What the Fed’s July Rate Hike Means for the Rental Housing Market

- The Federal Reserve raised its Federal Funds Rate by another 75 basis points at its July meeting — its fourth increase of the year.

- The Central Bank’s Beige Book reports dampening homebuying demand amid tightening credit conditions, while rental demand remains robust.

- The convergence of higher financing costs, labor cost inflation, and materials inflation are slowing down the multifamily construction pipeline.

The Federal Reserve Hikes Rates for the Fourth Time This Year

The Federal Reserve’s tightening cycle is in full swing, and the rental market is beginning to feel its effects. Since March, the Federal Open Markets Committee (FOMC) has conducted a series of four rate hikes in an attempt to tame inflation. With each rate hike comes an implied increase in borrowing costs for both consumers and producers, and early indications suggest that the housing and rental markets are feeling the effects, albeit in different ways.

How Housing and Rental Markets are Responding to the Tightening Cycle

Higher borrowing costs appear to already be slowing down the pace of homebuying. The Mortgage Bankers Association of America reported a 22-year low in mortgage applications during the week ending on July 15, as the average rate on a 30-year mortgage rose to 5.82%.

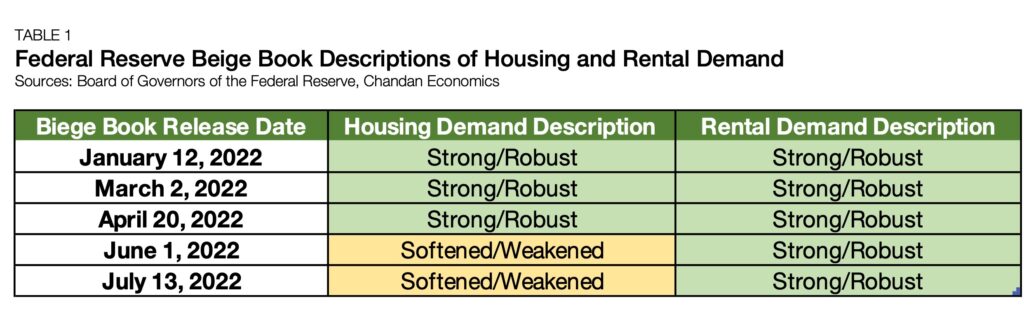

As homebuying becomes less obtainable for many households, some residential demand is shifting towards rentals. The Federal Reserve’s latest Beige Book points to an increasingly robust rental housing market as its descriptions of homebuying turn bearish. In each of the previous two Beige Books, housing demand was described as “weakened” (Table 1). By contrast, in every other release this year through April, housing demand was described as “strong” or “robust.” Meanwhile, mentions of the rental market have maintained the labels of “strong” or “robust” throughout the Fed’s tightening cycle.

The persistence of rental demand against continued inflationary pressures and higher interest rates follows a simple rationale — as housing costs rise, people still need a place to live.

However, the supply-side of the rental market has proven to be more sensitive to higher interest rates. According to the latest NMHC Construction Survey multifamily developers reported permitting delays (97%) and deal repricing (83%) over the past three months. These factors are likely to limit the incoming development pipeline and continue to drive rent growth higher.

Moving Forward

Cap rates for multifamily properties have been reaching new lows, however, they are likely to experience upward pressure in the coming months of the monetary tightening cycle, according to First American.

