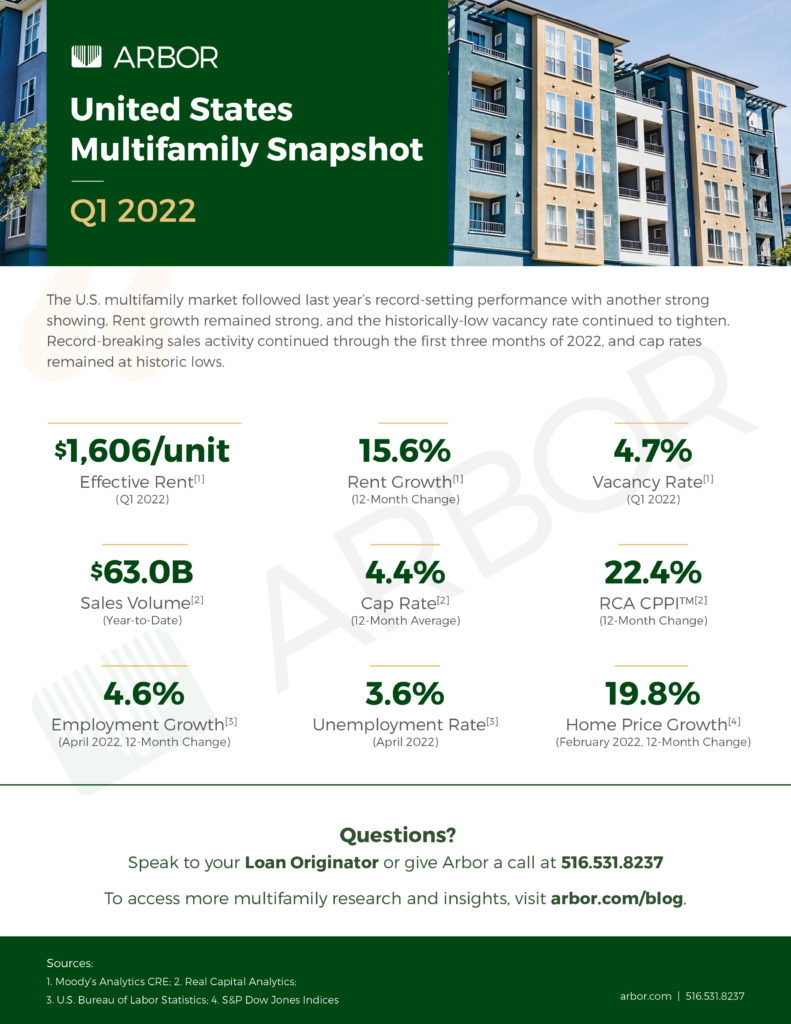

U.S. Multifamily Market Snapshot — Q1 2022

In the first quarter of 2022, the U.S. multifamily market followed last year’s record-setting performance with another strong showing. According to Moody’s Analytics CRE, rent growth remained strong, climbing 15.6% year-over-year, higher than the 12.7% increase for all of 2021. New rent records were set in the third quarter of 2021, increasing 12.7% for the year. Rents are forecasted to increase 5.5% for 2022, and then average 3.0% over the next three years. The vacancy rate improved to 4.7%, slightly down from 4.8% at the end of 2021, and is expected to remain near that level through 2025.

The record-breaking investment activity continued through the first three months of 2022. Real Capital Analytics reported $63.0 billion in sales for the quarter, on pace to reach the second highest level on record. Cap rates remained at historic lows, averaging 4.9%, up slightly from 4.5% for 2021. Multifamily cap rates remained the lowest among major property types, followed by industrial (5.6%), office (6.5%), retail (6.5%), and hotel (8.2%).

The labor market continued to surge to start the year. According to the U.S. Bureau of Labor Statistics, a total of 2.0 million jobs were gained through the first four months of the year, although job creation remained 1.2 million below the pre-pandemic level. The unemployment rate improved to 3.6%, even as job openings continued to climb. Home prices continued their rapid accent, rising 19.8% year-over-year. However, the market showed signs of slowing amid continued limited housing inventory.

Here’s a look at the U.S. multifamily finance and investment key benchmarks for Q1 2022.

For more multifamily market insights, read our latest Small Multifamily Investment Report and check out our other multifamily research.