U.S. Metro Labor Markets Show Sizable Gains and Solid Growth

- All of the top 50 metro areas in the U.S. reported improved unemployment over the last 12 months.

- Los Angeles and several other California markets recorded some of the largest annual unemployment rate declines, though these trends likely still reflect pandemic-era factors.

- Jacksonville, Columbus, and Las Vegas have the largest employment growth rates of all U.S. metros for the 12 months ending in August 2022.

Economic volatility has heavily influenced the U.S. labor market over the last three years. After a decade-long economic expansion, the pandemic ushered in job losses at an unprecedented scale. While the losses were acute, they did not last for long. By the Summer of 2021, the U.S. started to see one of the tightest labor markets in recent history. Now, with the prospect of a recession looming, the health of the labor market is again under the microscope.

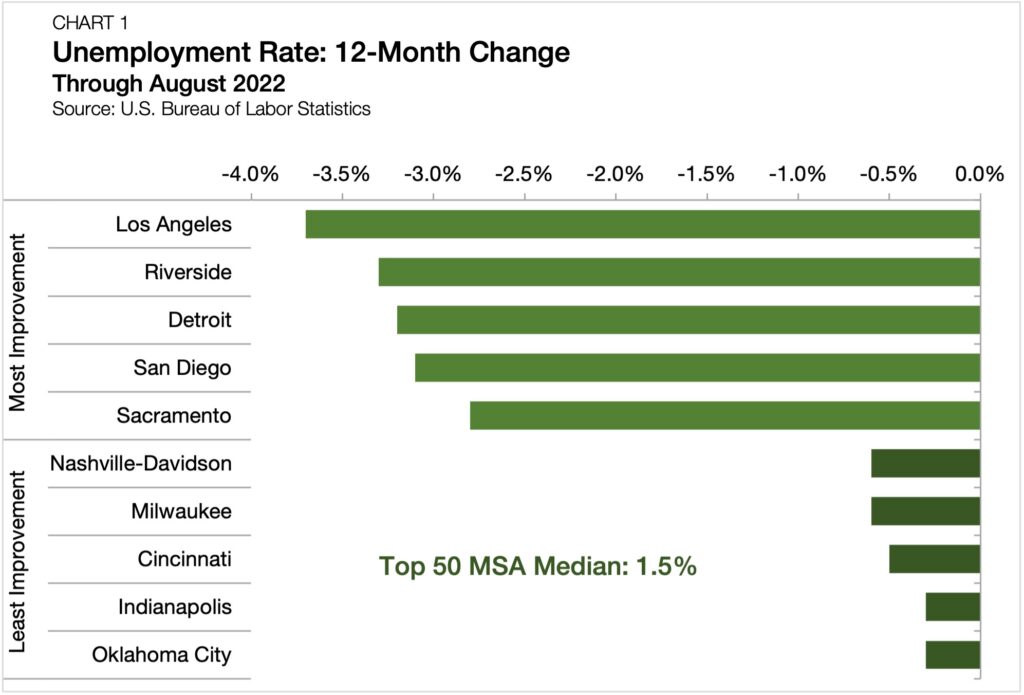

Unemployment Rate

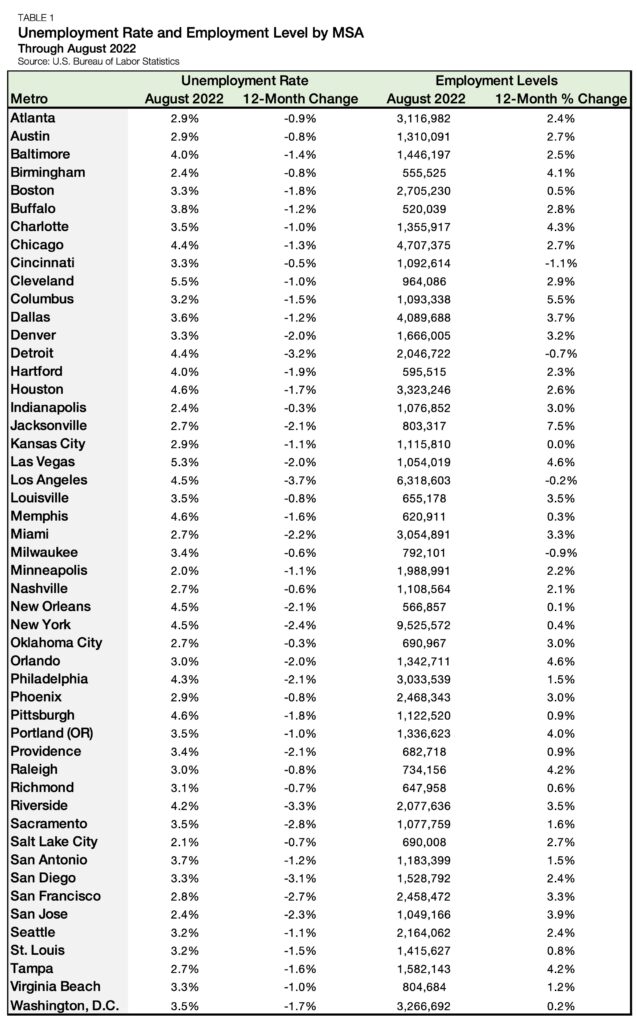

All of the top 50 metropolitan areas in the U.S. registered unemployment rate improvements during the 12 months ending in August 2022, according to the household survey from the U.S. Bureau of Labor Statistics (BLS). The household survey is a sample of eligible households, whereas the establishment survey measures a sample of business establishments.

