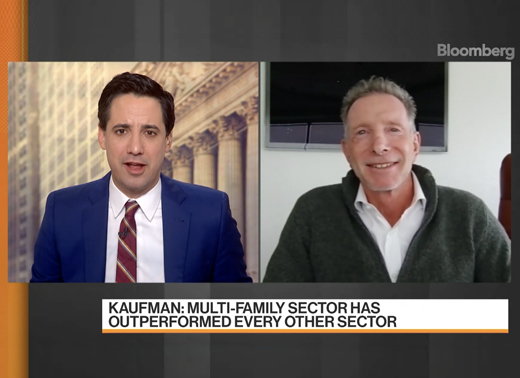

Ivan Kaufman on Bloomberg TV’s “What’d You Miss?”: The Housing Market is Booming

Arbor Realty Trust’s CEO explains why 2021 will be another phenomenal year for the housing market

Despite pandemic-related concerns, the housing industry had an extraordinary year in 2020. While 2021 may not see as robust price appreciation, low supply and pent-up demand will support another strong year for the housing market, noted Ivan Kaufman, the founder, chairman and CEO of Arbor Realty Trust, Inc. (NYSE:ABR), in an interview on Bloomberg TV’s “What’d You Miss?” with Caroline Hyde, Joe Weisenthal and Romaine Bostick.

Even with the recent rise in interest rates, homeowners and consumers have been benefitting from low interest rates while creating “an enormous amount of wealth, almost $4 trillion of savings for homeowners,” Kaufman noted. “The bump up in interest rates has had a nominal effect but rates are still at historic lows.”

Getting into specific sectors of the housing market, Kaufman noted he’s extremely bullish on multifamily, which has “outperformed almost every other sector consistently and even through dislocations and recessions,” and the single-family market due to the rising homeownership rate and home price appreciation.

He noted, however, that the asset class he’s most excited about is the single-family build-for-rent community sector.

“It’s a new asset class, it’s being done very efficiently with a lot of demand and desire. And I think people have a hybrid between renting in a multifamily unit versus buying in a single-family community and that’s the sector I like the most in this investment cycle,” Kaufman said.

In the interview, Kaufman also shared his insights on the returning to cities. He noted that while there was a fear of a mass exodus, people will begin to return to the urban areas, especially younger people who want to live and work where there’s a lot of action.

He added that New York City is already beginning to see a resurgence.

“Over the last 30 days, you’ve had a rent adjustment in New York City. The number of apartments being rents are at record numbers, albeit at lower rates, but people are renting and renting quickly. There’s huge demand and concessions are disappearing.”

Looking at other commercial real estate sectors, Kaufman noted that the retail sector will face the most challenges, given that it was already going through a reconfiguration pre-COVID. On the other hand, he expects hard-hit sectors like restaurants and hospitality to begin to recover due to people’s pent-up desire to travel and dine out once they are vaccinated and places open up more capacity.

Watch the full interview here.