Top Markets for Wage Growth in 2024

- Raleigh’s 8.1% annual wage growth rate was highest among the top 50 largest metropolitan areas in the U.S.

- Limited geographical flexibility in San Diego, the second-leading metro for wage growth, has required some life science employers to continue raising wages to keep pace with soaring housing costs.

- Post-pandemic wage growth trends in high and low-cost markets have been reversed in 2024.

One of the most essential factors multifamily investors need to consider before executing a transaction is the health of the local labor market. Wage growth and other trends are driven by a delicate, constantly adjusting balance of labor supply and demand. In some markets, an inflow of employers can cause wages to spike. While in others, population outflows can create the same effect.

In this deep dive, we expand on the data findings from the 2024 Top Markets for Multifamily Investment Report, exploring the unique conditions driving metro wage growth trends.

Top and Bottom Markets

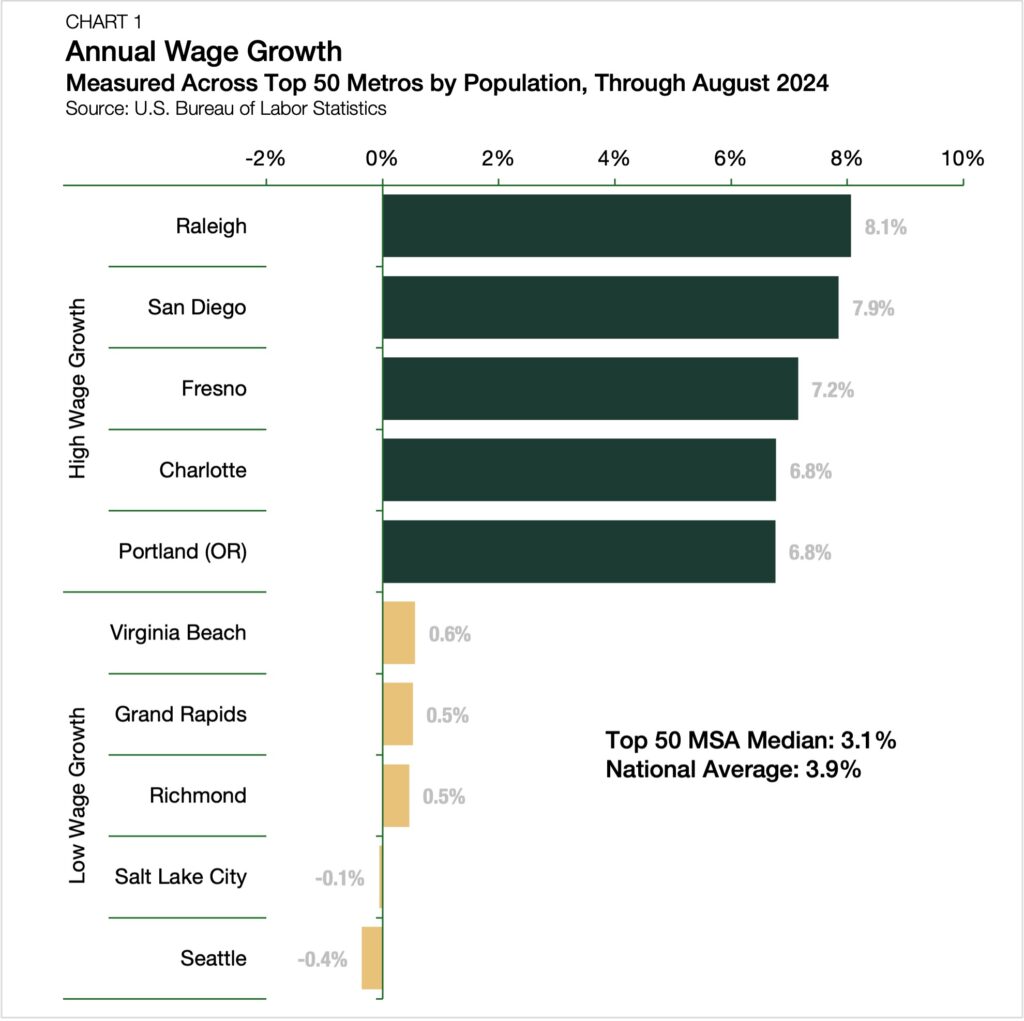

North Carolina’s capital city, Raleigh, NC, experienced the most intense wage growth pressure of any of the 50 largest metropolitan areas. Notably, it was one of only two East Coast cities in the top 10. According to data from the U.S. Bureau of Labor Statistics, wages were up 8.1% year-over-year in Raleigh through August 2024, substantially outpacing the national average of 3.9% (Chart 1).

The cornerstone of Raleigh’s labor market success is its abundance of highly educated young people from top-tier educational institutions. Duke University, The University of North Carolina at Chapel Hill, and North Carolina State University, the three pillars of The Research Triangle, make the Raleigh micro-region a magnet location for high-profile employers, including Apple, Google, and IBM. Raleigh has achieved a positive feedback loop, where workers are moving there for jobs, and employers are moving there for talent.

The second and third strongest markets for wage growth are in California. San Diego, CA, the home of a well-established life sciences sector, had 7.9% wage growth over the year ending in August 2024. Much like Raleigh, San Diego’s biotech and biopharmaceuticals prowess is anchored by a concentration of leading universities, including the University of California San Diego, Salk Institute for Biological Studies, and Sanford Burnham Prebys Medical Research Institute.

San Diego-area average home prices have risen 8.5% over the past year and a cumulative 50.8% since the start of 2020. With the life sciences sector requiring costly, custom-built physical locations, such as biomedical lab space, its employers have less geographical flexibility. As the cost of living in San Diego has increased, employers have had little choice but to keep raising wages.

