Rental housing’s long-term investment outlook remains head and shoulders above its peers, driven by structural supply constraints and steady demand growth, finds the 2026 Emerging Trends in Real Estate report. Explore this trend and other key takeaways from the 47th edition of Urban Land Institute (ULI) and PwC’s influential industry report.

Single-Family Rental Investment Trends Report Q3 2025

Occupancy and Retention Rebound as SFR Sector Matures

Key Findings

-

Cap rates moved higher as rents grew faster than home prices.

-

Operational metrics strengthened as tenant retention and occupancy

rates improved. -

SFR delinquency rates continued to move lower and have outperformed trends within the single-family housing market.

Table of Contents

State of the Market

The single-family rental (SFR) sector shows renewed operational strength, supported by higher occupancy rates and improving tenant retention even as home prices have softened in mid-2025.

From a cash flow perspective, the investment return profile of the SFR sector became more attractive during the second quarter. Acquisition prices of suburban homes slid lower, while SFR rent growth remained positive, leading to an increase in property-level yields.

Build-to-rent (BTR) construction momentum has slowed in recent quarters, but its pace remained robust last quarter when compared to historical highs. Demand for purpose-built rental communities remains strong as the cost of homeownership has hit an all-time high. In today’s market, the median U.S. household would have to devote 48% of its total income to housing payments to buy a home.

Entering the second half of 2025, the SFR sector will look to continue to settle into a cycle of strong, stable growth following more than a decade of rapid expansion.

Performance Metrics

CMBS Issuance

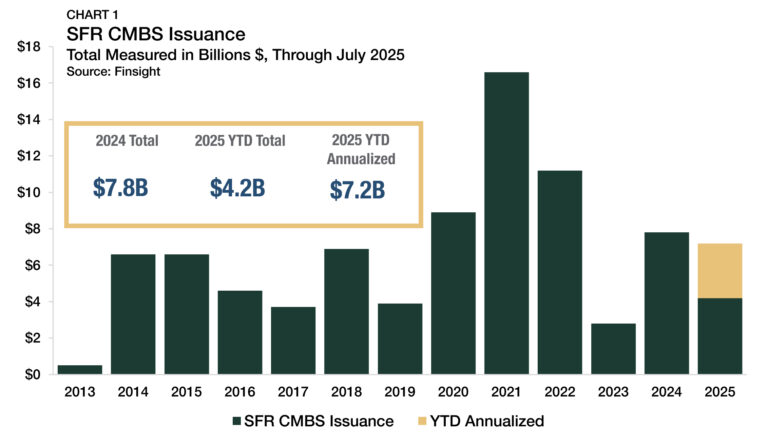

Following a notable increase last year, structured SFR capital markets have maintained a similar pace of activity in 2025. Through July 2025, year-to-date SFR CMBS issuance totaled $4.2 billion, putting it on an annualized trajectory to hit $7.2 billion this year. This pace would be only $0.6 billion shy of last year’s mark of $7.8 billion, which was nearly three times the total from 2023 (Chart 1).

Deal flow in SFR CMBS often tends to be inconsistent, with a relatively small number of large deals driving large fluctuations in quarter-to-quarter volume. All things considered, SFR capital markets have remained constant through the first half of 2025.

