What Is Driving Lifestyle Renter Demand?

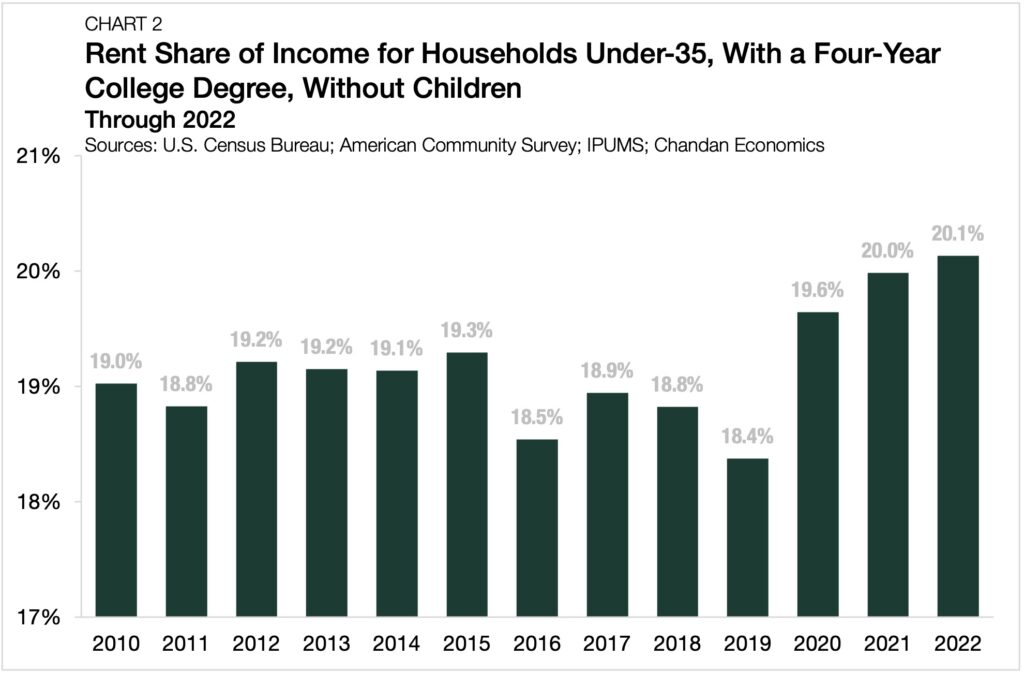

- Highly educated young renters spent 20.1% of their income on rent in 2022, a new high.

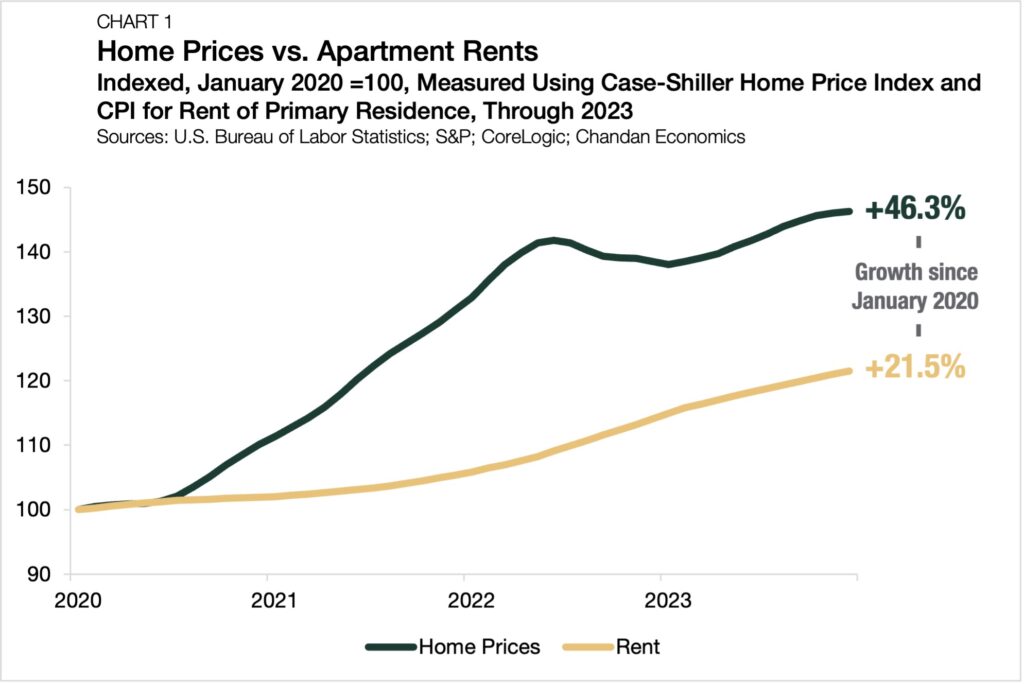

- With home prices up an average of 46.3% since early 2020, fewer renters see themselves becoming homeowners.

