Top Counties for Demographic Tailwinds

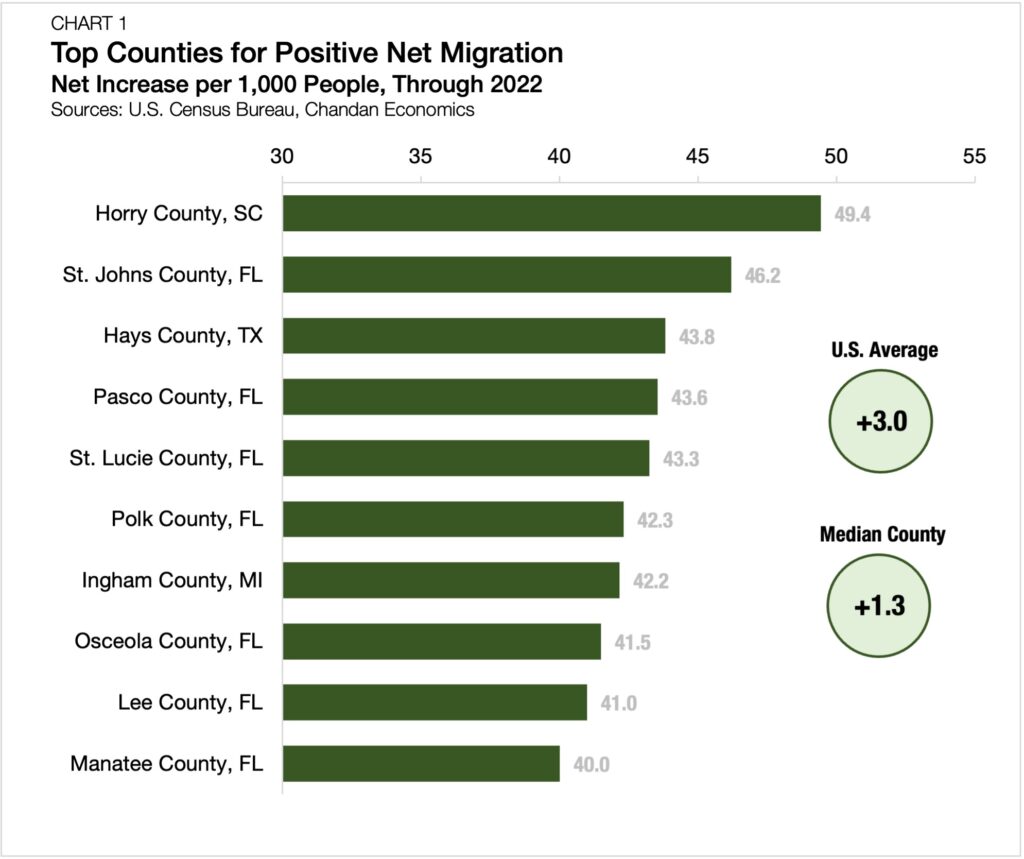

- Two coastal beach counties, Horry County, SC, and St. Johns County, FL, led the nation in net migration gains per capita in 2022.

- 42 of the top 50 counties in net migration growth were in the Sun Belt.