Occupancy and Retention

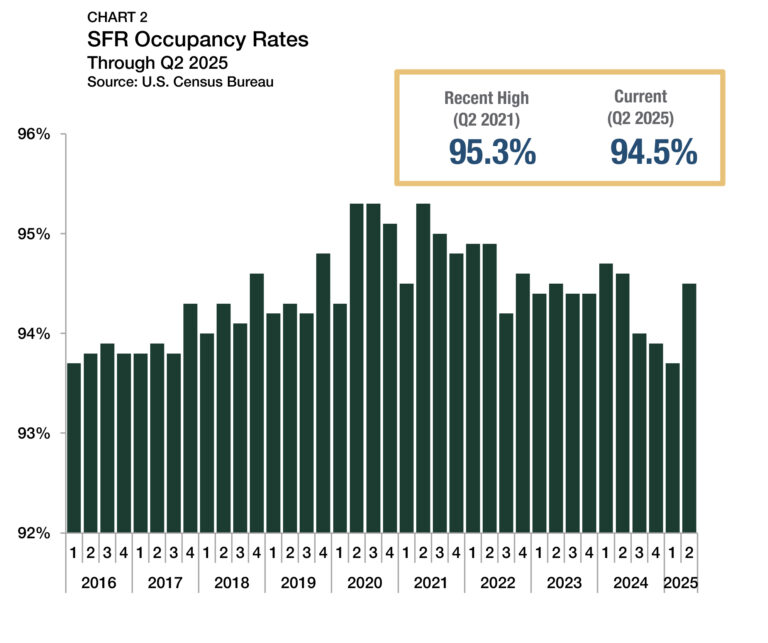

According to the U.S. Census Bureau, occupancy rates across all SFR property types averaged 94.5% in the second quarter of 2025 (Chart 2), 80 basis points (bps) higher than in the first quarter. Not only did the second-quarter increase break a four-quarter streak of declines, but it also marked the most significant quarterly improvement over the last four years. SFR occupancy rates averaged 93.9% between 2015 and 2019. After falling below this benchmark earlier in 2025, the second-quarter improvement moved the sector’s occupancy rate well above the pre-pandemic average.

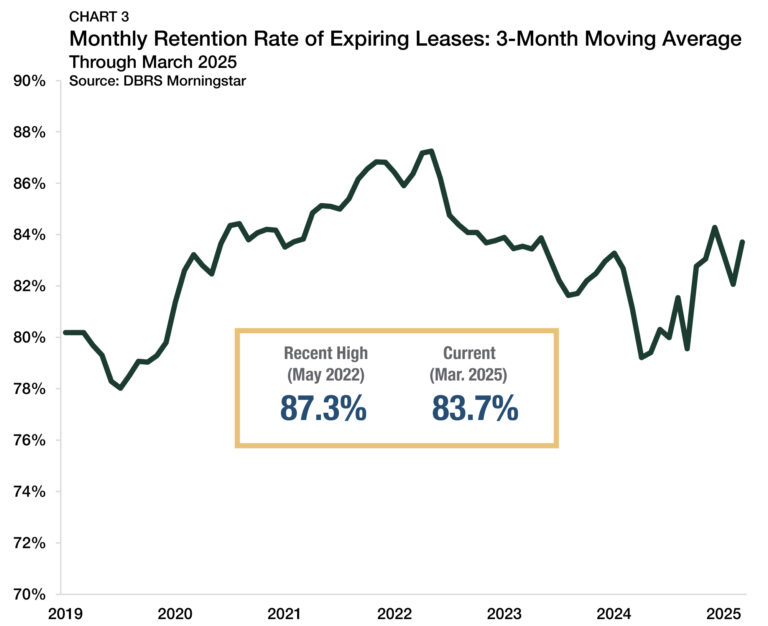

Reductions in SFR occupancy rates over the past few years coincided with a decline in the share of residents choosing to re-sign a lease. According to data from DBRS Morningstar, retention rates for expiring leases dipped significantly between 2022 and mid-2024. In May 2022, the share of tracked SFR units with expiring leases that re-signed for another year had a three-month moving average of 87.3% (Chart 3). By April 2024, the share dropped to 79.2%. However, a recovery in retention rates is already underway. Through March 2025, the moving average recovered to 83.7% and has held above 82% for the past six months.

