Top Markets for Multifamily Permitting Per Capita

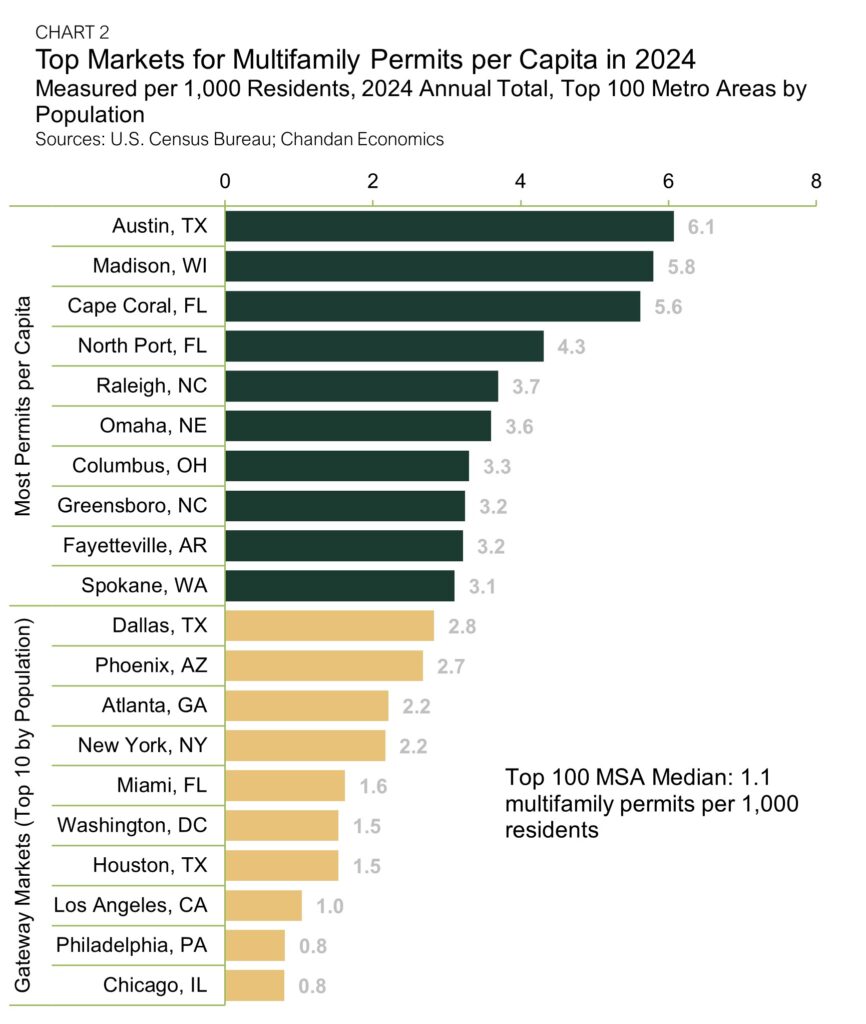

- Austin, TX, issued the most multifamily permits per capita in 2024, followed by Madison, WI, and Cape Coral, FL.

- The top 10 U.S. metros finished last year in the middle of the pack, with Dallas, TX, leading all gateway markets.

- The ongoing slowdown of permits issued is a roadmap to locating high-supply markets with rebounding rent growth.