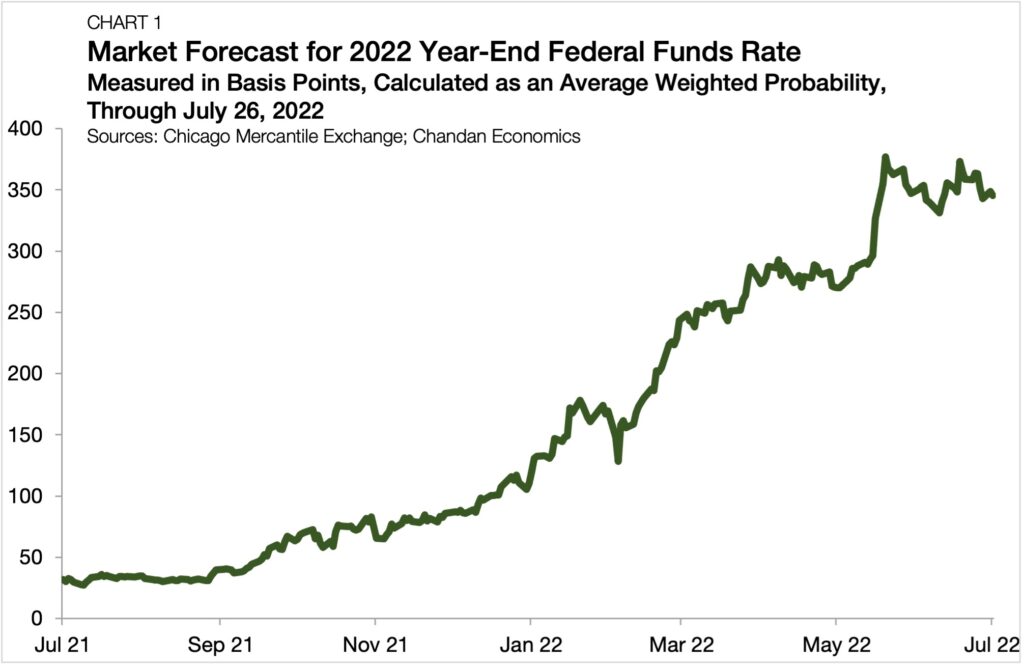

The CME Fed Watch tool found that a majority of market participants now anticipate that the Federal Funds rate will land at 325-350 bps by year’s end when observers anticipate that the FOMC will set its terminal rate in its tightening cycle (Chart 1).

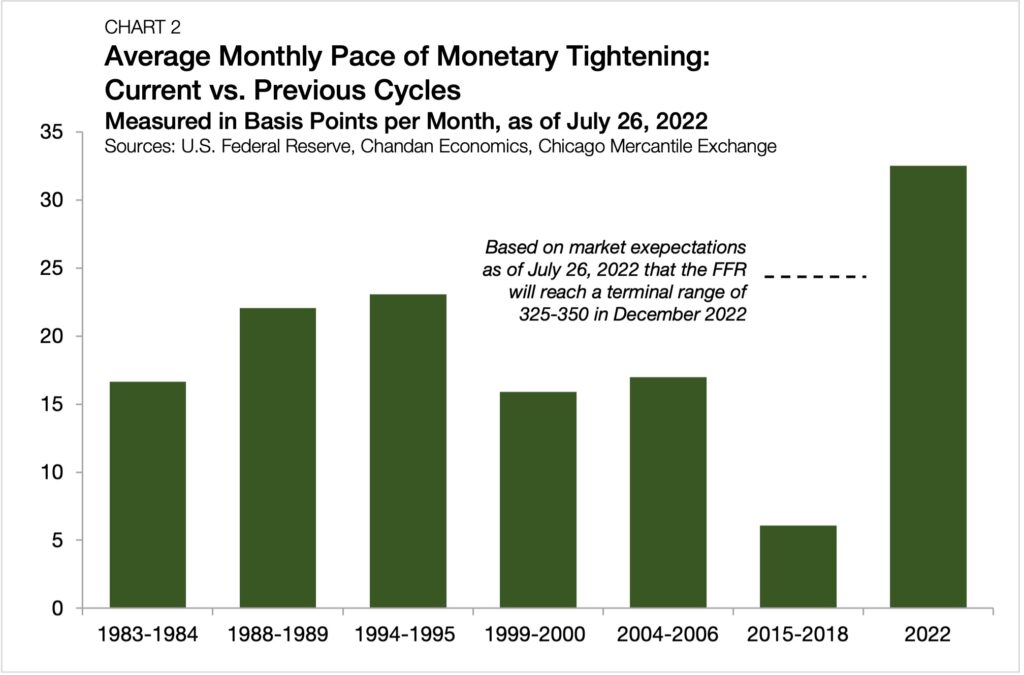

Under that forecast, the average pace of tightening would total 35 bps per month — the most rapid ascent of interest rates in over 40 years (Chart 2). All else equal, rising capital costs from monetary tightening and high levels of net operating income (NOI) growth are both forces that should exert upward pressure on cap rates.

Rental demand has so far weathered the impact of rising rates, but supply constraints risk making affordability an increasing headwind for renters. As the Fed ratchets up its fight against inflation, an eye toward input prices in the committee’s Beige Book will be a useful tool for tracking supply-side effects on the rental housing market.

Interested in the multifamily real estate investment market? Contact Arbor today to learn about our array of multifamily and single-family rental financing options and view our other market research and multifamily posts in our research section.