Los Angeles led the country with the largest decline in its unemployment rate, shaving off 3.7 percentage points from one year ago (Chart 1). Riverside (-3.3%), Detroit (-3.2%), San Diego (-3.1%), and Sacramento (-2.8%) all followed closely behind with sizable declines.

It’s important to note that these annual improvements are likely to have been impacted by the timing of when states decided to remove their pandemic-era extended unemployment benefits. However, improvements in unemployment were seen across the board, even at the lower end of the spectrum. Oklahoma City (-0.3%), Indianapolis (-0.3%), and Cincinnati (-0.5%) all saw the least improvement in their local unemployment rates in the past 12 months, though trends there point in an overall positive direction.

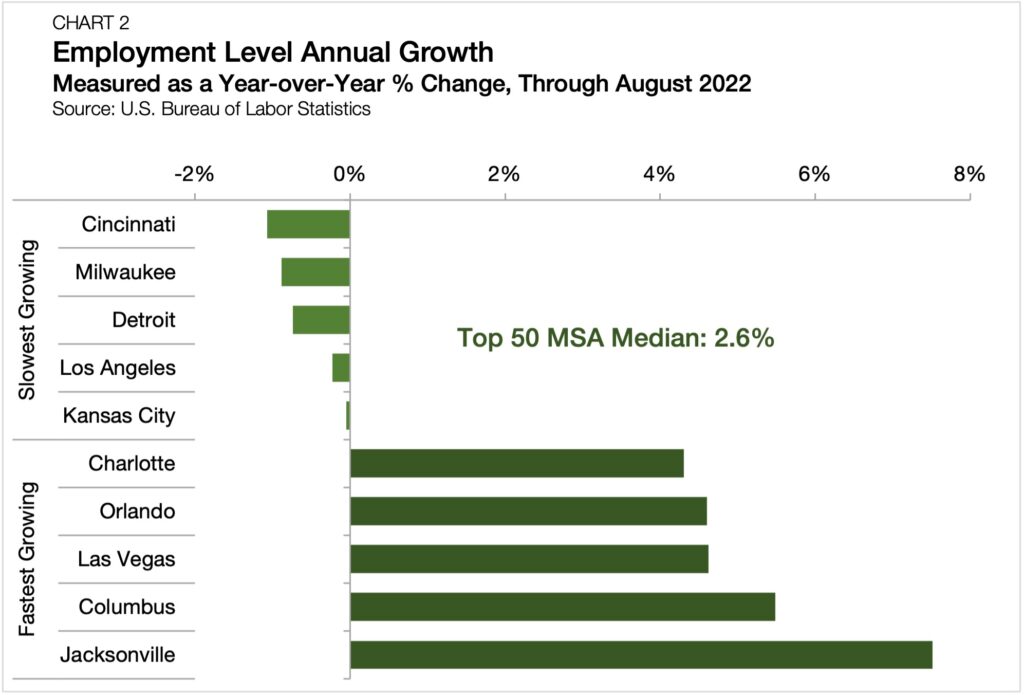

Employment Level Growth

Looking at the establishment survey from the BLS tells a similar story of the national labor market’s resiliency, albeit with a different set of metros standing out above the pack. Of the top 50 metro areas, 45 saw employment growth totals rise during the 12 months ending August 2022. Jacksonville saw the most impressive growth totals, with the number of employees in that metro expanding by a robust 7.5% (Chart 2). Columbus (+5.5%), Las Vegas (+4.6%), Orlando (+4.6%), and Charlotte (+4.3%) rounded out the top 5 in this category.

Cincinnati, Milwaukee, and Detroit were among the cities that experienced employment declines. However, these declines occurred along a backdrop of either flat or falling population totals in Ohio, Wisconsin, and Michigan.

Labor market conditions were among the central areas of analysis in this year’s Arbor Realty Trust-Chandan Economics Top Opportunities in Large Multifamily Investment Report. With population and economic growth slowing, how well metros are retaining employees and creating new jobs will be critical for the health of their local rental housing markets.

Interested in the multifamily real estate investment market? Contact Arbor today to learn about our array of multifamily and single-family rental financing options and view our other market research and multifamily posts in our research section.