Understanding the Impact of Wildfires on Rental Property Insurance

- A higher frequency of wildfires combined with more development in vulnerable areas has sharply increased the number of homes located in high-risk areas.

- California has the highest dollar volume of at-risk housing development, totaling nearly $761 billion.

- Insurance premiums in high-risk states have not kept pace with the growing wildfire threat, leading to a pullback from property insurance providers — especially in California.

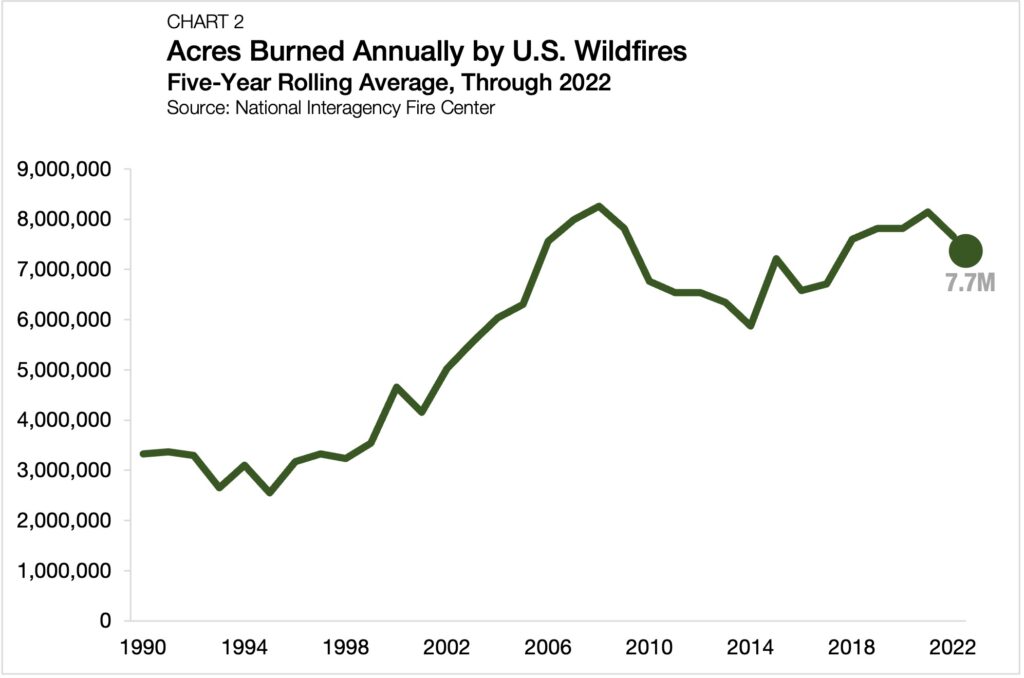

Last year alone, nearly 70,000 wildfires burned over seven million acres of land in the U.S. From California to Maui, the frequency and scope of wildfire events are rising, causing insurance markets and public agencies to reevaluate property in areas at risk for catastrophic damage. As a result, rental housing providers are seeing greater limitations to coverage, higher premium prices, and, in some cases, a total absence of viable private insurance — a trend detailed in the NMHC 2023 State of Multifamily Risk Survey and Report.

This troubling new trend has placed many rental housing operators in a bind where they must simultaneously contend with the declining availability and affordability of insurance options.

National Risk Expansion

Although the threat of wildfires is growing in some regions of the U.S., more people are moving into high-risk areas, such as the wildland-urban interface (WUI). The WUI — the area where human development and wildland vegetation intermingle — has expanded over the last two decades, putting more homes in locations of increased wildfire risk. Between 1990 and 2010, the amount of new housing in the WUI expanded by 41%, and the WUI’s land area increased by 33%, according to a 2018 study published in Proceedings of the National Academy of Sciences.

