What’s Next for the Federal Reserve?

- A recent jump in long-term U.S. Treasurys may enable the Federal Reserve to pause interest rate increases indefinitely as various market forces tighten financial conditions.

- Financial market observers anticipate the central bank is at or near the end of its monetary tightening cycle.

- Interest rates may remain elevated in the medium term, leaving little room for multifamily cap rate compression.

Over the past year and a half, the Federal Reserve has embarked on one of its most aggressive monetary tightening cycles in history. With the federal funds rate sitting above 5.25% and two more Federal Open Market Committee (FOMC) policy meetings scheduled through the end of 2023, questions remain about how short- and medium-term monetary policy adjustments could influence multifamily investing. While a rapid reversal is unlikely, the next phase could ease some interest rate pressure.

Taming Inflation

The Federal Reserve initiated its monetary tightening cycle to regain control over inflation. While inflation has markedly improved from its 8.9% peak in the summer of 2022, the headline Consumer Price Index annual inflation rate remained at 3.7% through September 2023 and the Personal Consumption Expenditures Price Index was 3.5% — both measures still well above the Fed’s 2% target. Inflation has not improved since June, and recent labor market data signals that hiring demand remains robust. However, there are recent signs of cooling, such as declines in job openings, fewer quits, and continued unemployment claims.

These economic indicators suggest that more monetary tightening could be needed to suppress inflationary pressures. At the same time, there is also a counterbalancing market force reducing the need for more monetary tightening: rising long-term Treasury yields. Since late July, the yield on the 10-year Treasury note has jumped from around 4% to most recently hovering around a 16-year high of 5%. In his most recent speech, Jerome H. Powell, Chair of the Federal Reserve, stated that the central bank is committed to moving forward with caution. He also noted that interest rates may need to be raised higher if economic growth remains strong.

The Next Phase of the Cycle

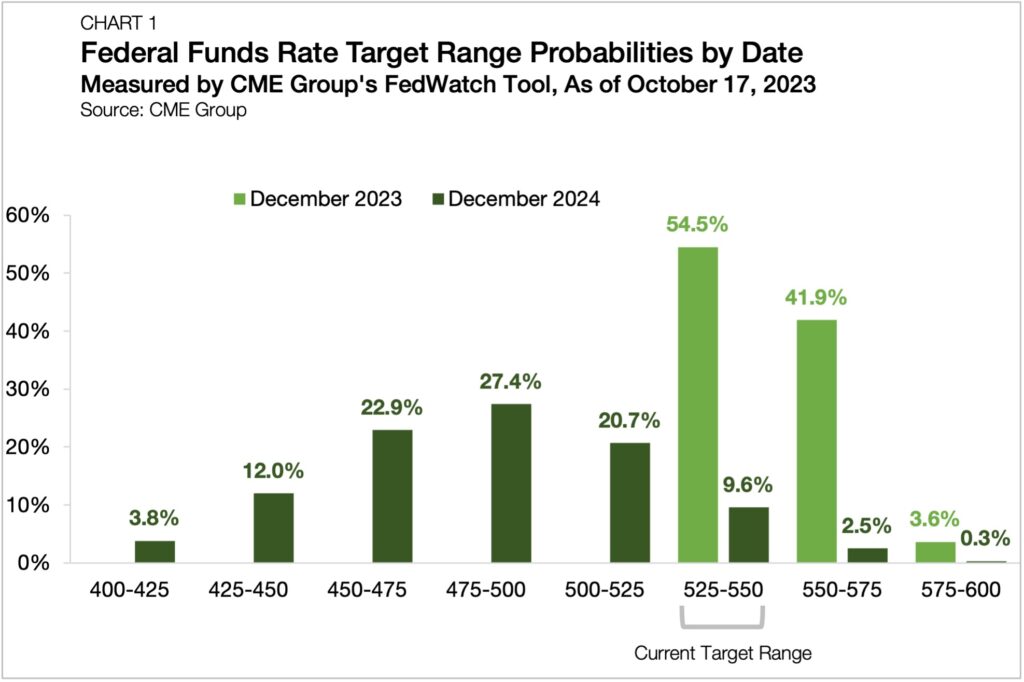

Many believe the central bank is at or near the end of its current monetary tightening cycle. According to the CME Group’s FedWatch Tool, there is a 54.5% chance that the Fed will not raise rates again this year, as of mid-October (Chart 1).

While market watchers believe that the Federal Reserve will cut interest rates in 2024, multifamily investors should not expect a rapid reversal to the accommodative interest rate environment of two years ago. The federal funds rate is expected to be lowered by about 50 basis points (bps) from its current levels in 2024. Similarly, the Fed’s projections do not call for sizable rate cuts next year.

What Multifamily Investors Should Know

The challenges of a high-interest-rate environment have significantly impacted the multifamily sector in 2023. The bid-ask spread between what buyers are willing to pay and what sellers are willing to accept has widened, leading to a measurable drop-off in transaction activity and higher market-clearing cap rates.

Even if the Federal Reserve begins to cut short-term interest rates in the year ahead, investors should ready themselves for the possibility that long-term interest rates will see upward pressure from a yield curve normalization — a possibility discussed at length in Special Report Fall 2023: Recalibrating Amid Uncertainty by Arbor’s Chairman and CEO Ivan Kaufman and Sam Chandan of NYU’s Stern School of Business. With multifamily risk premiums already at historically compressed levels, multifamily investors should prepare for the potential of further cap rate increases into 2024 and always anticipate the possibility of the unexpected.

Interested in the multifamily real estate investment market? Contact Arbor today to learn about our array of multifamily, single-family rental, and affordable housing financing options. Don’t miss our other market research articles, and our latest reports can be found in our research section.