Rent Growth: National

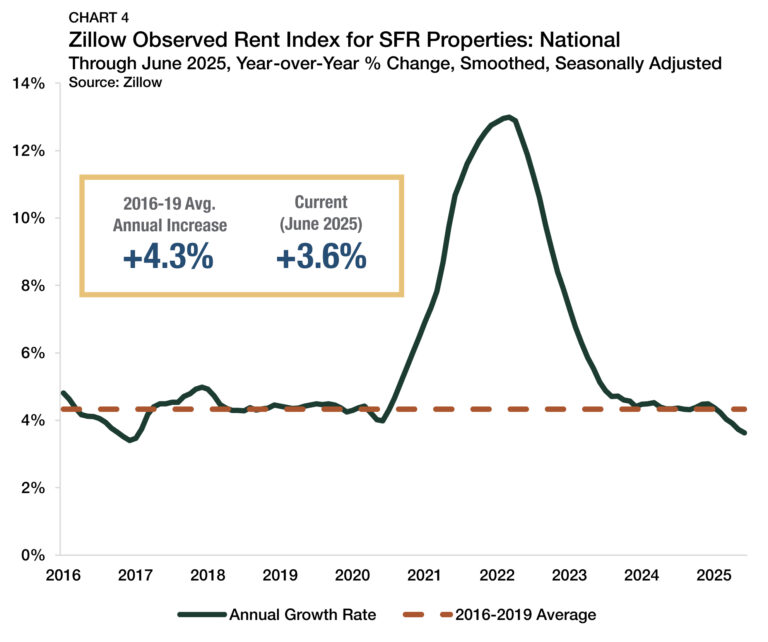

Nationally, SFR rent growth has continued to ease. According to Zillow’s Observed Rent Index, the overall average rent for the sector was up 3.6% year-over-year through June 2025 (Chart 4). After annual rent growth ticked up to 4.5% in December 2024, the pace of gains slowed in each of the first six months of 2025, reaching its lowest level since January 2017. Despite recent patterns, national rent growth in June 2025 was only 0.7 percentage points below the 2016-2019 average (4.3%), underscoring that while momentum has decelerated, prices have still risen steadily.

