U.S. Added 514,000 New Rental Households in 2023

- The number of rental households increased by 514,000 in 2023 — a 1.2% annual increase.

- Additional new housing supply, changing household preferences, and weakening homeownership affordability all supported rental sector growth in 2023.

- The number of rental households nationwide has risen in 13 of the past 15 years.

In a year when inflation and elevated interest rates weakened affordability, the rental housing sector strengthened and expanded. An analysis of newly released U.S. Census Bureau Housing Vacancies and Homeownership data shows the number of rental households climbed in 2023. In this analysis, Chandan Economics will explore how rental sector growth compares to the overall housing market and analyze the economic conditions shaping real estate trends.

Rental Households Rise

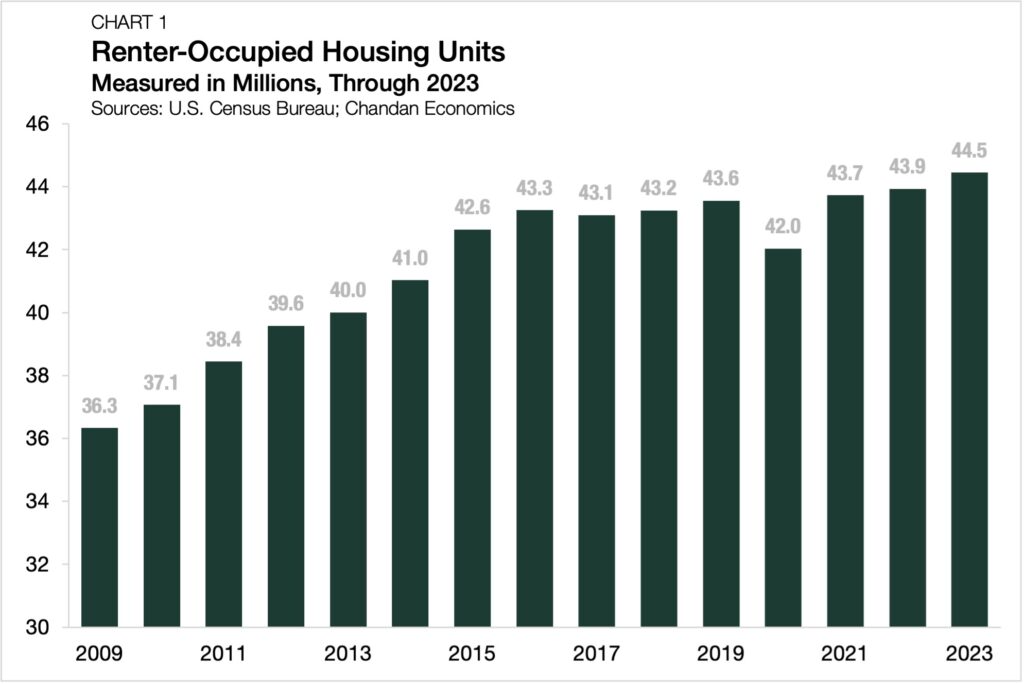

According to Census data, the number of renter-occupied housing units increased from 43.9 million in 2022 to 44.5 million in 2023, marking a new high (Chart 1). The U.S. added 514,000 new rental households in 2023, the second-largest aggregate increase over the last seven years. Only 2021, the pandemic bounce-back year when 1.7 million rental households were added, saw a larger increase.