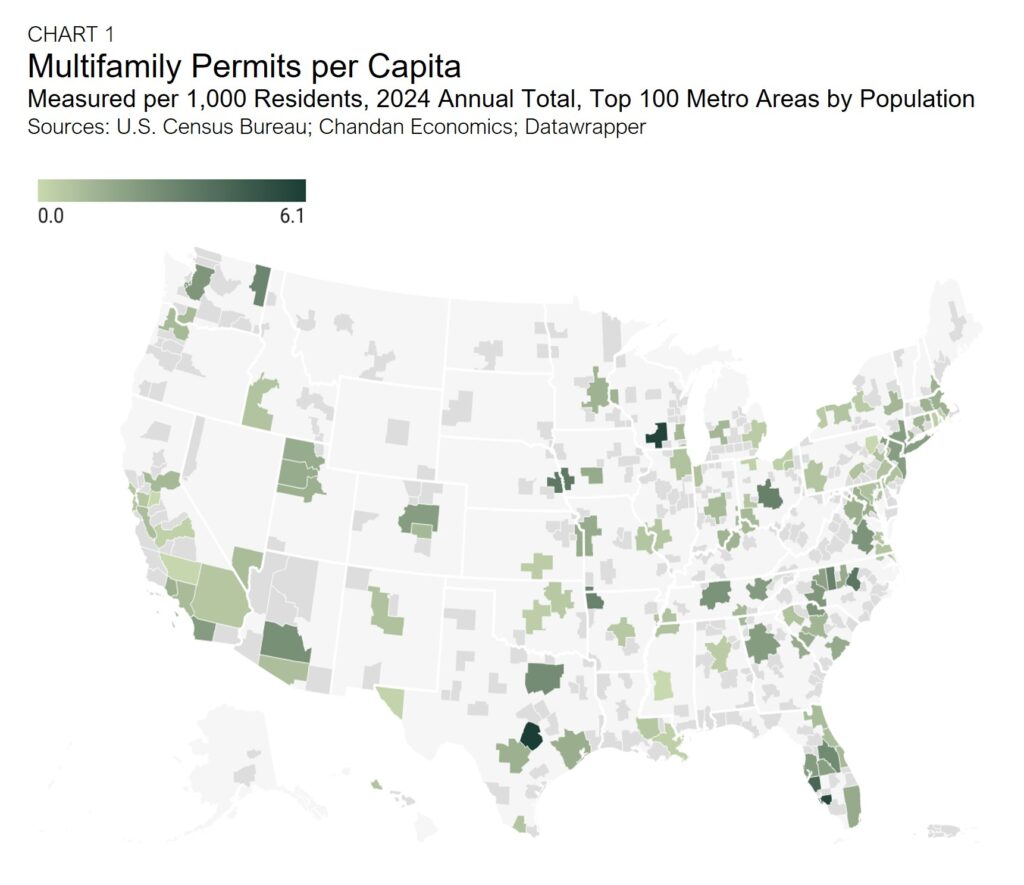

With construction activity continuing to vary according to market, newly released U.S. Census Bureau data reveals emerging trends in multifamily building permits issued and how supply dynamics are poised to impact rent pricing patterns in the nation’s top 100 markets.

Per Capita Permitting Trends

Austin, TX, a blossoming technology hub with a vibrant cultural center, had the most multifamily permits per capita in 2024. For every 1,000 Austin residents, 6.1 new permits were issued last year. By comparison, the median metro of the top 100 markets had 1.1 multifamily permits per 1,000 residents. (Chart 2). Despite leading the nation in permitting, Austin’s 2024 total was significantly lower than the year prior. In 2023, Austin’s permitting per capita total was more than 45% higher.

Following closely behind first-place Austin are Madison, WI, and Cape Coral, FL, which had 5.8 and 5.6 permits per capita, respectively. Top 100 markets have seen both high levels of multifamily permits and rent growth softness — a pattern that includes Austin and Cape Coral, where average multifamily rents slid in 2024. However, Madison, which had the most multifamily permits per capita through the first half of last year, bucked this trend. Wisconsin’s capital, which boasts a strong labor market and healthy population inflows, saw its multifamily rents grow by a robust 5.1% in 2024, according to Zillow. Among the top 10 U.S. markets according to population, multifamily permitting trends ranged from 0.8 permits per 1,000 residents in Chicago, IL, to 2.8 in Dallas, TX, following middle-of-the-pack rankings in 2023.