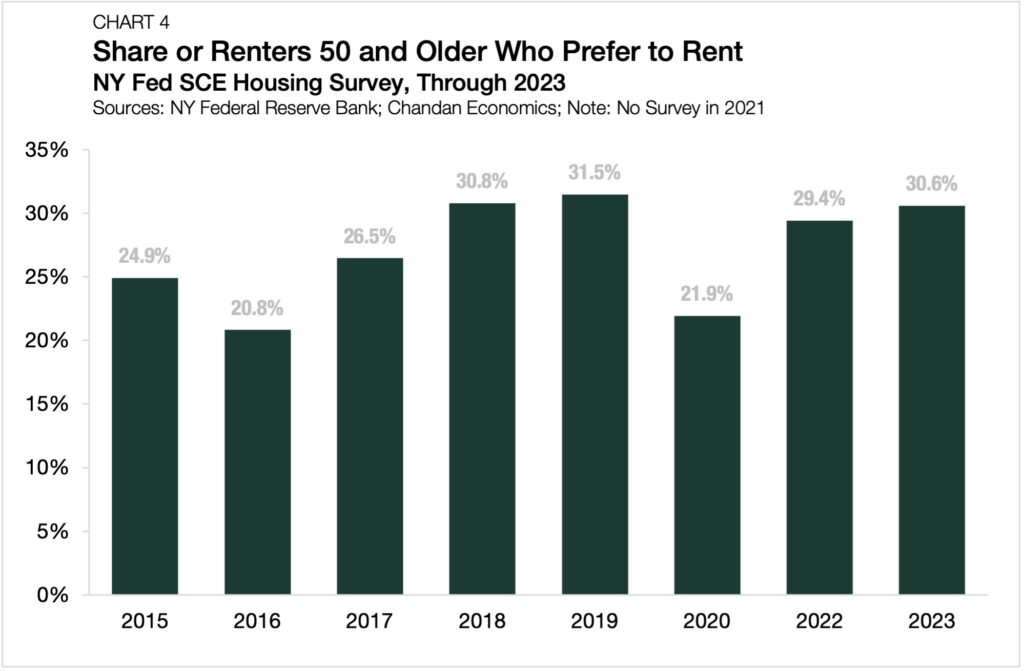

- The share of renters 50 and older who would rather not own a home increased in two consecutive years, reaching 30.6% in 2023.

Lifestyle renters — those who have the means to own but prefer to rent or are willing to pay more for apartments with amenities — have become a key driver of rental demand in single-family rental homes, build-to-rent communities, and other types of high-quality multifamily housing. With this small yet influential demographic growing, our research teams examine and explain the factors driving lifestyle renter demand.

Market Dynamics

The choice to rent or buy a home involves a variety of factors. Pricing trends shape perceptions of value and alter decision-making. For example, if home prices rise more quickly than rents, there should theoretically be an increase in renters. The market has seen this scenario play out recently. Although rents have increased markedly, home prices have seen considerably more upward pressure. From the start of 2020 to the end of 2023, rents rose 21.5%, while home prices climbed 46.3% (Chart 1).

Further, average home prices have risen more quickly than incomes in every calendar year since 2012 — making homeownership less attainable for many Americans. A 2023 survey by Home Bay found that 72% of renters say they will never have enough money to own a home.

Renters who prefer to own but do not see a path to homeownership instead prioritize amenities when selecting housing. For renter households under 35 with at least a four-year college degree and who do not yet have children, the share of income spent on rent increased for its third consecutive year in 2022, reaching a record high of 20.1% (Chart 2).

Value of Experience

While declining access to affordable homeownership is a significant part of the story, it is not the whole story. The lifestyle advantages of renting are clear.

Renting provides advantages such as flexibility and proximity to cultural amenities, such as restaurants, bars, and entertainment, as well as centers of job activity. According to the National Multifamily Housing Council (NMHC) and Grace Hill 2024 Renter Preferences Survey, 85% of renters report enjoying living in their community. Additionally, 60% of renters cited maintenance-free living as the biggest benefit of renting. Experts cite the ease of renting compared to the headaches of homeownership as a factor supporting lifestyle renter demand.