In Fresno, CA, wage growth accelerated at a pace of 7.2%. Across all industries, a significant factor driving wage growth in Fresno is its labor shortage. In 2023, Fresno lost 1,891 residents to net migration outflows. As a result, firms operating in Fresno are raising wages to stem the outflow and retain workers.

Located in the fertile San Joaquin Valley, the agricultural share of Fresno’s labor market is more than five times the national average. [1] Moreover, according to the USDA, California’s agricultural sector creates more net economic value than that of any state in the country.

At the other end of the spectrum, only two of the observed markets had declining average wages: Seattle, WA, and Salt Lake City, UT. A slowdown in Seattle’s technology sector is the primary cause of the metro area’s average pay pullback. Seattle’s tech sector employment totals peaked at 150,088 in the summer of 2022 following the post-pandemic hiring frenzy. Since then, technology employment there has dropped by more than 10%.

In Salt Lake City, the local economy has started to recalibrate following record levels of labor market tightness in 2021 and 2022. Further, negative wage growth trends in Salt Lake City could also result from lower-earning occupations, such as those in hospitality and services, growing more quickly than high-earning occupations. Tourism in Salt Lake City has accelerated in recent years, and that is projected to continue over the next decade in the lead-up to the 2034 Olympic Games.

Low-Cost vs. High-Cost Markets

The relative pay discrepancy between high- and low-wage markets is a long-term pattern worth watching. Markets with lower labor costs and a large talent pool are hotspots that are likely to attract employers. However, as more employers concentrate in an area over time, the balance between employment demand and labor supply shifts, giving workers more leverage. As a result, the discount enjoyed by employers starts to evaporate.

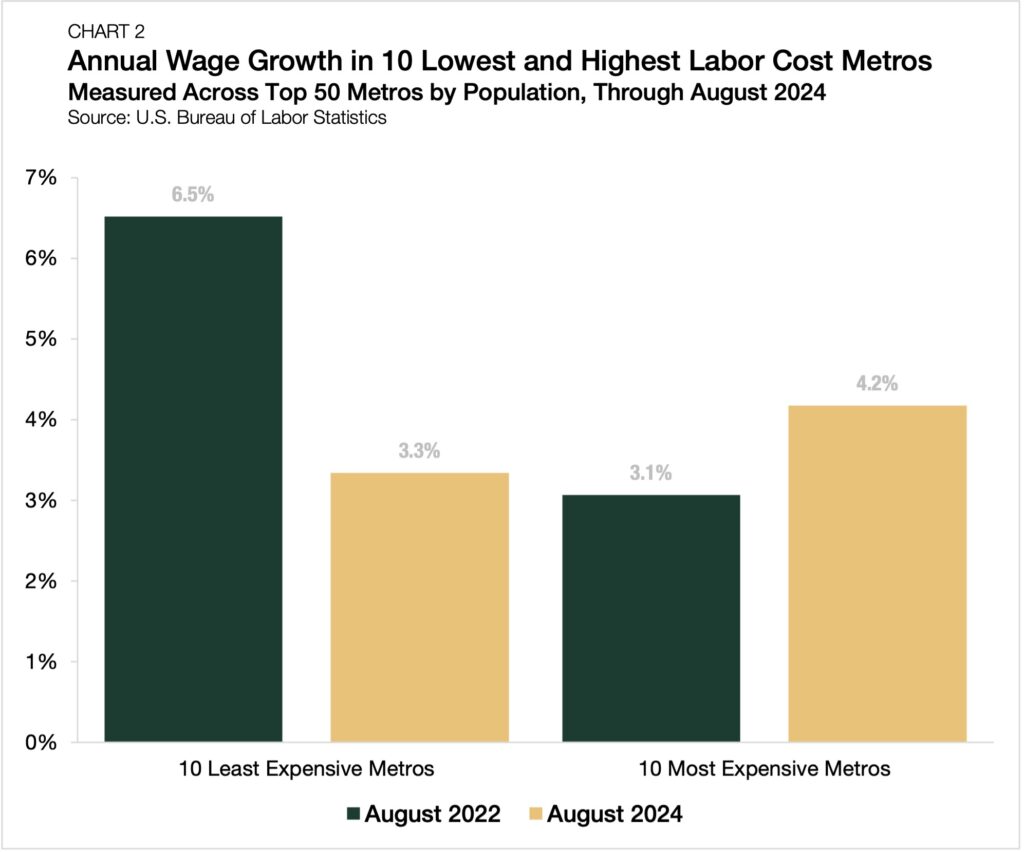

In the 10 metropolitan areas with the lowest average labor costs, wages grew at an annual rate of 6.5% in August 2022, almost twice the average of the high-labor-cost markets (+3.1%) (Chart 2). This trend arrived as remote work proliferated immediately after the pandemic. High-earning households began relocating to more affordable metros, causing average wages to grow quickly in areas where salaries were lowest. This trend has now reversed, and high-cost markets (+4.2%) have seen wages grow more rapidly than low-labor-cost markets (+3.3%) in the past year through August.

Looking Ahead

When analyzing the leading markets for multifamily investment, investors should also consider the relationship between labor demand, wage growth, and housing demand influences an area’s rent growth patterns. Given changing national labor trends, understanding local indicators and their context can provide a clearer sense of a metro market’s investment potential.

[1] Based on a Chandan Economics analysis of BLS data. 7.8% of Fresno’s labor force is employed in the farming sector compared to 1.4% nationally.

Interested in the multifamily real estate investment market? Contact Arbor today to learn about our array of multifamily, single-family rental, and affordable housing financing options or view our multifamily articles and research reports.