Top 10 Markets for Undergraduate Apartment Renters

- The Oklahoma City metropolitan area, home to 15 public and private colleges, had the highest share of apartments rented by undergraduate students.

- New York City had the highest number of apartments rented by undergraduate students.

- Limited supply of quality multifamily housing near colleges and universities highlights the need for targeted investment in off-campus housing.

For undergraduate students nationwide, apartments fill the gap in campus housing. Off-campus housing offers a better value proposition in many markets, giving students more space at a competitive price. In other markets, students pursue apartments due to insufficient dormitory space. As colleges and universities acquire and build to keep pace with enrollment, the supply-demand imbalance has created new opportunities for multifamily real estate investment.

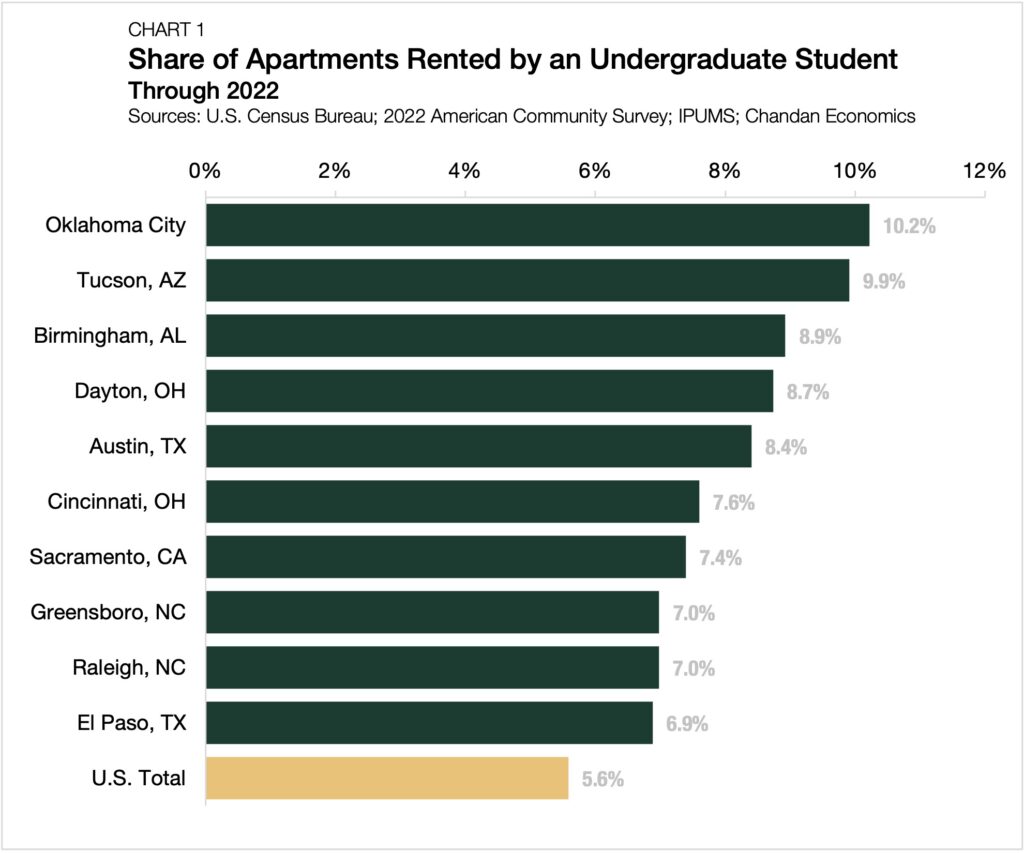

Metros with the Highest Concentration of Undergrad Renters

Oklahoma City, OK, leads the country with the highest share of rental households headed by an enrolled undergraduate student. In total, 10.2% of apartments in Oklahoma City are rented by a college student, nearly double the national average (5.6%) (Chart 1).

A confluence of 15 colleges in the Oklahoma City area, including two major university systems, contributes to the metro’s high density of undergraduate apartment renters. The University of Oklahoma and Oklahoma State University collectively bring more than 42,000 undergraduate students to the area.

Following closely behind Oklahoma City is Tucson, AZ, where 9.9% of the metro’s renters are enrolled in undergraduate programs. Tucson is the home of the University of Arizona, which has about 40,000 undergrads. Rounding out the top five markets are Birmingham, AL (8.9%), Dayton, OH (8.7%), and Austin, TX (8.4%), all of which boast major institutions of higher learning.