Renters also have a much wider array of options today than they’ve had historically. Apartment providers have been engaged in an amenity race, adding lobby attendants, mail rooms, rooftops, lounges, and gyms as part of the lifestyle renting package.

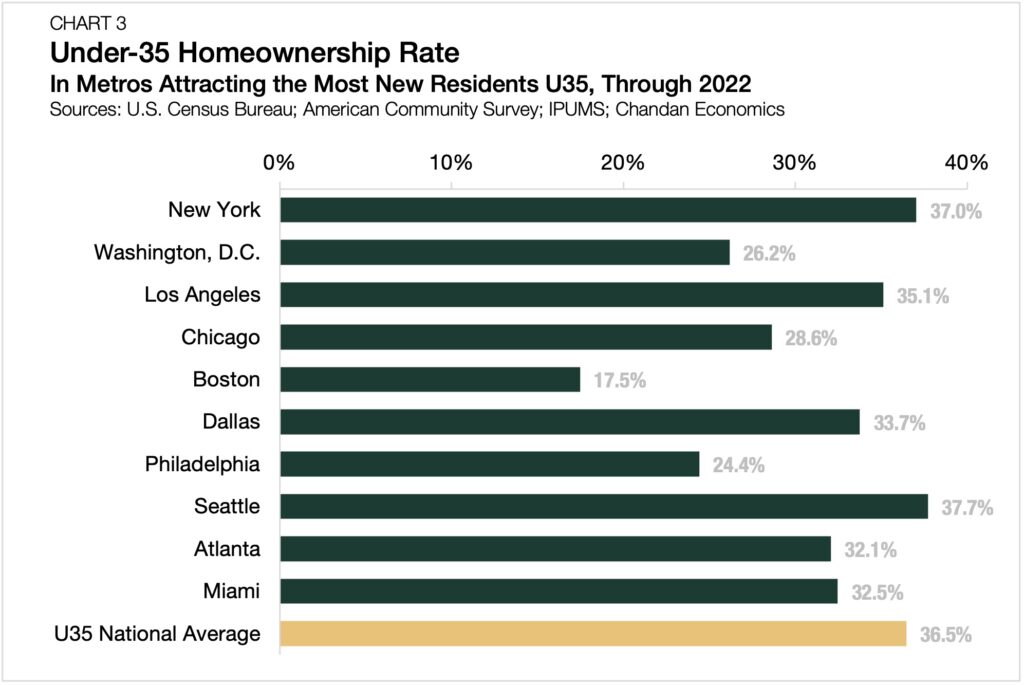

Today, it tends to be younger households that are willing to put a premium on lifestyle factors, such as cultural and property-level amenities, over unit-level square footage and ownership. Of the ten metro areas attracting the highest volume of young residents, eight had homeownership rates that were below the national average for the under 35 age group — a reflection of the fact that young households often prioritize lifestyle factors over an expedient path to owning a home (Chart 3).

Empty Nesters

Even if the motivating factors and amenity preferences look markedly different, older households are also critically important to the lifestyle renting discussion. Homeowners whose children are now adults often have more living space than they require. As a result, downsizing offers many unique advantages to so-called empty nesters, including the ability to live off of their accrued home equity in retirement.

Evidence suggests that older renter households are leaning into the rental lifestyle. According to the Federal Reserve Bank of New York’s SCE Housing Survey, the share of renters age 50 and over who prefer to rent (30.6%) is nearly three times greater than that of renters under age 50 (10.8%) and within one percentage point of its 2019 high (Chart 4).

In addition to preferences, demographics are also a major contributing factor. Baby boomers are reaching retirement age, creating the largest wave of retirees in history. According to a Chandan Economics analysis of the 2022 U.S. Census Bureau American Community Survey (ACS), the number of renter households headed by someone age 50 or older has increased by 27.3% between 2010 and 2022 — nearly four times the growth rate of renter households headed by those under age 50 (+7.3%).

Conclusion

While it’s convenient to categorize renters, lifestyle renters are a broad spectrum of households of many different ages and income levels. Whether they are older adults downsizing or young households prioritizing experience, it’s clear the number of renters making housing decisions based on lifestyle factors is on the rise.

Interested in the multifamily real estate investment market? Contact Arbor today to learn about our array of multifamily, single-family rental, and affordable housing financing options or view our multifamily articles and research reports.