Why is Rent Inflation Still High While Reports Show Prices Cooling?

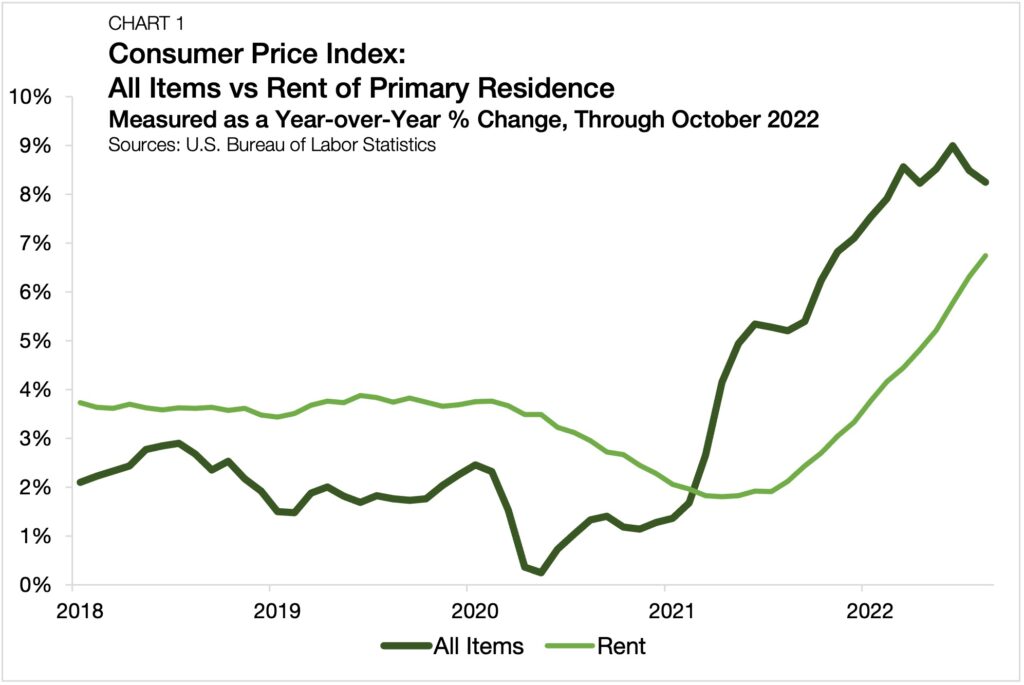

- U.S. inflation, as measured by the CPI, fell to 7.8% in October 2022, down from 8.2% in September.

- The rent component of CPI rose to 7.5%, marking 15 consecutive months of increases.

- Even as other measures of rent growth have fallen in many markets, the rent component of the CPI is poised to rise due to lag effects.

Rent Inflation Continues to Rise

With the latest release of the Consumer Price Index (CPI) report from the U.S. Bureau of Labor Statistics (BLS), policymakers and consumers alike found signs of inflation relief for the first time in a long time. While the headline annual inflation rate of 7.8% for October 2022 remained uncomfortably high, it was a marked improvement from 8.2% in September and the lowest reading since January 2022. Together, these new numbers signal that the Federal Reserve’s monetary policy tightening cycle is starting to slow inflation.

Despite the CPI’s overall improvement in October, one notable price category is still seeing rising inflation: rent of primary residence. The annual growth rate for the rent component of the CPI has now increased for 15 consecutive months, with October 2022’s reading landing at 7.5% (Chart 1).

Rent CPI Lags the Market

As reported by Moody’s Analytics CRE, and other sources that track the multifamily market, there has been an inflection in recent months with rent prices paid on newly signed leases decelerating throughout the U.S. Even still, the rent component of the CPI has continued climbing every month.

Private data providers most often report on the rent prices paid on newly signed or renewed leases, the so-called prevailing market rent. On the other hand, the BLS’s CPI rent segment measures the average price paid across all renters with long-standing occupancy. Most apartment leases are renewed annually, so it can take several months for landlords to be able to reset prices to match the market. Ultimately, this waiting period creates a lagged effect between changes in privately-reported rents and the rent portion of the CPI, which was reflected in the October report.

Considering multifamily’s robust rent growth over the past year (up more than 10% in most major markets in the U.S.), expect the rent of primary residence component of the CPI to continue to put pressure on overall inflation in the short term, even if other reported rent measures continue to show slowing growth.

Interested in the multifamily real estate investment market? Contact Arbor today to learn about our array of multifamily and single-family rental financing options and view our other market research and multifamily posts in our research section.