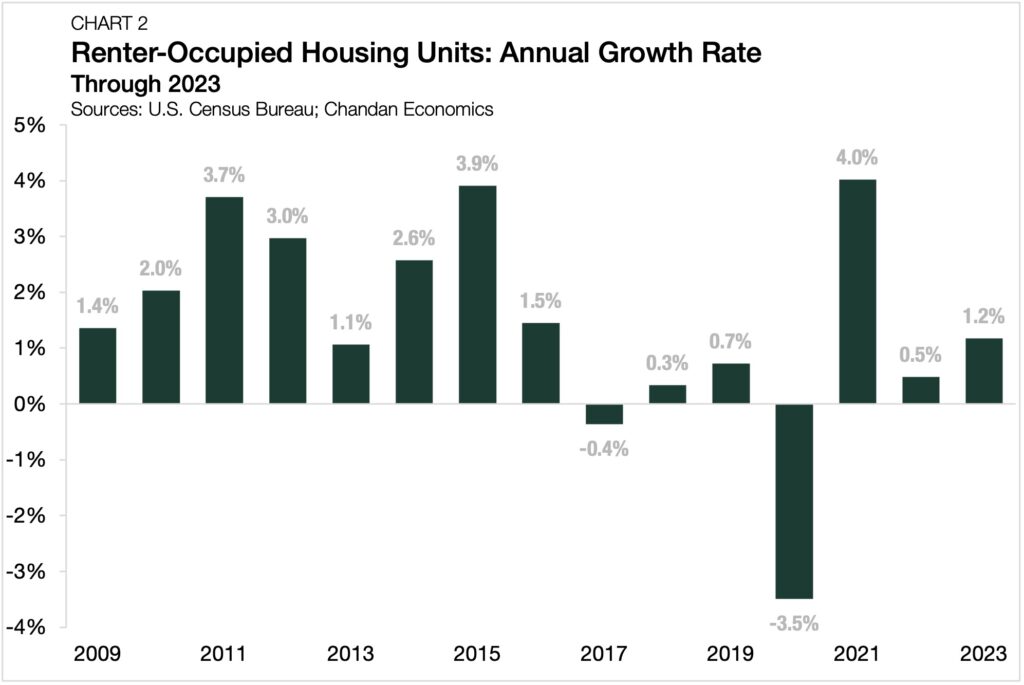

The annual growth rate for the rental sector accelerated in 2023, rising from 0.5% to 1.2% (Chart 2). Although the relative increase for owner-occupied homes was slightly higher at 1.9%, it is likely more the result of fewer households exiting homeownership than an increase in homebuying. Nevertheless, the rental sector has been impressively consistent. Despite the homeownership rate rising in each of the past three years, rental households have also increased. Looking at the long-term picture, the number of rental households increased in 13 of the past 15 years, with 2017 and 2020 being the only two years that recorded a decline.

Supporting Factors

Data trends show that the national rental housing sector has grown gradually over time. Underneath the surface, three stand-out factors have kept the engine running: supply additions, lifestyle renter demand, and homeownership affordability.

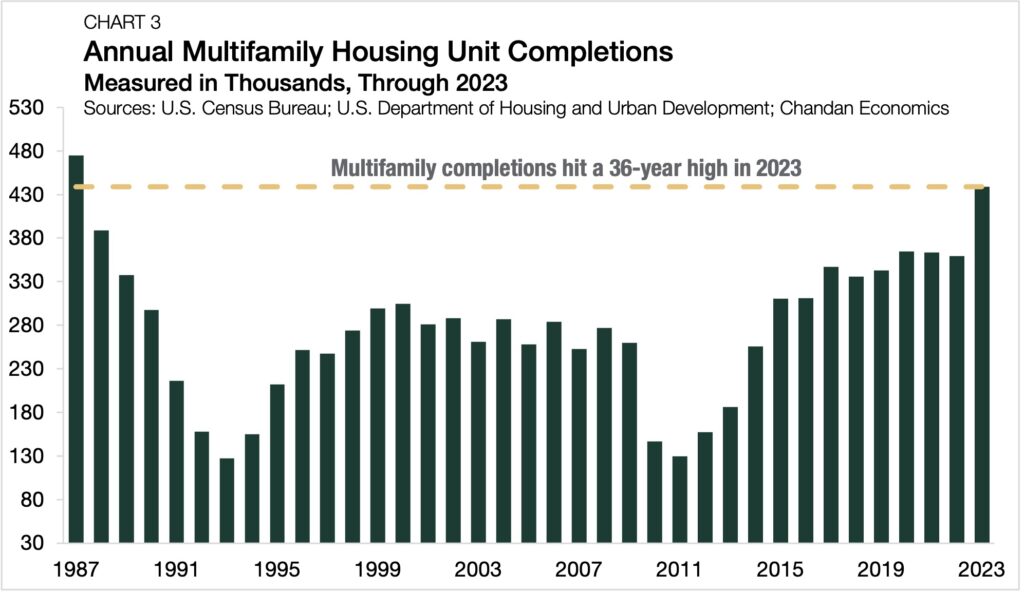

Simply put, supply puts pressure on household formation. Last year, 438,600 multifamily housing units finished construction — marking a post-1987 high-water mark (Chart 3). While not every multifamily property constructed is intended for renter-occupants, the share of units built for rental grew above 97% in 2023.

Meanwhile, rentals have made inroads in the single-family housing market, where owner-occupied units have historically dominated. Based on our U.S. Census Bureau analysis, the rental share of single-family construction reached a record high of 7.9% in 2023.

In addition to supply-side trends, shifting preferences have fueled rental sector growth. Lifestyle renters — those who rent by choice and those who are willing to pay more for an optimized living experience — have been a steadily rising source of apartment demand. According to the 2024 NMHC and Grace Hill Renter Preferences Survey Report, 86% of renters either agreed or strongly agreed with the statement: “I enjoy living in my community” — a sign of the strength and quality of the U.S. rental housing market.

Declining access to affordable homeownership has also played a significant role in the recent increase in rental households. A 2020 RentCafe survey indicated that 43% of prospective homebuyers had their plans derailed by the pandemic. In the time since, a combination of high mortgage interest rates and record home prices has only made the transition into homeownership more difficult.

Outlook

Rentals, home to more than a third of the U.S. housing market, are a significant piece of the housing ecosystem. In a moment when access to homeownership is declining, rental housing’s profile is expanding to meet our nation’s housing needs, and its underlying market fundamentals should continue to propel its performance forward in 2024 and beyond.

Interested in the multifamily real estate investment market? Contact Arbor today to learn about our array of multifamily, single-family rental, and affordable housing financing options or view our multifamily articles and research reports.