Top Markets for Multifamily Permitting in 2024’s First Half

- Madison, WI, had the most multifamily permitting per capita of any top 100 market in the first half of 2024.

- Several markets in the Midwest and Florida recorded well-above-average levels of multifamily permitting again in the first two quarters of this year.

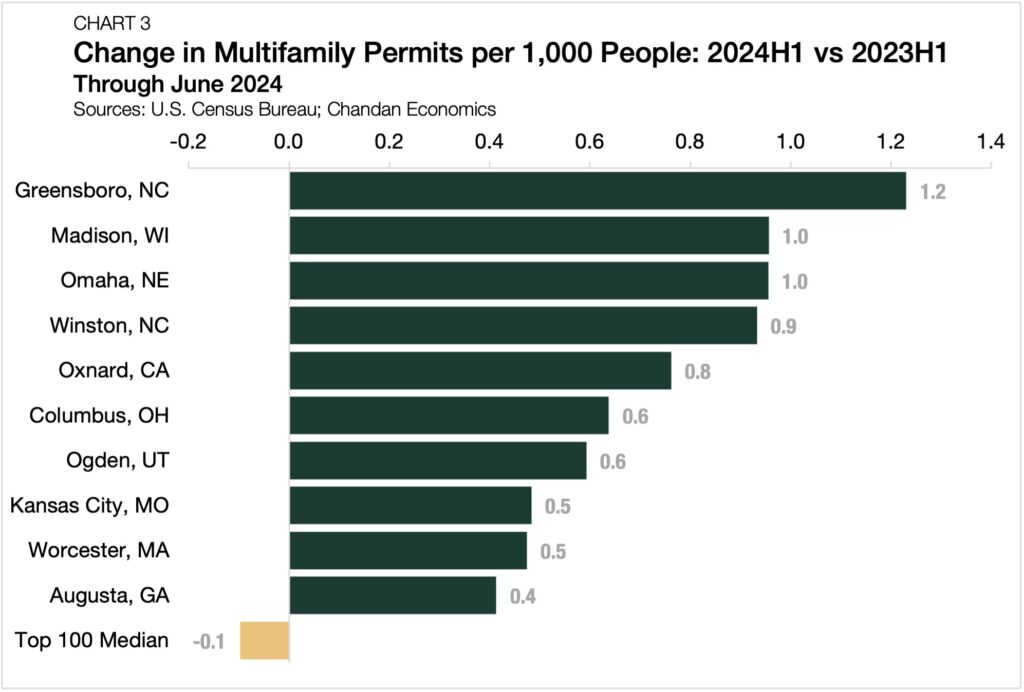

- In contrast to national trends, 38 of the top 100 U.S. markets saw higher levels of permitting per capita in 2024 compared to the same point in 2023.

While the overall pace of new multifamily permitting per capita in the U.S. slowed recently, it has picked up momentum in pockets of the country, especially the Midwest. In the first two quarters of 2024, Madison, WI, Columbus, OH, and Omaha, NE, were among the major metropolitan markets posting solid permitting gains, another sign of multifamily’s strength in all cycles.

Permitting Per Capita Hotspots

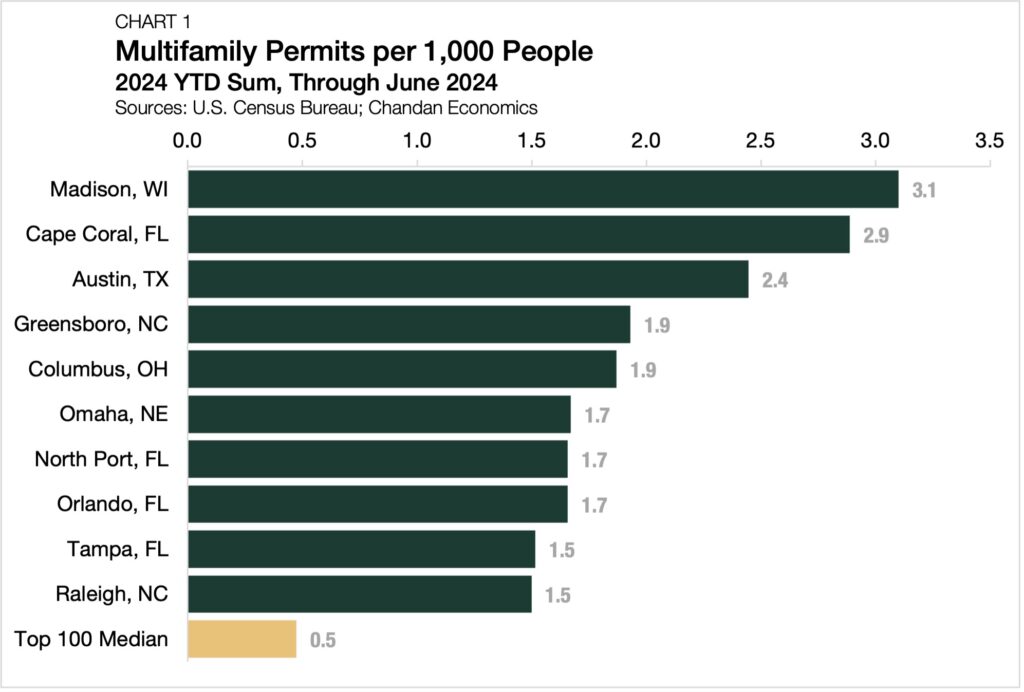

Madison, the vibrant home of a major university, is the nation’s leading hotspot for new multifamily permits. Through the first six months of 2024, Wisconsin’s state capital issued a total of 2,152 multifamily permits, which amounts to 3.1 permits for every 1,000 existing residents (Chart 1).