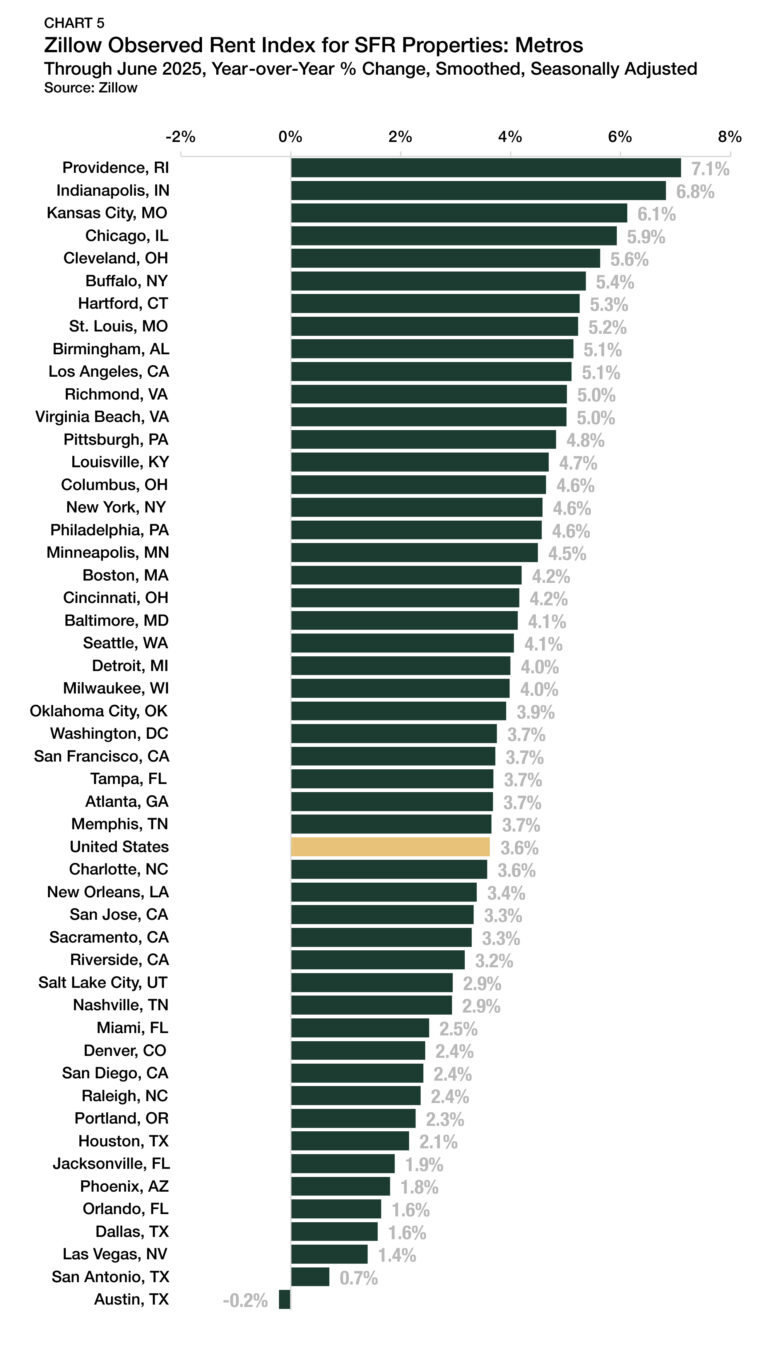

Rent Growth: Metros

Among the 50 largest metropolitan areas in the U.S., Providence, RI, led in annual SFR rent growth, with prices up 7.1% year-over-year through June 2025 (Chart 5).

Two Midwest standouts, Indianapolis, IN (+6.8%) and Kansas City, MO (+6.1%), ranked second and third, respectively. The Midwest and Northeast continued to see the most robust rent growth patterns through the midpoint of 2025, claiming all eight of the leading markets. However, different patterns have emerged in the Sun Belt after its post-pandemic surge. The last eight markets were in the Sun Belt, with Austin, TX (-0.2%), San Antonio, TX (+0.7%), and Las Vegas, NV (+1.4%) rounding out the last three spots.

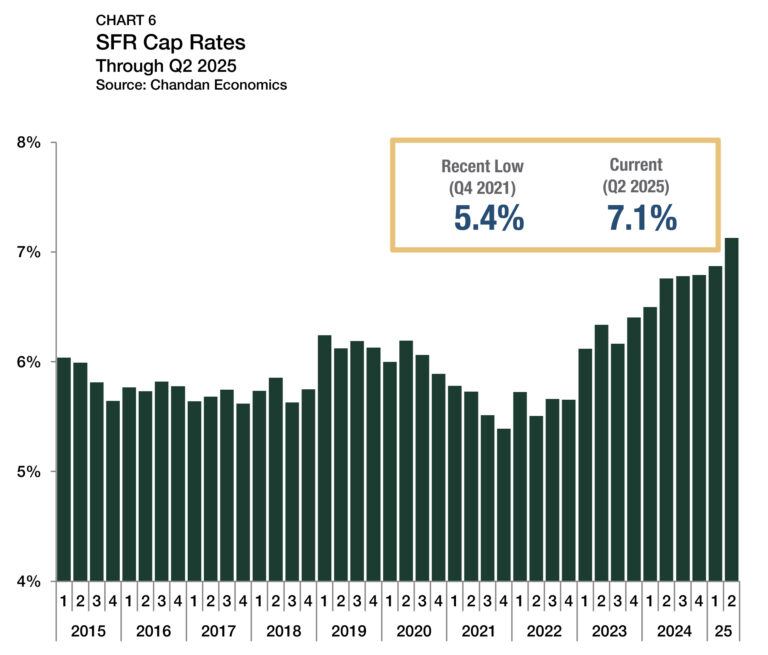

Cap Rates

SFR cap rates continued to push higher in the second quarter of 2025, reaching 7.1% (Chart 6).1 After holding steady at 6.8% for three consecutive quarters in 2024, cap rates rose again in the first and second quarters. In late 2021, SFR cap rates sat at an all-time low of 5.4%. Over the 14 quarters since, they have risen by a cumulative 174 bps, reflecting the impact of higher interest rates and softening single-family home prices.

1 Unless otherwise noted, the Chandan Economics data covering single-family rental cap rates and debt yields are based on model estimates and a sample pool of loans. Data are meant to represent conditions at the point of origination.

