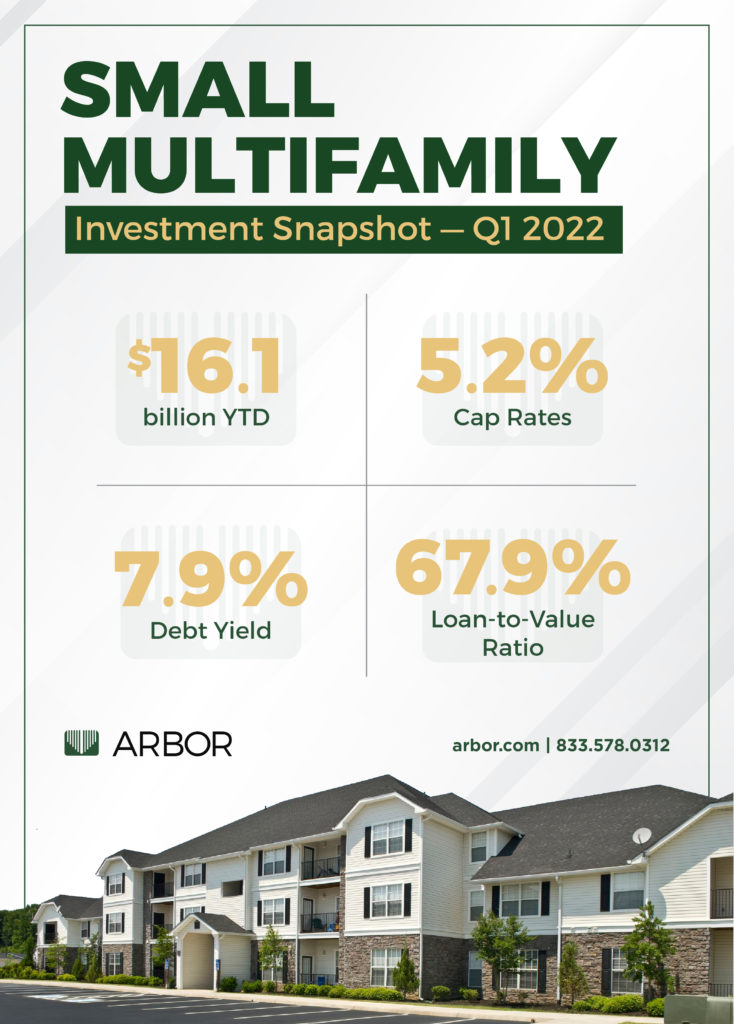

Small Multifamily Investment Snapshot — Q1 2022

Within small multifamily, the start of the new year brought a reversal of some COVID-induced trends. Notably, loan-to-value ratios (LTVs) and debt yields, two metrics that saw hyper-variability due to increased risk aversion, have started to trend back toward their pre-pandemic levels.

All else equal, small multifamily remains resilient heading into 2022’s warm weather months. Small multifamily asset valuations are up an estimated 5.5% year over year, and cap rates are down to just 5.3%. Originations have started to recover, and the share of new lending volume going toward acquisitions increased for the first time in six quarters. Challenges are still a daily reality, but the balance of macroeconomic and small multifamily-specific tailwinds are finally starting to outnumber the headwinds.

Access more key highlights in our Small Multifamily Investment Trends Report.

For more insights on the small multifamily market, view our latest Small Multifamily Investment Trends Report and the rest of our multifamily research.