U.S. Multifamily Market Snapshot — August 2025

The U.S. multifamily market stood on the cusp of a new cycle at the halfway point of 2025. Demand continued to be driven by favorable demographic trends and a structural need for housing, despite ongoing macroeconomic uncertainty. Rent growth remained in line with pre-pandemic norms, while occupancy rates held steady as the pace of new deliveries slowed, and investors continued to take advantage of market opportunities.

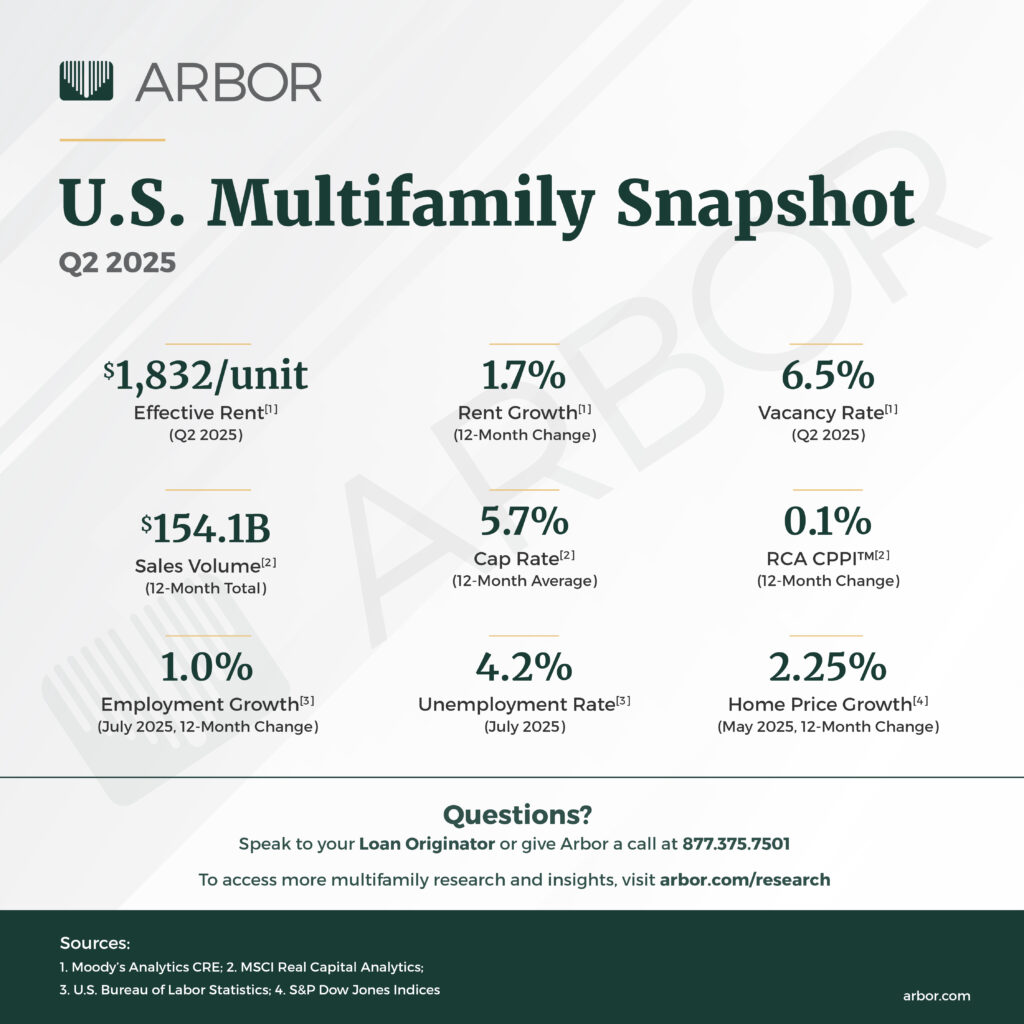

According to data from Moody’s Analytics CRE, effective rent growth nationally climbed by 1.7% over the past 12 months and remained more than 20% higher than pre-pandemic levels in 2019. Affordable and high-growth markets in the Midwest and Sun Belt have recently outperformed, according to the latest Arbor-Chandan Multifamily Opportunity Matrix.

Although new supply had recently driven vacancy rates higher, that pressure seems to have eased, with the overall market vacancy rate holding steady at 6.5% this past quarter. Moody’s forecasts that absorption is expected to rise in 2025, aligning more closely with the pace of new deliveries. A slowdown in permit activity during the first half of the year is likely to ease future supply pressures as the market enters its next phase. U.S. multifamily completions hit record levels in 2024, surpassing net absorption for the third year in a row—even amid historically strong housing demand.

The average size of newly built multifamily units has decreased over the past 20 years, with studios and one-bedroom apartments now making up more than half of all completions. Developers are increasingly targeting lifestyle and workforce renters, leading to smaller units within larger residential projects.

Well-positioned investors continued to capitalize on market uncertainty, with transaction activity reaching pre-pandemic levels. MSCI Real Capital Analytics reported that apartment sales volume over the past 12 months totaled $154.1 billion, in line with the 15-year average of $154.9 billion. Dallas led the country in transaction volume, holding its top position from last year. Over the past 12 months, cap rates for apartment sales averaged 5.7%, essentially unchanged from the prior period.

Results of the National Multifamily Housing Council’s (NMHC) latest Quarterly Survey of Apartment Market Conditions once again signaled that high levels of political and economic uncertainty have had a significant effect on the market. Additionally, 71% of participants in NMHC’s Quarterly Survey of Apartment Construction & Development Activity cited the primary causes for delays in construction starts over the past three months were economic uncertainty, which was up from 68% in March.

The U.S. multifamily market continues to show its strength, with a solid foundation for growth amid broader economic uncertainties. Investors have become increasingly optimistic as demand fundamentals and interest rates stabilize, leading to greater potential for growth and opportunities.

Interested in the multifamily real estate investment market? Contact Arbor today to learn about our array of multifamily, single-family rental, and affordable housing financing options and view our multifamily articles and research reports.