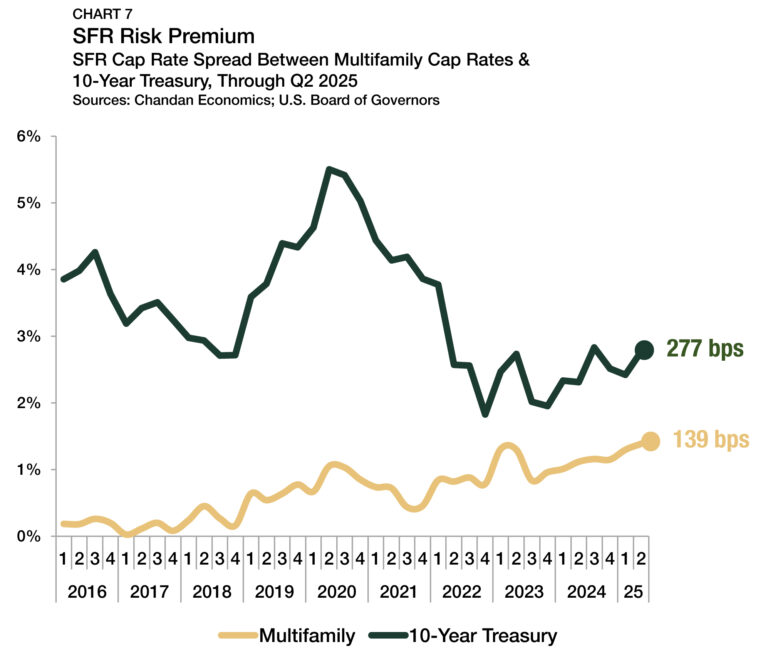

The spread between SFR cap rates and 10-year Treasury yields approximates the SFR risk premium. In the second quarter of 2025, 10-year Treasury notes carried an average yield of 4.4%, down 0.1% from the fourth quarter. With SFR cap rates moving higher and Treasury yields dipping, these moves led to a widening of the SFR/Treasury risk premium by 35 bps, settling at 277 bps in the second quarter (Chart 7). Similarly, the spread between single-family rentals and multifamily properties widened slightly (+7 bps) to reach 139 bps.

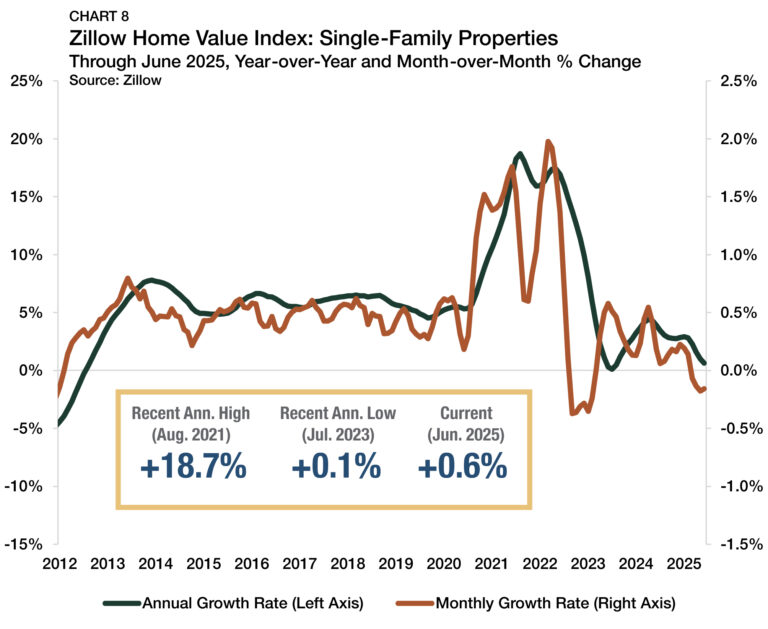

Pricing

Measured year-over-year, single-family home valuation growth remained positive through June 2025 — albeit by the slimmest of margins. According to Zillow’s Home Value Index, the average valuation for a single-family property in the U.S. increased to $370,523, up just 0.6% from the same time last year (Chart 8). On a monthly basis, single-family home values fell in each of the past four months. Compared to the February 2025 high, Zillow estimated that prices are down by a cumulative $1,994 (or 0.5%). Looking ahead, Zillow forecasts that U.S. home prices will fall by 1.0% over the next 12 months.

