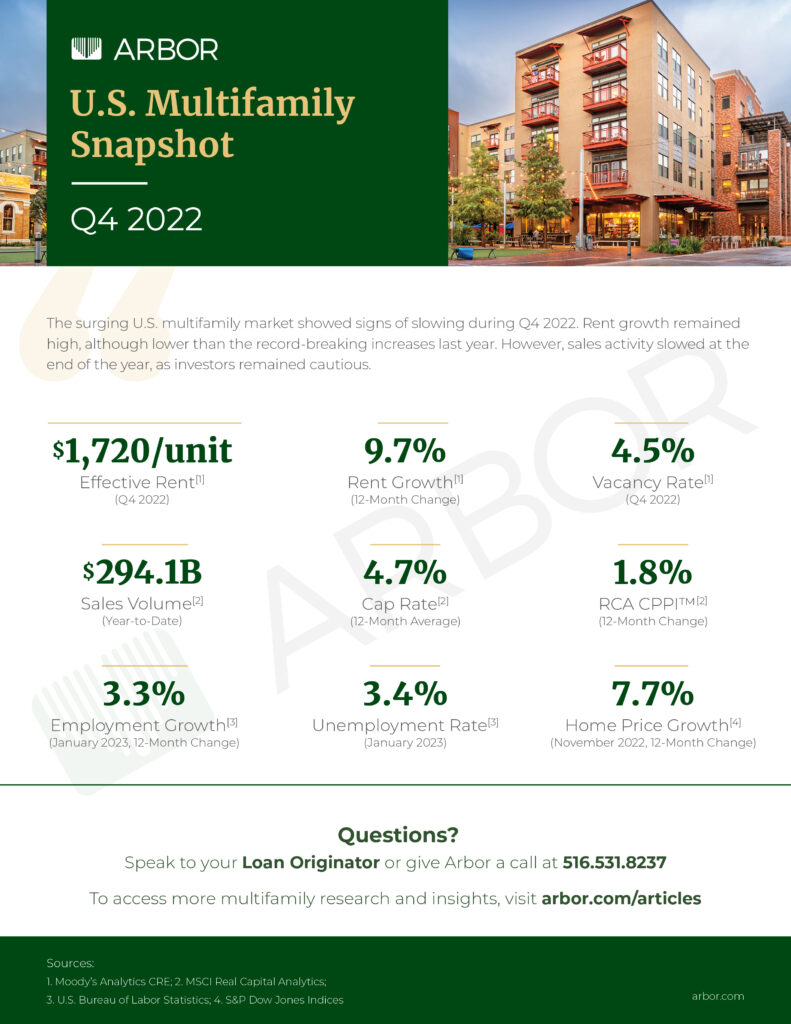

U.S. Multifamily Market Snapshot — Q4 2022

The U.S. multifamily market continued to show signs of slowing at the end of 2022. Moody’s Analytics CRE reported that average the effective rent increased 9.7% year-over-year, down from 2021’s record-high pace of 12.7%. The vacancy rate ticked up to 4.5%, compared to 4.4% in the third quarter, though remained lower than the 4.8% rate reported at the end of 2021. Demand slowed to its lowest level in several years, with net absorption totaling only 141,659 units for the year, down from 248,891 units last year.

Investment activity remained strong, despite slowing at the end of the year. MSCI Real Capital Analytics reported that total multifamily sales finished at $294.1 billion, which was higher than any year prior to 2021’s incredible record-high total of $353.5 billion. There was a noticeable drop-off in activity during the fourth quarter. Sales volume averaged $81.2 billion through the first three quarters of the year, but fell to $50.4 billion in the fourth quarter. Cap rates ticked higher during the year, finishing at 4.7%, up from 4.5% at the beginning of the year. The RCA CPPI apartment index posted a 1.8% annual pace of growth, down dramatically from the feverish pace of 22.6% recorded one year ago.

According to the U.S. Bureau of Labor Statistics, U.S. employment increased by 517,000 jobs in January, the 25th straight month of job gains, beating expectations for the 10th straight month. The unemployment rate was 3.4%, the lowest since 1969. Every major sector has recovered from the pandemic except for leisure and hospitality. High-profile layoffs in the technology industry have not been significant enough to offset gains in other sectors.

The housing market continued to show signs of slowing amid affordability constraints and rising interest rates. The S&P CoreLogic Case-Shiller National Home Price Index fell 0.6% in November, the fifth straight month-over-month decline. Year-over-year, the index rose 7.7% in November, down significantly from the 18.8% pace reported one year ago.

Here’s a look at the U.S. multifamily finance and investment key benchmarks for Q4 2022.

For more market insight, read our Special Report: Spring 2023 and view our other market research and multifamily posts in our research section.