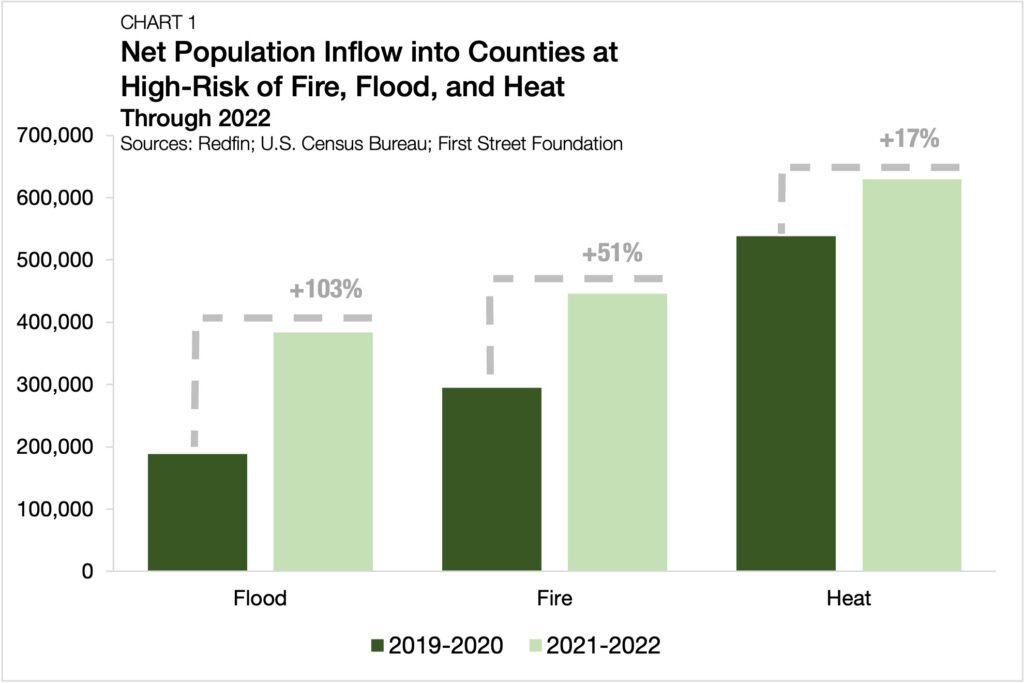

Recent studies suggest that migration into high-risk areas is not just continuing at pace but accelerating. A 2023 Redfin analysis indicated that net migration into wildfire-prone areas totaled 446,343 people in 2022 — jumping by more than 50% in two years. For example, Riverside County, CA’s population increased by 39,000 during this time despite two-thirds of its homes being located in high-risk areas.

Further, research conducted by the University of Nevada, Las Vegas (UNLV) suggests that new development trends are more than the result of a misunderstanding of risk factors. Instead, the study points out that even after wildfire disasters occur, there is minimal impact on the pace of new housing development in WUIs, which are now the fastest-growing land-use type in the U.S.

As more people live in WUIs, the incidence of wildfires has also risen in recent decades. According to National Interagency Fire Center data, the five-year average of annual area burned from wildfires has more than doubled in the past 30 years, totaling 7.7 million acres through 2022.

With wildfire events becoming more frequent and their impacts on lives and communities expanding, the U.S. government has directed more funding for resilience and preparedness. In July 2023, the Bipartisan Infrastructure Law granted an additional $185 million of federal funding to the U.S. Department of the Interior for the training and pay support of wildfire firefighters, on top of $278 million already in this year’s budget. In the FY 2024 Federal Budget, the USDA will receive a 28% (+$647 million) increase in funding for wildland fire and hazardous fuels management.

Risk Landscape

According to FEMA, 18.8% of U.S. residents live in moderate or high-risk zones for wildfire. However, the distribution of those at risk varies significantly from state to state. Thirty-four states do not have any residents who live in moderate or high-risk zones. Meanwhile, six states (Arizona, Nevada, Hawaii, California, Utah, and Florida) have a majority of their residents living in moderate or high-risk wildfire areas.

Of all U.S. states, California’s wildfire risk profile stands out. According to CoreLogic, California is the most at-risk state by number of homes and property value. The study notes that the Golden State has 1.3 million homes at risk of wildfire, representing a total reconstruction cost value (RCV) of $760.8 billion. A distant second in both risk categories is Colorado. It has nearly 333,000 at-risk homes with a total RCV of $140.9 billion.

Insurance

Property owners in areas at risk of wildfire understand, even if imperfectly, that the threat of catastrophic destruction is omnipresent. Efficient insurance markets are necessary for property owners to limit financial exposure while investing in communities that feature both heightened risk and natural beauty.