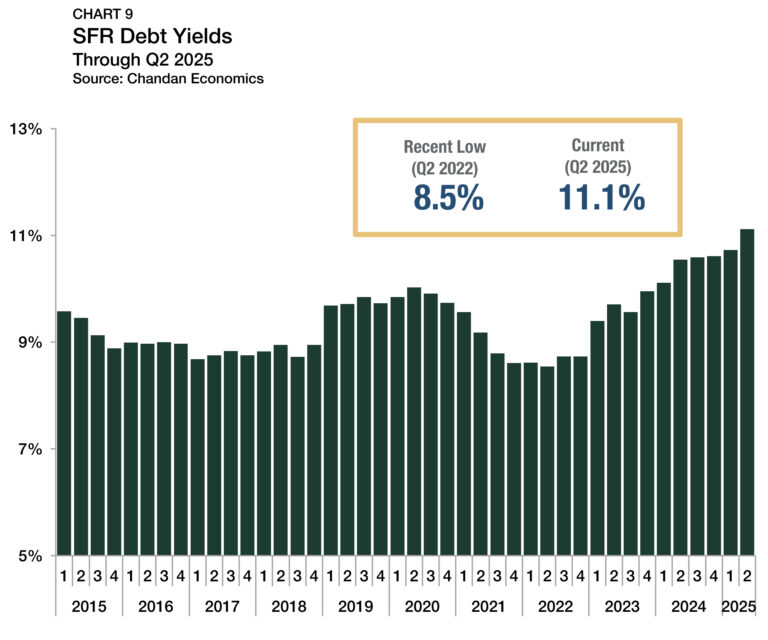

Debt Yields

Debt yields, a key measure of credit risk, rose again during the second quarter of 2025, increasing 39 bps to finish at 11.1% (Chart 9). Compared to a low of 8.5% in the second quarter of 2022, debt yields are now 257 bps higher. When the pricing outlook is uncertain or negative, it is common for debt yields to rise — as lenders seek deals with higher cash-flow cushions and lower leverage to mitigate the risk of devaluation.

The rise in debt yields in recent quarters means SFR investors are securing less debt capital for every $1.00 of property-level net operating income (NOI). Through the second quarter of 2025, SFR investors secured an average of $8.99 of debt for every $1.00 of NOI — down $2.71 from a 2022 peak and $0.49 lower than the same time last year.

High debt yields last quarter may constrain leverage for new acquisitions, shifting investor focus to stabilized assets or cash-flow-positive portfolios.

