After proving its resilience, the multifamily real estate sector is positioned to thrive in the next growth cycle. While uncertainties persist and risks remain, new federal policies and long-awaited interest rate relief have brought optimistic investors back to the table with a new sense of urgency.

Small Multifamily Investment Trends Report Q2 2022

Cap Rates Compress as Buyers Seek Inflation Protection via Multifamily Assets

Key Findings

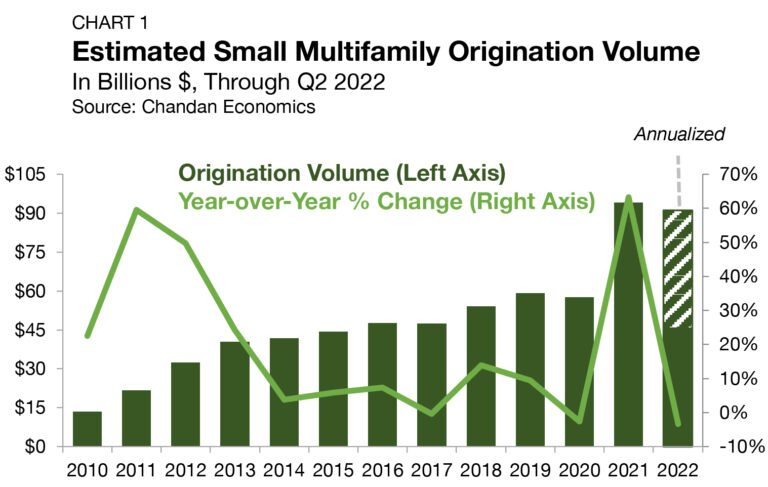

- Small multifamily originations are on pace to hit $91.1 billion in 2022, just shy of 2021’s record high.

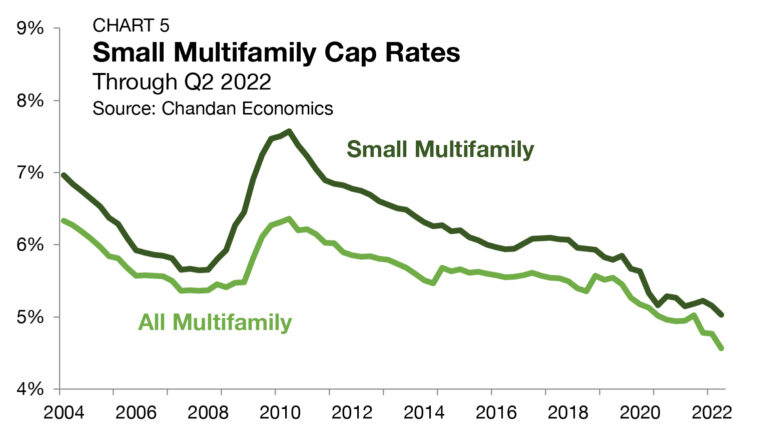

- Cap rates reached a new record low in the second quarter, declining to 5.0%.

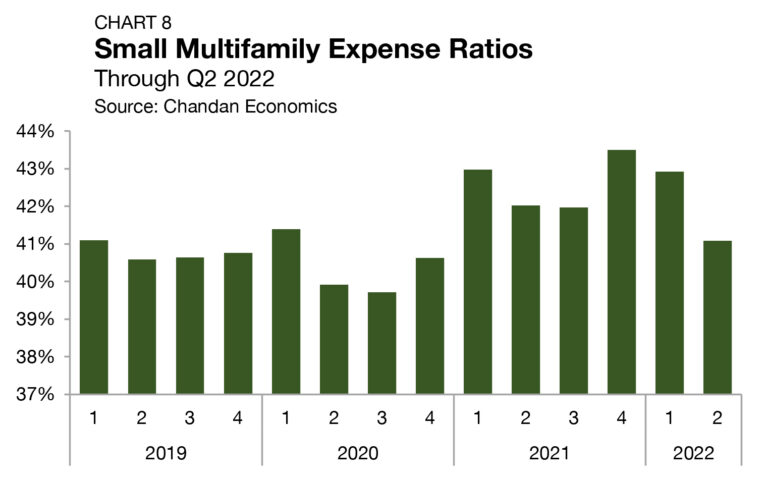

- Amid surging rents and property-level incomes, expense ratios have returned to pre-pandemic levels.