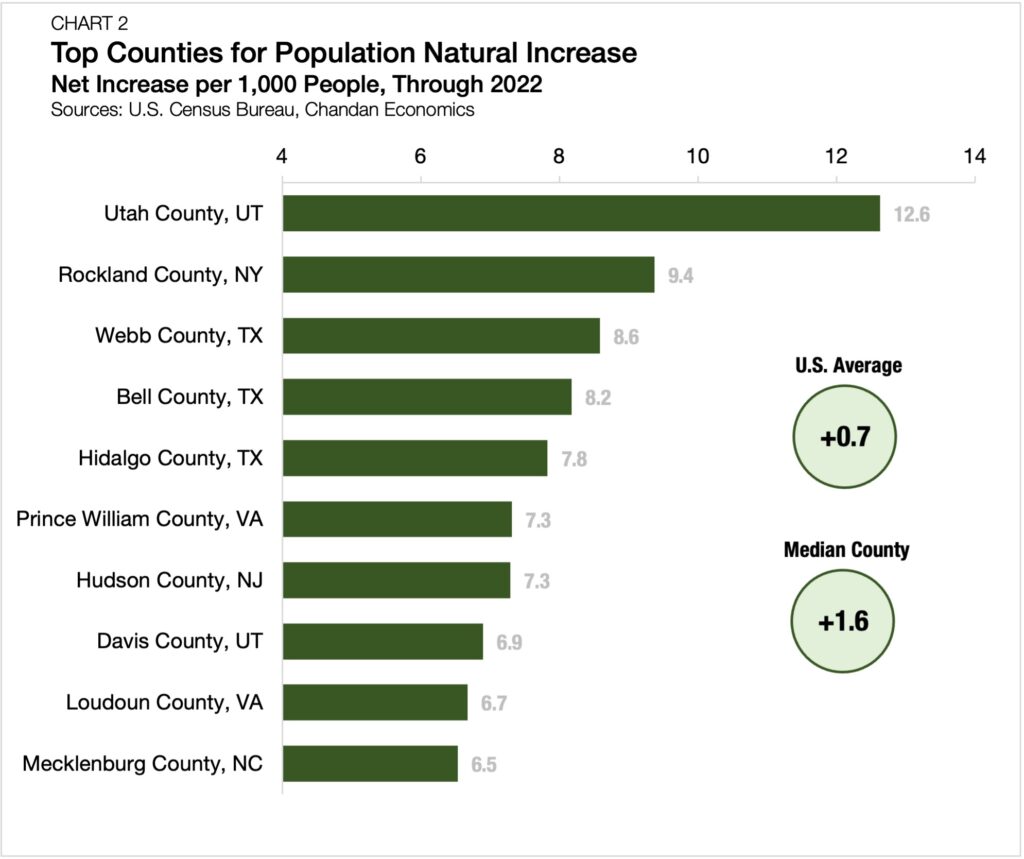

- A diverse group of markets, ranging from Utah County, UT, to Rockland County, NY, led the nation in natural population gains.

When apartment investors consider locations for capital deployment, growth potential is a top-of-mind concern. On a local level, population changes can influence everything from rent growth to occupancy to future property values. County-level positive net migration and natural population growth trends, identified in an analysis of U.S. Census Bureau data, reveal the counties where demographic tailwinds make a compelling case for real estate investment.

Short-Term Tailwinds (Positive Net Migration)

Positive net migration, the number of people moving in minus the number of people moving out, is a metric that can be used to gauge short-term macroeconomic tailwinds. Of people that reported moving in 2021, 80.4% were adults — indicating that positive migration trends lead to an immediate increase in the number of new local households.[1]

Relative to its population of just over 365,000, Horry County, SC, leads the nation with the most robust levels of net migration. For every 1,000 existing Horry residents, 49.4 new residents moved into the county in 2022, substantially higher than the U.S. average of 3.0.

Horry County is home to Myrtle Beach — a popular tourist destination that attracts an estimated 19 million visitors annually, especially from the Northeast. According to Apartment List’s migration report, New York, Washington, D.C., Philadelphia, and Boston are all among the largest sources of new residents moving to Myrtle Beach.

St. Johns County, FL, which is directly southeast of Jacksonville, placed second on the list for the highest positive net migration per capita. In 2022, 46.2 people moved into St. Johns County for every 1,000 existing residents. Like Horry County, St. Johns County has prime ocean frontage, including St. Augustine Beach.

Other counties with robust positive net migration levels include Hays County, TX, Pasco County, FL, and St. Lucie County, FL. Notably, seven of the top 10 counties with the highest net migration gains per capita are in Florida, and 42 of the top 50 are in the Sun Belt.

Long-Term Tailwinds (Natural Population Increase)

Natural population increase, which is the differential between births and deaths in an area, is another factor that supports long-term tailwinds in a market.

Unlike net migration, which primarily adds new residents capable of forming their own households upon arrival, today’s natural population increases will not have an immediate impact on housing demand. Instead, natural population increases are valuable for developing projections about the longevity of housing demand a generation ahead.

According to U.S. Census Bureau data, 59.8% of American-born heads of households live in the same state where they were born, with the trends for renters (59.8%) and homeowners (59.9%) being nearly identical.[1]

The top counties that had the most net increases in natural population in 2022 did not follow a particular pattern, with the three leading markets hailing from Utah (Utah County), New York (Rockland County), and Texas (Webb County) (Chart 2).