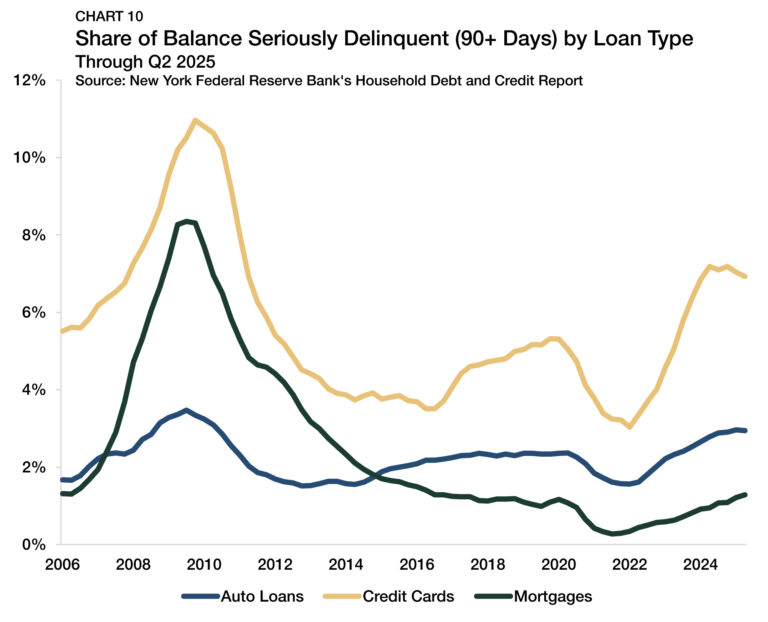

Residential Distress

Despite elevated mortgage interest rates, distress across the U.S. housing market remains low. The Federal Reserve Bank of New York’s latest Quarterly Report on Household Debt and Credit indicated that only 1.3% of household mortgages were more than 90 days delinquent through the second quarter of 2025 (Chart 10). Although serious delinquency rates sit at their highest point since 2016, the cause for concern is low. Delinquency rates have risen in total by 102 bps from a post-pandemic low and remain down by 706 bps from a high recorded during the 2008 housing crisis.

According to the FHFA’s National Mortgage Database, the average interest rate on an outstanding home loan is 4.3%, low by historical standards. As a result, most homeowners have not struggled to remain current on their monthly obligations, and the recent uptick in serious delinquencies has been modest. Even as delinquency rates edged up from record lows, homeowner distress has remained in a categorically different place than it was during or leading up to the housing crisis.

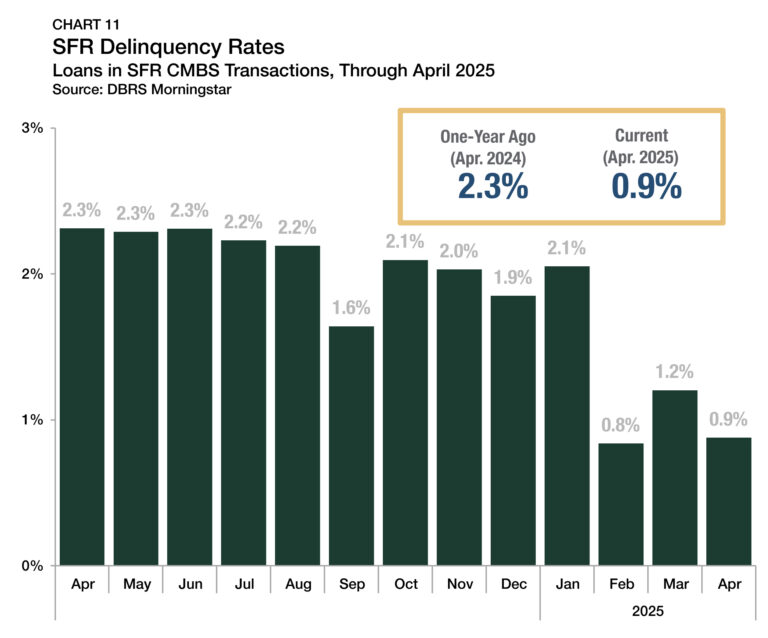

Distress patterns in the SFR sector have outperformed trends in the broader single-family ecosystem. Over the past year, SFR delinquency rates have continued to move lower. According to DBRS Morningstar, 0.9% of loans within rated SFR CMBS transactions were delinquent in April 2025, down 143 bps from a year earlier (Chart 11).

Supply & Demand Conditions

Build-to-Rent (BTR)