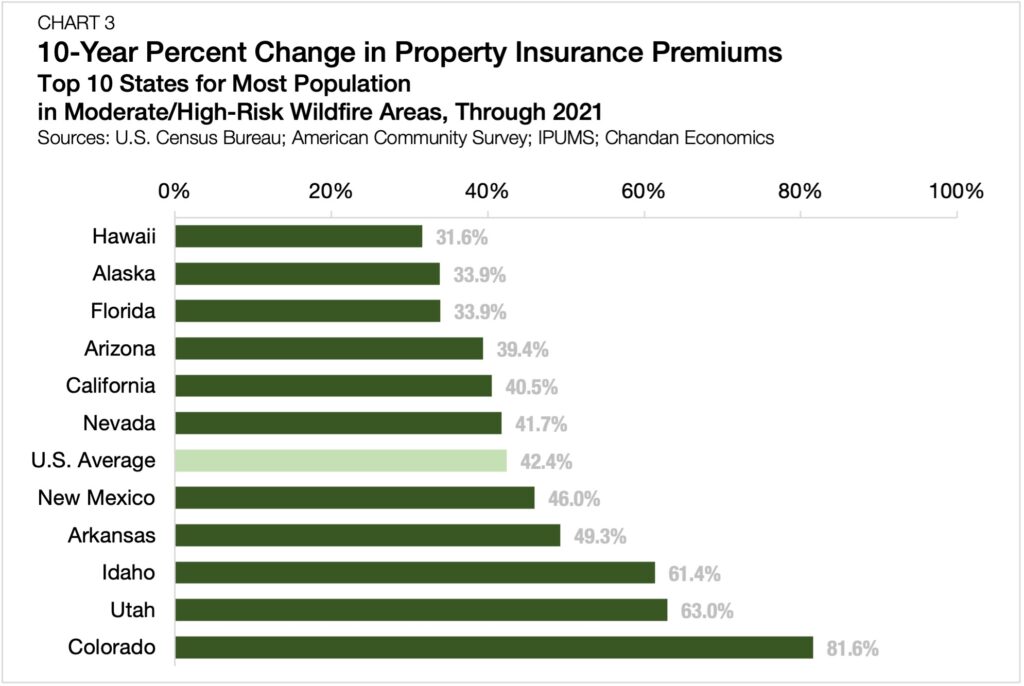

For the insurance market to operate properly, it requires that policy providers calibrate the cost of coverage to a property’s unique risk profiles — based on analysis of the U.S. Census Bureau’s American Community Survey and FEMA data, it does not appear that an efficient calibration of risk pricing is taking place. Nationally, annual property insurance prices have risen by 42.4% in the 10 years ending in 2021. Property insurance prices have risen slower than the national average in the four states with the highest share of the population living in moderate/high-risk wildfire areas. Moreover, looking at all states, there is only a modest correlation between growth in property insurance premiums and wildfire risk.[1]

In California, state-level regulations have long stood in the way of insurance providers effectively pricing coverage options. A 1988 referendum passed Proposition 103, which makes it difficult for insurance providers to quickly increase premiums, preventing coverage from rising proportionately with growing risks. As a result, major homeowner and property insurance providers, including Allstate and State Farm, have pulled out of California. In a June 2023 announcement, State Farm stated it would stop writing new policies for all business and personal lines of property and casualty insurance in California due to “rapidly growing catastrophe exposure.” In response, California’s Insurance Commissioner Ricardo Lara announced on September 21 that he would write new rules for insurance companies to allow them to consider climate change when setting rates in the state.

The Outlook

For multifamily and single-family rental (SFR) operators, considering a wide spectrum of risk is crucial to success. Prudent operators would be wise to incorporate wildfire risk factors into their investment calculus while also exploring and supporting community-level preparedness measures. Now more than ever, investors should apprise themselves of the challenges and options available within local insurance markets to secure the best protection for their rental assets.

[1] According to a Chandan Economics analysis of FEMA and U.S. Census Bureau Data, measured across all 50 states, the 10-year percent change of average insurance prices is only 26.9% correlated with FEMA wildfire risk scores.

Interested in the multifamily real estate investment market? Contact Arbor today to learn about our array of multifamily, single-family rental, and affordable housing financing options and view our other market research and multifamily posts in our research section.