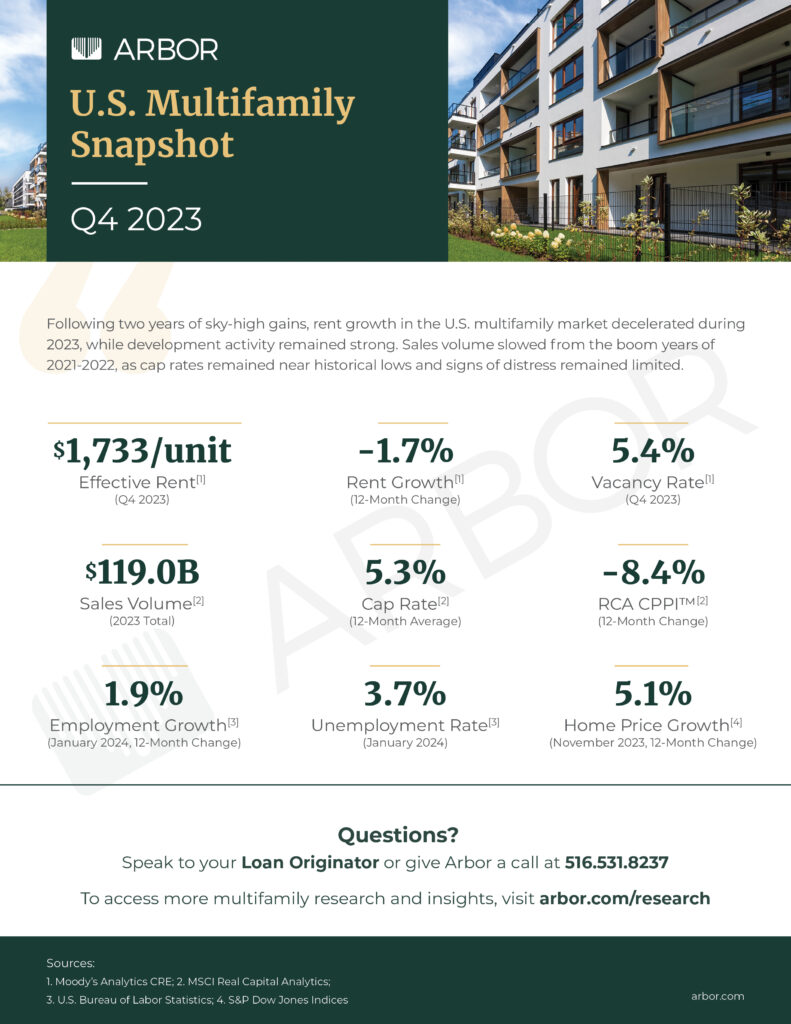

U.S. Multifamily Market Snapshot — Q4 2023

The U.S. multifamily market continued to show signs of slowing at the end of 2023, although demand remained robust, with high home prices leading younger generations of higher-income households to choose renting over homeownership.

According to Moody’s Analytics CRE, multifamily rent growth in the U.S. was down 1.7% overall during the year, but with growth rates of 10.1% in 2022 and 12.9% in 2021 the multifamily market entered 2023 in a strong position. Additionally, there were standout performances at the market level.

Completions outpaced net absorption during the year for the first time since 2020. Although the pace of new construction has declined for two consecutive years, the developmental pipeline is still full. However, the pace of new permit filing showed signs of slowing, as financing costs have increased, easing supply pressures for the longer run.

The past few years of elevated development activity have led to a slight rise in vacancy nationally, although rates remained at new record lows. The slowdown in new permit filings suggests that the pace of construction is approaching normalcy and that rising vacancy rates are not here to stay.

The latest Quarterly Survey of Apartment Construction & Development Activity from the National Multifamily Housing Council (NMHC) signaled that construction delays were reported by 84% of respondents. The NMHC also reported that apartment market conditions overall continued to weaken during the quarter with three out of the four components of the Quarterly Survey of Apartment Market Conditions coming in below the break-even level. The exception being Debt Financing, which turned positive this quarter.

After a two-year boom in the multifamily investment market, sales volume fell to $119.0 billion during 2023, according to MSCI Real Capital Analytics. Although this was a significant slowdown as compared with the previous two years of record-breaking investment activity, the total was only 7.6% below the 15-year annual average. Apartment prices fell 8.4% year-over-year and were down 15% from their early-2022 peak, according to the RCA CPPI™.

The U.S. economy added 353,000 jobs during January, the 37th straight month of gains, blowing away economists’ expectations. The unemployment rate held steady at 3.7% for the third month in a row, remaining near 50-year lows, and has remained below 4% for 23 months in a row.

The housing market continues to show few signs of life amid supply pressure, affordability constraints, and high interest rates. Home prices fell in November, although it was the first monthly decline since January 2023, according to S&P CoreLogic’s latest Case-Shiller U.S. National Home Price NSA Index.

Here’s a look at the U.S. multifamily finance and investment key benchmarks for Q4 2023.

Interested in the multifamily real estate investment market? Contact Arbor today to learn about our array of multifamily and single-family rental financing options and view our other market research and multifamily posts in our research section.