In Dayton, its largest college, Sinclair Community College, is a two-year public institution with about 19,000 students. It does not have its own dormitories, a common issue confronting many community colleges. As a result, the student population lives off-campus, competing for living space with students from the University of Dayton and Wright State University.

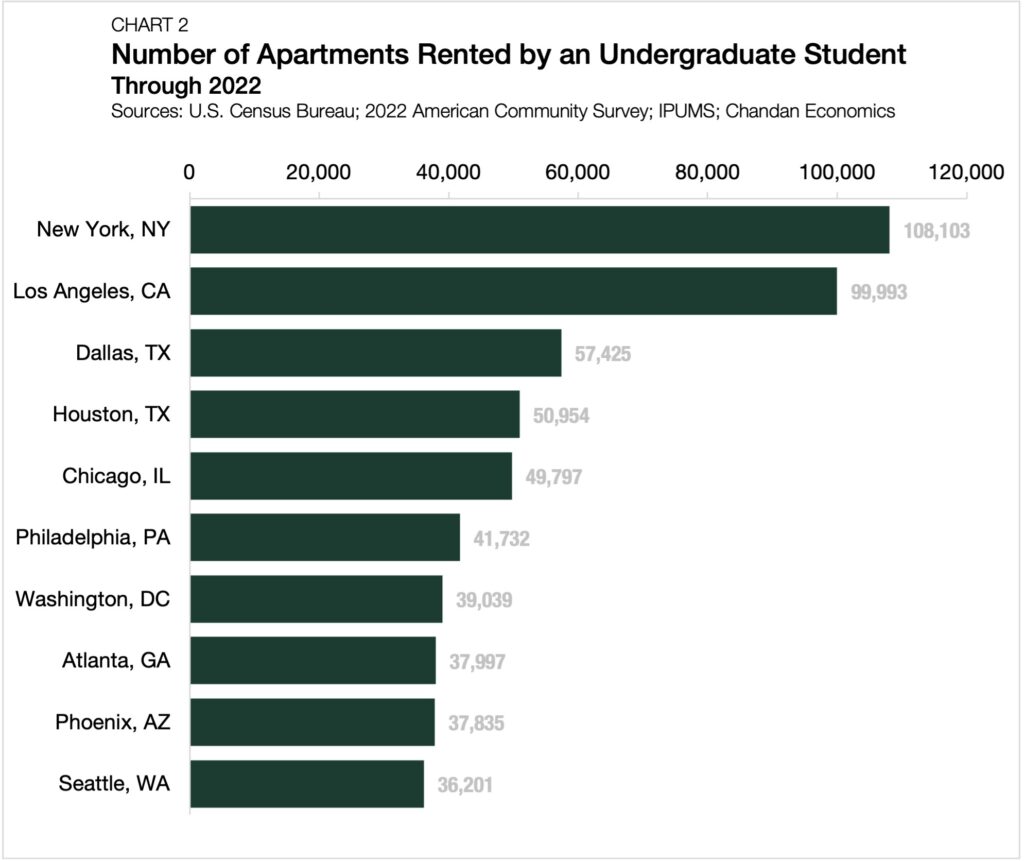

Metros with the Highest Totals of Undergrad Renters

Unsurprisingly, major population centers dominate the list of markets with the highest aggregate total of undergrad apartment renters. While only 2.9% of New York City’s 3.7 million renter households have a head of household who is an undergraduate student, this amounts to an estimated 108,103 households — the most of any market in the country (Chart 2).

Filling out the top five are Los Angeles (99,993), Dallas (57,425), Houston (50,954), and Chicago (49,797). Of these five cities, Dallas has the highest concentration of undergraduate students as a share of all rental households. But at 5.1%, it is still below the U.S. average.

Collectively, the 10 largest U.S. markets account for nearly a quarter (23.1%) of all undergraduate rental households — highlighting the critical role that apartment buildings play in filling the student housing gap in urban environments.

Today, multifamily housing has become fully integrated into college life. As institutions of higher learning continue to expand, a scarcity of quality off-campus housing is likely to become a bigger issue for colleges and a greater opportunity for investors, especially in markets with a supply-demand imbalance.

Methodology

The data used in this article pertain to the heads of households in single-family, 2-4-unit, and multifamily rental properties within select metropolitan statistical areas. Only metro areas with more than 100,000 rental households are included in this analysis. Data are from the U.S. Census Bureau’s American Community Survey and were retried using IPUMS.

Interested in the multifamily real estate investment market? Contact Arbor today to learn about our array of multifamily, single-family rental, and affordable housing financing options or view our multifamily articles and research reports.