State of the Market

Storm clouds continue to gather for the U.S. economy and advanced economies around the world. After the U.S. gross domestic product shrank at a 1.6% seasonally adjusted annualized rate in the first quarter of 2022 and current forecasts anticipate another contraction in the second quarter, talks of an impending recession are omnipresent.

Headlining the list of concerns impacting the U.S. economy is inflation. According to the U.S. Bureau of Labor Statistics (BLS) Consumer Price Index, prices of goods and services increased 9.1% from one year ago through June — the highest mark since 1981. As a result, the financial markets are betting that the Federal Reserve will need to keep its foot on the gas at upcoming policy meetings, raising the cost of capital via hiking its Federal Funds rate.

While the macroeconomic landscape has caused stock market investment returns to sink negative thus far in 2022, multifamily real estate has maintained its resiliency. As has historically been the case, during periods of rising interest rates, would-be homeowners tend to re-engage with the rental market as mortgage costs rise, placing upward pressure on rental housing demand.

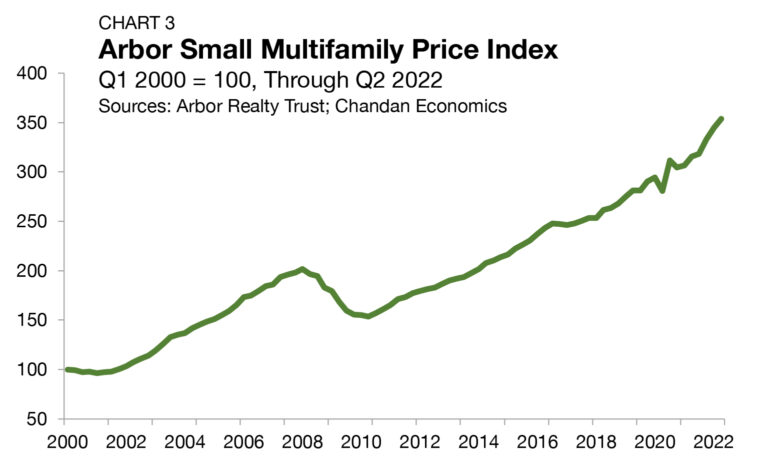

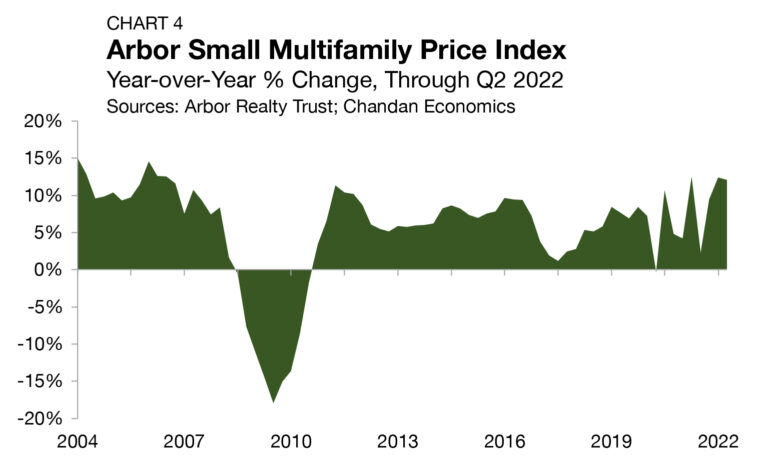

The multifamily sector and small asset sub-sector continue to benefit from a unique set of circumstances. Residential commercial real estate continues to attract new buyer demand as investors seek assets that can quickly absorb inflationary pressures. Small multifamily prices continued to press higher at a double-digit annual rate in the second quarter of 2022 and cap rates sank to new all-time lows. According to First American, cap rates may be poised to shift higher in the coming months, particularly if benchmark interest rates and property-level incomes keep ascending. All else equal, small multifamily remains to be a sector buttressed by a favorable balance of tenant and investor demand, a sign of stability during a period of heightened business cycle volatility.

