. California recently adopted a resolution effectively ending historically restrictive single-family-zoning rules in the state, not only increasing investment opportunities but providing a blueprint for other states considering similar initiatives. Other popular policies in recent years that are poised to remain topical in 2022 are rent control and eviction moratoriums, even though economic-minded housing advocates generally oppose these measures.

Will Construction Costs and Supply Bottlenecks Ease?

In 2021, the housing market fell victim to the same labor and supply constraints as the broader economy. Inflation and construction delays have proved to be an all-too-common result. Material bottlenecks in the lumber and steel markets ebbed and flowed. However, recent headwinds, including flooding in British Columbia, have recently sent lumber futures up again.

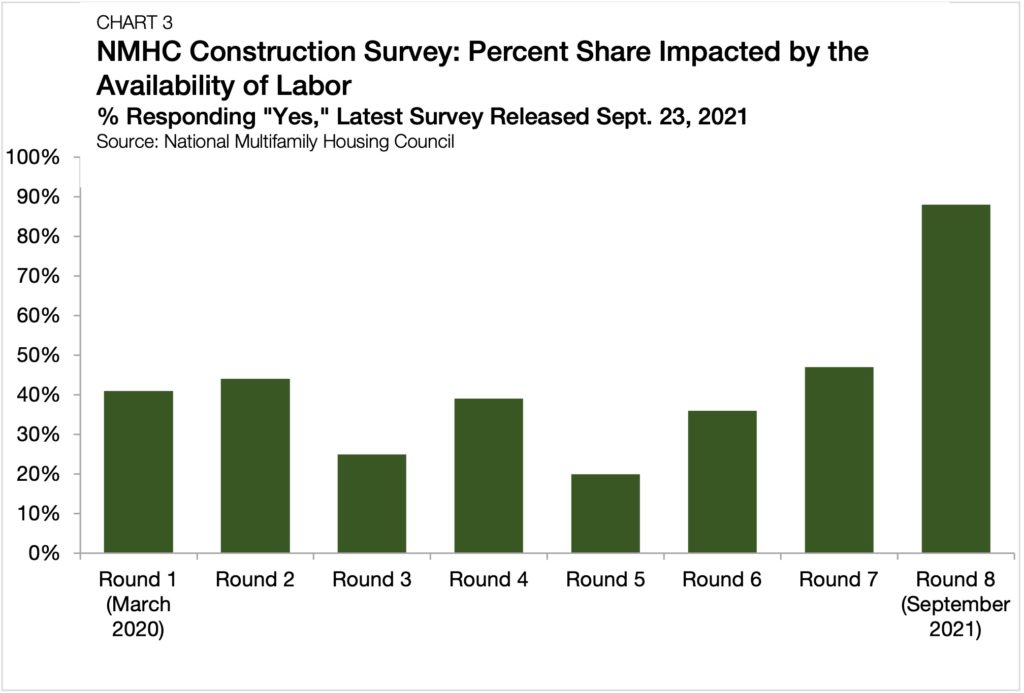

Meanwhile, the labor shortage is persisting. In the September 2021 NMHC COVID-19 Construction Survey, 88% of multifamily construction employers reported difficulty finding qualified labor, an increase from just 47% in the June 2021 survey and the highest level since the survey began in April 2020 (Chart 3).

The continued labor market shortage will be a key factor set to impact multifamily building activity in 2022. Despite these tighter markets, robust housing demand has kept construction activity at levels higher than pre-pandemic. In November, annualized housing starts reached about 1.7 million units compared to the high of 1.3 million starts reached in 2019.

In Summary

Altogether, shifts in working preferences, living choices and labor market conditions are poised to impact multifamily through 2022. The fundamental ways in which people interact with our built environment is evolving at an increasingly rapid rate. These changes are creating some uncertainty for investors as markets try to adjust. Nevertheless, in the past year alone, multifamily has demonstrated its resilience through a public health crisis, key supply shortages and a high-inflationary environment, with rents in many markets reaching or surpassing pre-pandemic levels. Overall, the multifamily market is well equipped for the challenges and opportunities in 2022.