Supply Impacting Rent Growth

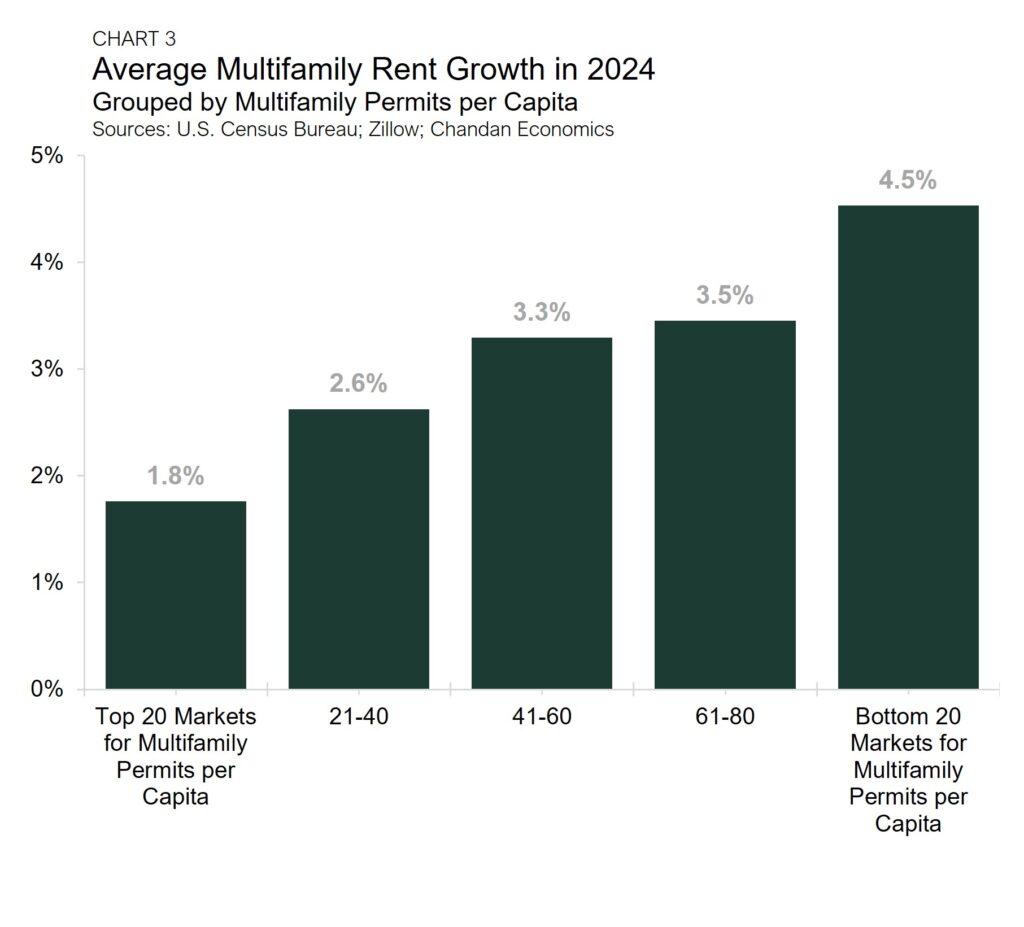

When rental demand surges, it can often take time for the construction sector to catch up. Resultingly, supply and demand cycles are not always fully aligned. This asynchronous pattern was present in 2024 as many of the leading permitting hotspots were also areas where rent growth was weakest. Conversely, the markets with subdued inventory pipelines saw some of the nation’s highest rent growth totals.

Across the 20 major U.S. markets with the most multifamily permits per capita, rent growth averaged 1.8% in 2024 (Chart 3).[1] This average increased as it moved down the spectrum to markets with fewer permits per capita, with the bottom 20 metros posting the most robust price increases last year (+4.5%).

The silver lining for most major markets with high levels of multifamily permitting is that they also remain well-equipped to absorb an influx of new supply. Every market in the top 10 for multifamily permitting in 2024 had faster resident population growth than last year’s U.S. average. Provided multifamily permit issuances continue cooling and migration inflow patterns remain steady, a rebound in rent growth trends for many of these high-inventory markets could be in store for 2025.

The Bottom Line

Multifamily construction has navigated numerous ebbs and flows of activity in recent years. Amid changing domestic migration patterns, supply chain disruptions, and interest rate volatility, the commercial real estate industry has been forced to adapt on the fly. Although many of the markets where multifamily construction has remained robust have also seen rent growth headwinds, construction hotspots have also historically demonstrated an ability to support population growth, which reinforces absorption, supports rent growth, and creates new opportunities for investors.

[1] Note: Analysis only considers top 100 U.S. metropolitan areas by population.

Interested in the multifamily real estate investment market? Contact Arbor today to learn about our array of multifamily, single-family rental, and affordable housing financing options or view our multifamily articles and research reports.