Lending Volume

Through 2022’s halfway mark, small multifamily originations are on pace to reach $91.1 billion. While 2022’s year-to-date pace would reflect a slight 3.3% annual decline, the fact that origination totals remain in the same stratosphere as the 2021 record is noteworthy.

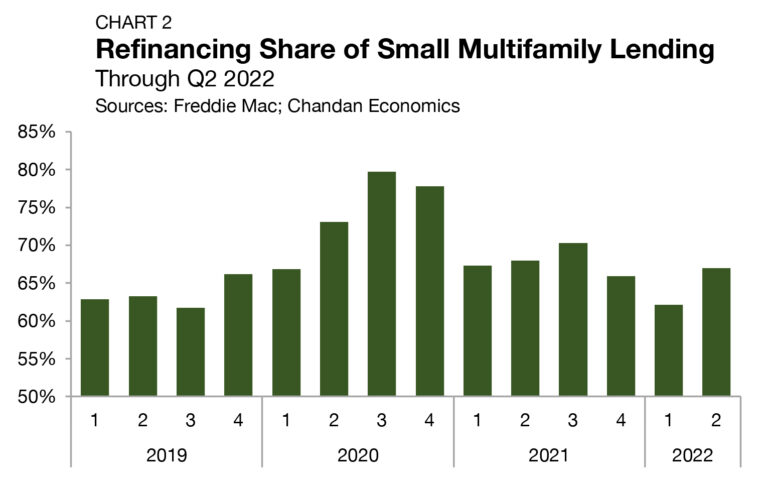

A key factor that led to an unprecedented surge in origination volume last year was a wave of refinancing activity ahead of the Federal Reserve initiating its interest rate hikes. However, even as interest rates rose off of their record lows, refinancing activity did not appreciably fall. In the second quarter of 2022, the refinancing share of small multifamily originations jumped up by 488 bps to land at 67.0% — the highest share since the third quarter of 2021 (Chart 2). Beyond stability in refinancing, a growing investor appetite for multifamily properties in a high inflation environment is the other causal factor keeping originations near record levels.