Utah County, UT, which is part of the Salt Lake City-Provo-Orem combined statistical area, was the nation’s leading county for natural population gains. In 2022, the county recorded 12,030 births compared to just 3,368 deaths, resulting in a natural population increase of 8,662 people. For every 1,000 existing residents, the natural increase accounted for an additional 12.6 residents in 2022 — 3.3 residents more than any other county in the country. Utah County’s positive natural population trend likely speaks to unique cultural factors within the state. The average family household (with at least one child) contains an average of 2.1 children in Utah — the third-highest mark in the country.[1] Moreover, Utah County’s births-to-deaths ratio of 3.6 is more than three times higher than the U.S. average (1.1). Rockland County, NY, had the second most substantial natural population increase per capita in 2022, adding 9.4 new residents per 1,000. Rockland is situated just northwest of New York City, allowing the county to position itself as a destination for newly forming families that need to remain in commuting range of a nearby metro. Of all Rockland residents working elsewhere besides their home county, 57% report doing so in Manhattan, the Bronx, Queens, or Brooklyn.[1]

On the other side of the spectrum, the four counties with the lowest natural population increase rates are all in Florida (Sarasota, Marion, Volusia, and Pinellas) — all had a natural population decrease between 6.7 and 9.7 persons per 1,000 residents. These trends may be a symptom of the state’s popularity amongst retirees. Of note, all four of these counties saw a more substantial net migration increase than their natural population decrease in 2022, which serves as a potent reminder that there are many ways for a market to engineer growth.

Competing for Growth Ahead

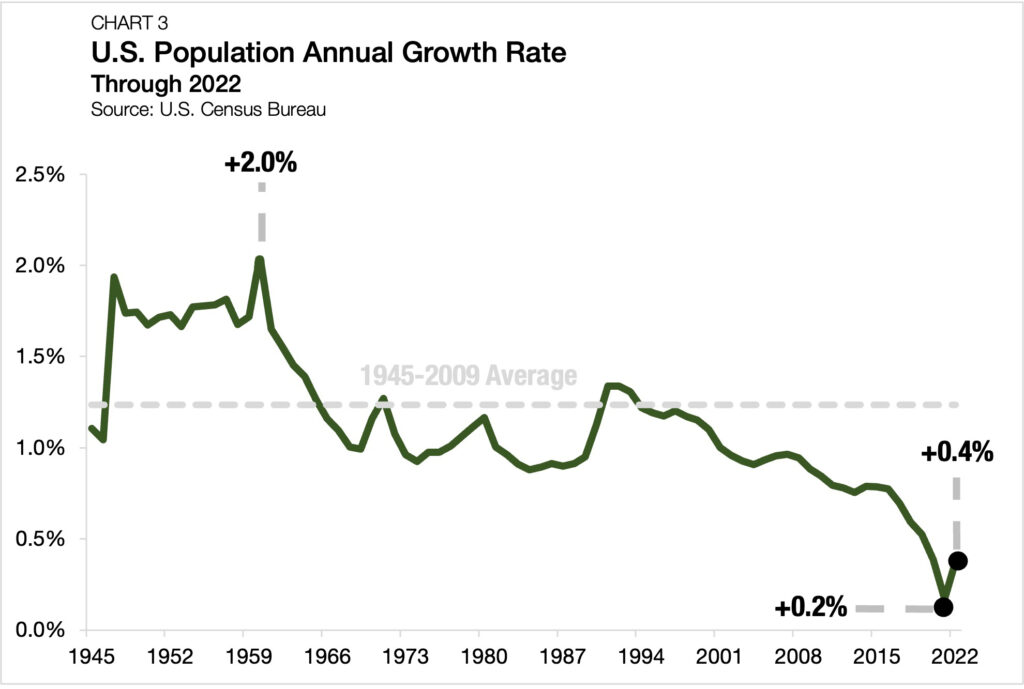

Overall, U.S. population growth continues to stall. Between the end of World War II (1945) and the end of the Great Recession (2009), U.S. population growth averaged 1.2% annually and never fell below 0.9%. Meanwhile, since 2010, average annual population growth has averaged just 0.6% — falling as low as 0.2% in 2021 (Chart 3).

In previous generations, local areas typically grew over time through natural population increases, leading to more demand for goods, services, and housing. Today, investors should be cautious in using previously reliable assumptions. By knowing about the latest trends in net migration and natural population, investors can make better assessments of the short- and long-term health of real estate markets.

[1] Based on a Chandan Economics analysis of the U.S. Census Bureau’s 2021 American Community Survey, retrieved through IPUMS.

Interested in the multifamily real estate investment market? Contact Arbor today to learn about our array of multifamily, single-family rental, and affordable housing financing options or view our multifamily articles and research reports.