By contrast, the per capita median across the top 100 U.S. markets was just 0.5 permits per 1,000 residents — a drop-off from 0.7 from the same time last year. However, Madison’s per capita total was still more than six times higher than the top 100 markets’ median multifamily permits per 1,000 people.

Madison’s permitting momentum comes as advocacy groups and state and local lawmakers have raised the alarm over the need for more construction and workforce housing. Statewide an estimated 227,000 new housing units are needed within the next decade to solve Wisconsin’s mounting affordability crisis.

Cape Coral, FL, ranked second with 2.9 permits per 1,000 residents. Given the cooling of its housing market, Cape Coral’s continued permitting momentum may come as a bit of a surprise. However, other markets in the Sunshine State saw similar results with five of the top 20 markets located in Florida.

The continued strength of permitting activity in Austin, TX, is also notable, even as its current pace sits below the 3.4 permits per 1,000 residents found at the same time last year. Despite the cyclical slowdown, this market’s impressive ability to add young, highly educated workers continues to make it a popular choice for multifamily investors. Austin, which saw its population grow at a rate of 2.1% between 2022 and 2023, continues to be one of the shining stars of Texas multifamily real estate.

Regionally, the Midwest stands out from the pack. Three markets in the region (Madison, Columbus, and Omaha) rank in the top six. The Midwest, known for stable rent growth, attractive acquisition entry points, and a need for more affordable housing options, has gained increased attention from multifamily investors and developers.

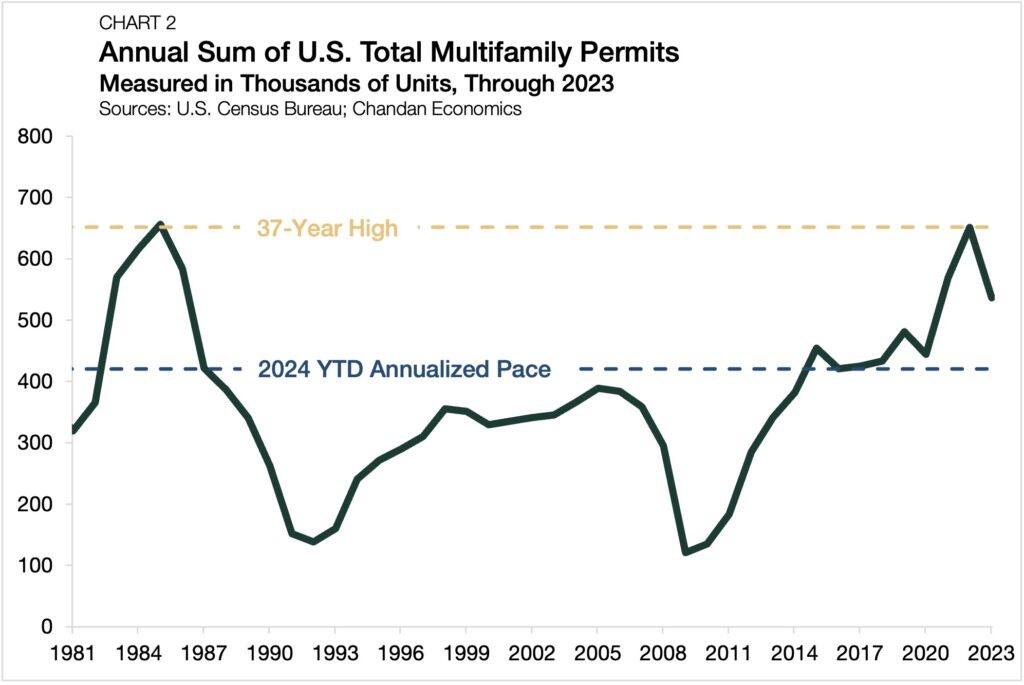

After multifamily permitting reached a 37-year high of 651,400 units nationally in 2022, last year’s total dropped by nearly 18% to 536,500 units amid a post-pandemic normalization (Chart 2). Through 2024’s halfway mark, multifamily permits have slowed and are now expected to reach a total of 420,200 units.

Despite declines seen on a national level, 38 of the top 100 U.S. metros saw more multifamily permitting through 2024’s first half than a year ago. Greensboro, NC (+1.2 permits 1,000 residents), Madison (+1.0), and Omaha (+1.0) have seen the three most substantial positive shifts compared to the same point last year (Chart 3). Greensboro and Omaha, which Multi-Housing News labeled as top emerging multifamily markets early this year, continue to display that they deserve more investor attention.

Outlook

In contrast to national trends in multifamily permitting activity, a handful of markets have seen substantial positive shifts in the first half of 2024. From Madison to Cape Coral to Austin, the structural need for new multifamily housing continues to be a source of strength for the sector in all cycles.

Methodology

Data in this analysis are from the U.S. Census Bureau’s Building Permits Survey and the U.S. Census Bureau’s 2023 population estimates. Unless otherwise stated, data are reported as multifamily permits per capita, which compares the sum of multifamily permits recorded in the year-to-date to each metropolitan area’s 2023 residential population.

Interested in the multifamily real estate investment market? Contact Arbor today to learn about our array of multifamily, single-family rental, and affordable housing financing options or view our multifamily articles and research reports.