Arbor Small Multifamily Price Index

Cap Rates & Spreads

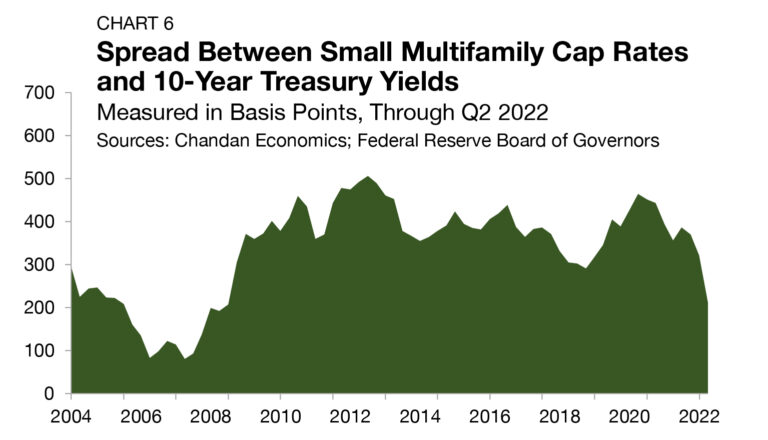

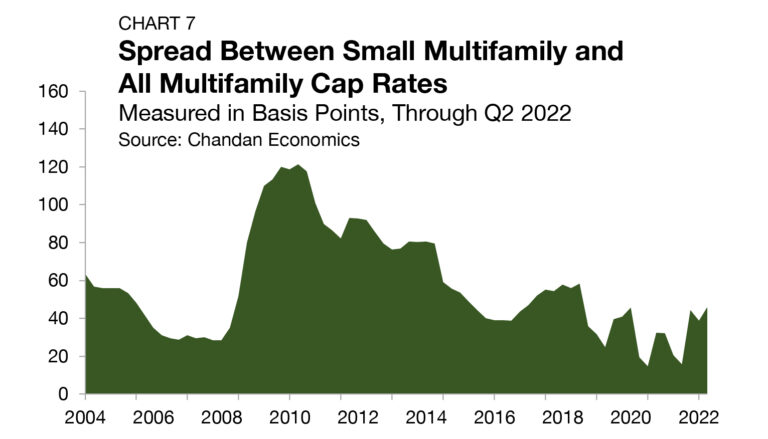

The small multifamily risk premium — a measure of additional compensation that investors require to account for higher levels of risk — is best measured by comparing cap rates to the yield on the 10-Year Treasury. The average small multifamily risk premium cratered in the second quarter of 2022, falling from 320 bps to 210 bps — its lowest level since 2008. (Chart 6). The narrowing spread comes as cap rates have fallen and Treasury yields have soared by nearly a full percentage point amid monetary tightening and increasing inflation. The cap rate spread between small multifamily assets and the rest of the multifamily sector — a measure of the risk unique to smaller properties — increased slightly by 7 bps during the second quarter of 2022, settling at 46 bps (Chart 7).

Expense Ratios

Leverage & Debt Yields

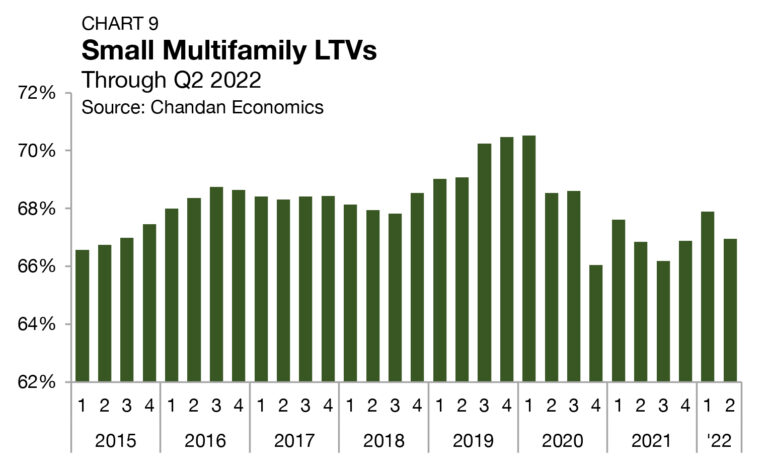

During the first year of the pandemic, loan-to-value ratios (LTVs) on newly originated small multifamily loans cratered — declining from 70.5% in the first quarter of 2020 to a low of 66.0% by the end of the year. While LTVs have recovered slightly from their 2020 depths, momentum has been uneven. LTVs reached a recent high of 67.9% in the first quarter of 2022 but then proceeded to decline 94 bps in the second quarter, landing at 67.0% (Chart 9). With market pricing of multifamily assets rising at a rapid pace in early 2022, the fact that LTVs failed to climb back to near pre-pandemic levels is a sign of disciplined lender underwriting in the face of growing macroeconomic uncertainty.

Outlook

For more small multifamily research and insights, visit arbor.com/articles

1 All data, unless otherwise stated, are based on Chandan Economics’ analysis of a limited pool of loans with original balances of $1 million to $7.5 million and loan-to-value ratios above 50%.

2 The Arbor Small Multifamily Price Index (ASMPI) uses model estimates of small multifamily rents and compares them against small multifamily cap rates. The index measures the estimated average price appreciation on small multifamily properties with 5 to 50 units and primary mortgages of $1 million to $7.5 million. For the full methodology, visit arbor.com/asmpi-faq.