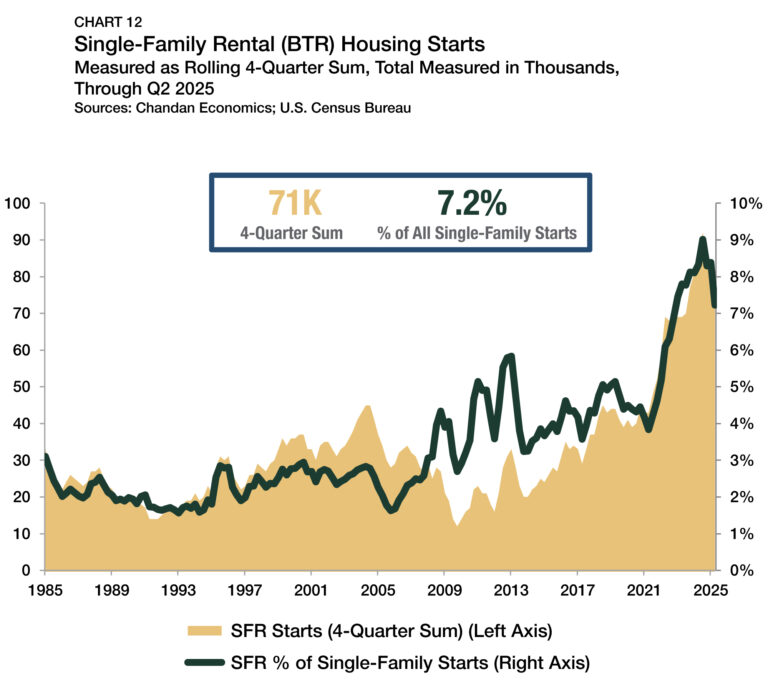

Build-to-rent (BTR) has become a driving force behind the growth of the SFR sector. As purpose-built communities are increasingly popular with both renters and investors, they have become the primary method for efficiently expanding supply while also creating product differentiation from typical single-family homes.

In the 12-month period that ended in the second quarter of 2025, 71,000 BTR units were started. During this period, BTR accounted for 7.2% of all SFR construction starts, a quarterly decline of 1.2 percentage points (Chart 12).

After BTR’s market share of single-family construction rose consistently throughout the 2010s and early 2020s, a modest reversion appears to be underway. Still, the pipeline of BTR starts remains robust when compared against any benchmark other than the recent market peak. The volume of starts in the past year is greater than at any point before the fourth quarter of 2023, and its single-family market share remains above its five-year average (6.5%).

Outlook

As homeownership moves further out of reach for many, SFR continues to enjoy the tailwinds derived from a supply/demand imbalance in the housing market. According to Fannie Mae, mortgage rates are forecast to remain above 6% until at least the end of 2026, which is expected to continue driving demand for quality rental housing.

At the same time, home valuations have barely held steady, making major discounts rare as many would-be sellers opt to withdraw listings rather than compromise on pricing. With the for-sale market at a standstill, more would-be homebuyers are searching for accessible entry points to suburban neighborhoods. SFR demand is on the rise as well.

Although localized oversupply and business cycle uncertainties are likely to persist through the year, SFR’s long-term outlook remains solidly positive as a set of steady tailwinds drives its growth forward.

For more single-family rental research and insights, visit arbor.com/research

Disclaimer

This report is intended for general guidance and information purposes only. This report is under no circumstances intended to be used or considered as financial or investment advice, a recommendation or an offer to sell, or a solicitation of any offer to buy any securities or other form of financial asset. Please note that this is not an offer document. The report is not to be considered as investment research or an objective or independent explanation of the matters contained herein and is not prepared in accordance with the regulation regarding investment analysis. The material in the report is obtained from various sources per dating of the report. We have taken reasonable care to ensure that, and to the best of our knowledge, material information contained herein is in accordance with the facts and contains no omission likely to affect its understanding. That said, all content is provided herein “as is” and neither Arbor Realty Trust, Inc. or Chandan Economics, LLC (“the Companies”) nor their affiliated or related entities, nor any person involved in the creation, production and distribution of the content make any warranties, express or implied. The Companies do not make any representations or warranties, express or implied, as to the reliability, usefulness, completeness, accuracy, currency nor represent that use of any information provided herein would not infringe on other third-party rights. The Companies shall not be liable for any direct, indirect or consequential damages to the reader or a third party arising from the use of the information contained herein. There may have been changes in matters which affect the content contained herein and/or the Companies subsequent to the date of this report. Neither the issue nor delivery of this report shall under any circumstance create any implication that the information contained herein is correct as of any time subsequent to the date hereof or that the affairs of the Companies have not since changed. The Companies do not intend, and do not assume any obligation to update or correct the information included in this report. The contents of this report are not to be construed as legal, business, investment or tax advice. Each recipient should consult with its legal, business, investment and tax advisors as to legal, business, investment and tax advice. The information contained herein may be subject to changes without prior notice. This report is only intended for the recipients, and should not be copied or otherwise distributed, in whole or in part, to any other person.