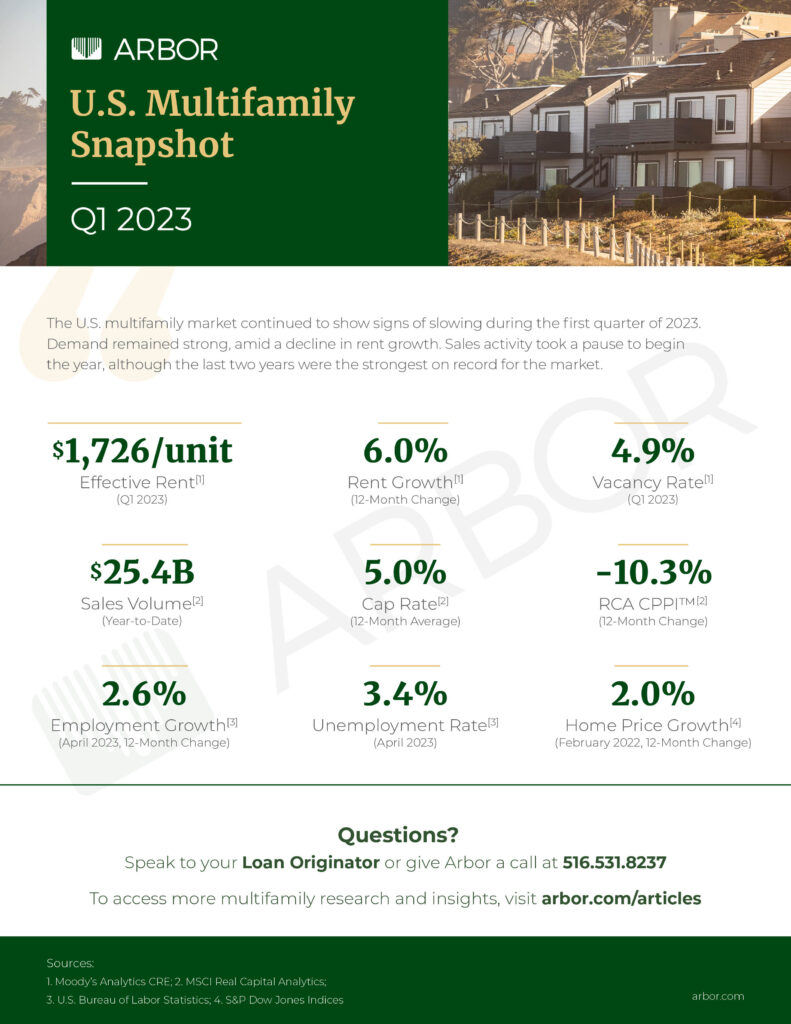

U.S. Multifamily Market Snapshot — Q1 2023

The U.S. multifamily market continued to show signs of slowing during the first quarter of 2023. Moody’s Analytics CRE reported that average effective rents were up 6.0% year-over-year, which was down from the skyrocketing pace of 9.7% in 2022, and 12.7% in 2021. Demand remained strong, with absorption outpacing high levels of new supply. The market’s overall vacancy rate remained near historic lows, rising to 4.9%, up from 4.5% at the end of 2022.

Multifamily investment activity slowed significantly during the quarter, as cap rates continued their increase. However, as MSCI pointed out, the year-to-date 2023 sales volume total was broadly in line with long-term prepandemic levels. Despite the decline in activity, there has been no significant signs of distress. Until well-capitalized investors begin taking over properties from motivated sellers, deal volume is expected to remain subdued.

The U.S. job market posted a 28th consecutive month of growth in April, as the unemployment rate reached its lowest level since 1969. Wage growth cooled, although remained above levels targeted by the Federal Reserve, and job openings remained elevated.

The housing market remained frozen, amid supply pressure, affordability constraints, and high interest rates. Home prices grew 2.0% year-over-year, marking the 10th straight month of slowing, and was the slowest growth measured since 2012.

Here’s a look at the U.S. multifamily finance and investment key benchmarks for Q1 2023.

For more market insight, read our Special Report: Spring 2023 and view our other market research and multifamily posts in our research section.